Check Call: Q1 earnings did most carriers no favors

It’s earnings season, which means it’s time to see how the competition stacked up.

Starting off earnings season was none other than J.B. Hunt’s brokerage unit reporting a $17.5 million operating loss as loads declined 22% year over year, with revenue per load down just 5%. The main reason for the loss was higher insurance expenses and integration costs from the acquisition of BNSF Logistics. The company overall reported earnings per share of $1.22 instead of the $1.50 target, attributing that to higher insurance premiums and weaker-than-expected demand.

Fan favorite C.H. Robinson’s first-quarter earnings highlighted the good and where there is strong room for improvement. The good was that the company beat Wall Street projections. EPS was projected to be 63 cents and came in at 83 cents. An article by FreightWaves’ John Kingston breaks it down: “Revenue was also beating expectations at $4.41 billion which was $130 million more than expectations. Gross profits in [core brokerage business North American Surface Transportation] NAST rose to $397.1 million from $380.2 million, and income from operations rose sequentially to $109 million from $96 million.”

Jumping over to the seemingly unflappable RXO, the company reported revenue of $900 million, down from $1 billion of the previous quarter. Kingston writes, “Revenue in key groups fell from the fourth quarter. Truck brokerage revenue sequentially fell to $564 million from $610 million in the fourth quarter. Last mile dropped to $232 million from $257 million. Freight forwarding rose slightly, to $55 million from $51 million, but managed transportation declined to $97 million from $103 million.” Despite all the bad, RXO is seeing higher gross margins, which points to a promising Q2.

Repping the carrier space is none other than RXO’s former parent company, XPO, seemingly one of the few LTL carriers that came out of Q1 relatively unscathed. The company beat expectations and has a favorable outlook. FreightWaves’ Todd Maiden writes, “Revenue in XPO’s LTL segment increased 9% y/y to $1.22 billion as tonnage per day increased 3% and revenue per hundredweight, or yield, was up 7% (up 10% excluding fuel surcharges). A 5% increase in daily shipments partially offset by a 2% decline in weight per shipment produced the tonnage increase.” Those double-digit accessorial increases and more than 3,000 local accounts added so far this year show the LTL carrier is all gas, no brakes heading into the rest of 2024.

The time around the Fourth of July is expected to be the part of the year when the market indicates what the rest of the year will look like for freight. That means Q2 earnings might be more of the same as everyone holds on for the hopeful flip.

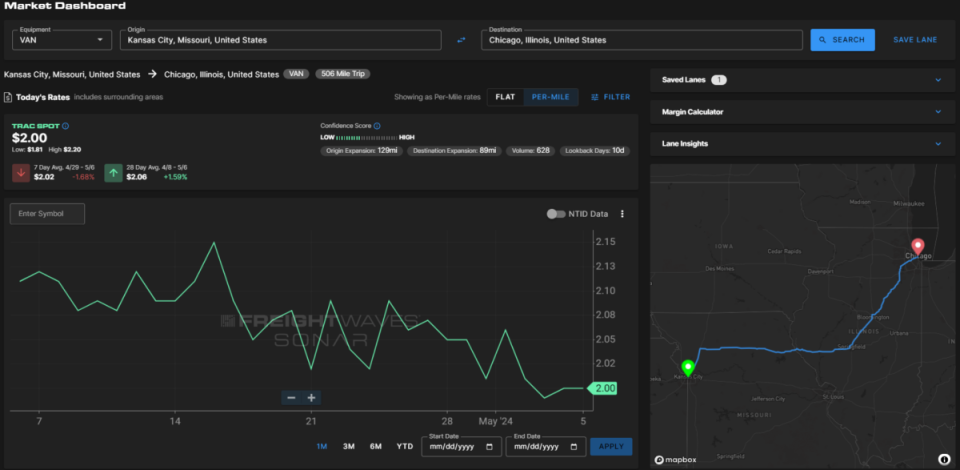

TRAC Tuesday. This week’s TRAC lane is a jaunt through the Midwest from Kansas City, Missouri, to Chicago. This 506-mile trip to the Windy City has slumping rates. The National Truckload Index is at $2.20 per mile, whereas this trip is at $2 per mile. Times are tough when the spot rate is lower than the NTI. Chicago’s Outbound Tender Reject Index being at 1.27% is weighing heavily on the spot rate. Kansas City is having some upward momentum for its OTRI, but the index is only at 3.27%, which isn’t quite enough to breathe life back into these rates. An all-in rate of $1,012 before margin should readily cover this load.

Who’s with whom? Cross-border freight between the U.S. and Mexico has always left a lot to be desired in terms of visibility and technology. FreightTech startup Cargado is on a mission to make it better after its $6.8 million seed funding round, led by Primary Venture Partners. Cargado was founded by CEO Matt Silver and Rylan Hawkins, chief technology officer, in October 2023.

Silver said in an article by FreightWaves’ Noi Mahoney, “We see so many different problems and opportunities with cross-border freight. I have a really strong understanding of all the problems that go into every part of the process of moving freight between the U.S. and Mexico. We’re excited to be building technology that operators involved in the cross-border process can leverage to do their jobs better, to make more money and grow their businesses, and to generally be able to be more efficient and successful.”

The more you know

Express’ troubles lead to job cuts at Bath & Body Works affiliate

Borderlands Mexico: Developers bullish on Texas logistics real estate

Secure logistics market soars: Expected to reach $191.9 billion by 2032 with an 8.4% CAGR

Shein and Forever 21 first to use UPS’ Happy Returns cross-brand solution

Spec industrial park opens on site of historic Columbus steel foundry

The post Check Call: Q1 earnings did most carriers no favors appeared first on FreightWaves.