Best Dividend Stocks This Month

Dividend stocks such as Sunningdale Tech and First Real Estate Investment Trust can help diversify the constant stream of cash flows from your portfolio. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. Today I will share with you my best paying dividend shares you should be considering for your portfolio.

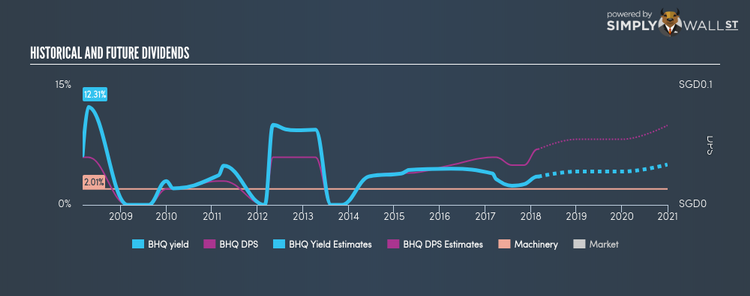

Sunningdale Tech Ltd (SGX:BHQ)

Sunningdale Tech Ltd manufactures and sells dies, tools, jigs, fixtures, high precision steel moulds, and plastic products. Sunningdale Tech was formed in 1995 and with the company’s market capitalisation at SGD SGD372.73M, we can put it in the small-cap stocks category.

BHQ has a good-sized dividend yield of 3.55% and the company currently pays out 41.99% of its profits as dividends . Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from S$0.06 to S$0.07 over the past 10 years. Continue research on Sunningdale Tech here.

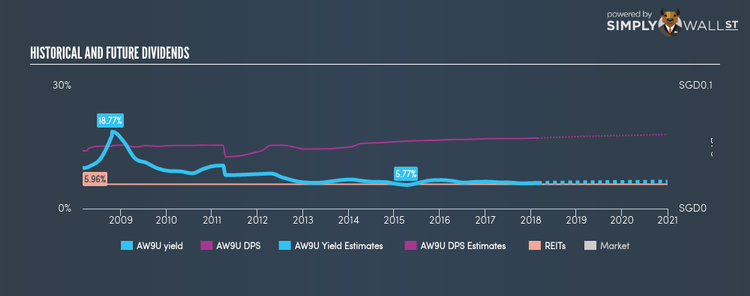

First Real Estate Investment Trust (SGX:AW9U)

First Real Estate Investment Trust (“First REIT”) is a real estate investment trust constituted by the Trust Deed entered into on 19 October 2006 between Bowsprit Capital Corporation Limited as the Manager and HSBC Institutional Trust Services (Singapore) Limited as the Trustee. First Real Estate Investment Trust was formed in 2006 and with the stock’s market cap sitting at SGD SGD1.07B, it comes under the small-cap group.

AW9U has a substantial dividend yield of 6.28% and their payout ratio stands at 95.05% , with analysts expecting this ratio in three years to be 105.19%. AW9U’s dividends have increased in the last 10 years, with DPS increasing from S$0.07 to S$0.086. The company has been a dependable payer too, not missing a payment in this 10 year period. The company outperformed the sg reits industry’s earnings growth of 4.85%, reporting an EPS growth of 81.01% over the past 12 months. More on First Real Estate Investment Trust here.

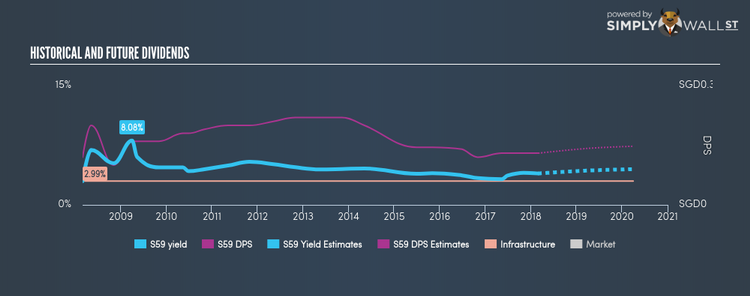

SIA Engineering Company Limited (SGX:S59)

SIA Engineering Company Limited, together with its subsidiaries, operates as an aircraft maintenance, repair, and overhaul (MRO) company in East Asia, West Asia, Europe, South West Pacific, Americas, and Africa. Started in 1982, and now run by Kim Chiang Png, the company size now stands at 6,330 people and with the stock’s market cap sitting at SGD SGD3.68B, it comes under the mid-cap group.

S59 has a sizeable dividend yield of 3.95% and the company has a payout ratio of 83.16% , with analysts expecting the payout ratio in three years to be 86.24%. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. Continue research on SIA Engineering here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.