Best-In-Class SEHK Dividend Stocks

A great investment for income investors with a long time horizon is in dividend-paying companies like Fufeng Group. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

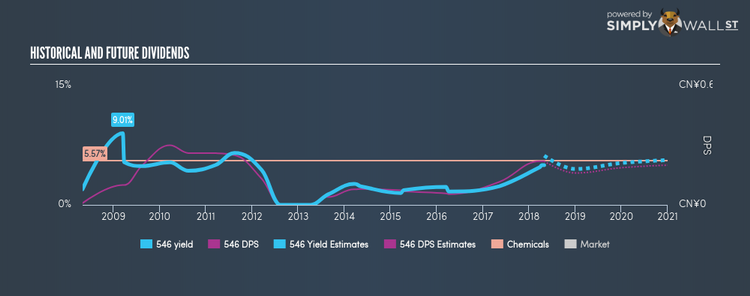

Fufeng Group Limited (SEHK:546)

Fufeng Group Limited, an investment holding company, engages in the manufacture and sale of fermentation-based food additive, and biochemical and starch-based products in the People’s Republic of China. Founded in 1999, and currently lead by Qiang Zhao, the company now has 9,500 employees and with the market cap of HKD HK$11.21B, it falls under the large-cap category.

546 has a juicy dividend yield of 5.00% and is currently distributing 28.73% of profits to shareholders . Despite there being some hiccups, dividends per share have increased during the past 10 years. Interested in Fufeng Group? Find out more here.

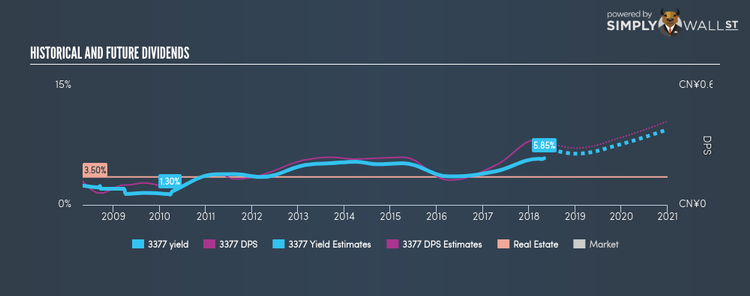

Sino-Ocean Group Holding Limited (SEHK:3377)

Sino-Ocean Group Holding Limited, an investment holding company, engages in the property investment and development activities in the People’s Republic of China. Established in 1993, and headed by CEO Ming Li, the company currently employs 10,081 people and has a market cap of HKD HK$41.32B, putting it in the large-cap category.

3377 has a large dividend yield of 5.86% and pays 39.41% of its earnings as dividends , with analysts expecting a 43.21% payout in three years. While there’s been some level of instability in the yield, 3377 has overall increased DPS over a 10 year period from CN¥0.12 to CN¥0.32. Sino-Ocean Group Holding’s future earnings growth looks strong, with analysts expecting 57.60% EPS growth in the next three years. More on Sino-Ocean Group Holding here.

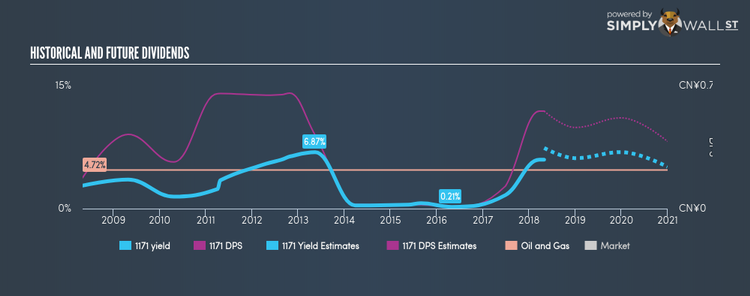

Yanzhou Coal Mining Company Limited (SEHK:1171)

Yanzhou Coal Mining Company Limited explores, mines, washes, processes, and sells coal in China, Japan, South Korea, and Australia. Started in 1973, and currently lead by Xiangqian Wu, the company currently employs 68,550 people and with the company’s market cap sitting at HKD HK$72.38B, it falls under the large-cap stocks category.

1171 has a sumptuous dividend yield of 5.97% and has a payout ratio of 32.64% , with the expected payout in three years being 35.68%. Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. More on Yanzhou Coal Mining here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.