Best ASX Growth Companies

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

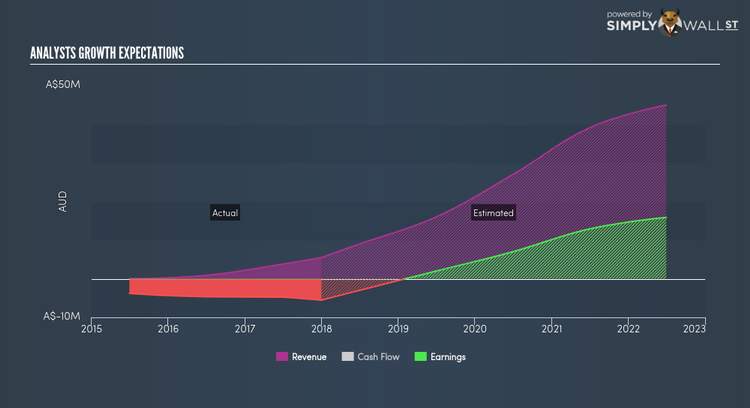

Carbonxt Group Limited (ASX:CG1)

Carbonxt Group Limited owns and develops technologies for capturing mercury and other emissions from coal fired power stations in the United States. Carbonxt Group was formed in 2001 and with the company’s market cap sitting at AUD A$43.42M, it falls under the small-cap category.

CG1’s forecasted bottom line growth is an exceptional 63.65%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that CG1’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 0.60%. CG1 ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering CG1 as a potential investment? Have a browse through its key fundamentals here.

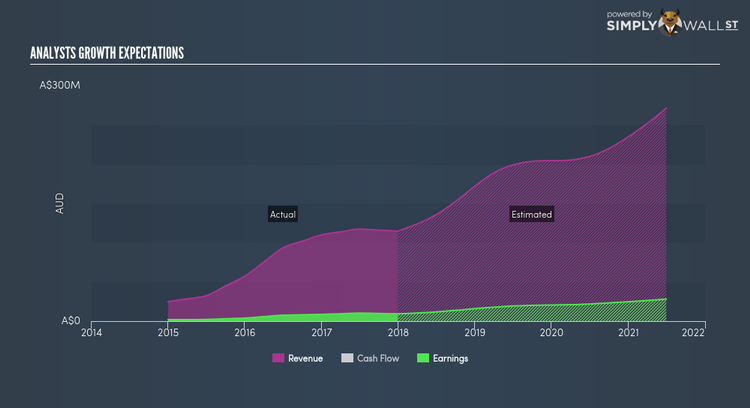

Paragon Care Limited (ASX:PGC)

Paragon Care Limited supplies durable medical equipment, medical devices, and consumable medical products to the acute, aged, primary, community, and hospital care markets in Australia and New Zealand. Paragon Care is currently run by Andrew Just. It currently has a market cap of AUD A$171.40M placing it in the small-cap category

PGC’s projected future profit growth is a robust 28.96%, with an underlying 78.14% growth from its revenues expected over the upcoming years. It appears that PGC’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 13.88%. PGC’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in PGC? Have a browse through its key fundamentals here.

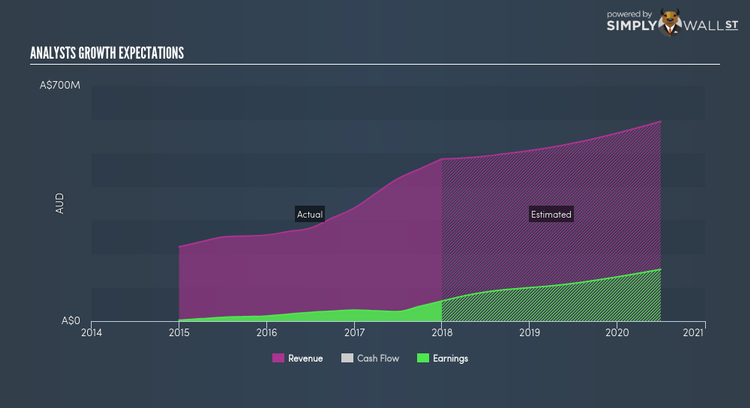

Saracen Mineral Holdings Limited (ASX:SAR)

Saracen Mineral Holdings Limited engages in the gold mining business in Australia. The company now has 317 employees and with the company’s market cap sitting at AUD A$1.33B, it falls under the small-cap group.

An outstanding 33.25% earnings growth is forecasted for SAR, driven by an underlying sales growth of 16.43% over the next few years. It appears that SAR’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 25.66%. SAR ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.