Alkali Metals (NSE:ALKALI) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Alkali Metals Limited (NSE:ALKALI) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Alkali Metals

What Is Alkali Metals's Debt?

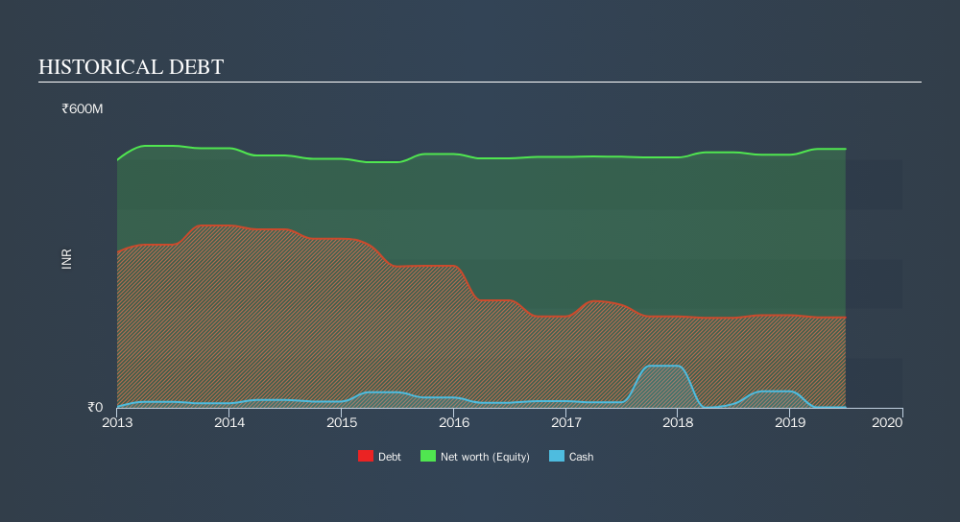

The chart below, which you can click on for greater detail, shows that Alkali Metals had ₹181.9m in debt in March 2019; about the same as the year before. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Alkali Metals's Balance Sheet?

We can see from the most recent balance sheet that Alkali Metals had liabilities of ₹362.9m falling due within a year, and liabilities of ₹26.6m due beyond that. On the other hand, it had cash of ₹733.1k and ₹108.7m worth of receivables due within a year. So it has liabilities totalling ₹280.1m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₹458.7m, so it does suggest shareholders should keep an eye on Alkali Metals's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Alkali Metals has a quite reasonable net debt to EBITDA multiple of 2.1, its interest cover seems weak, at 2.3. This does suggest the company is paying fairly high interest rates. In any case, it's safe to say the company has meaningful debt. Importantly, Alkali Metals grew its EBIT by 68% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Alkali Metals will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Alkali Metals generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Alkali Metals's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its interest cover. All these things considered, it appears that Alkali Metals can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Over time, share prices tend to follow earnings per share, so if you're interested in Alkali Metals, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.