5 Biotech Stocks Worth Adding to Your Portfolio in 2024

As we near the end of the ongoing reporting cycle in the biotech sector, the picture is pretty ho-hum. The bigwigs in the sector have already reported and the results have been mostly mixed. Nonetheless, the outlook provided by most of these companies is encouraging, indicating bright prospects driven by new drug approvals and positive pipeline updates. The macroeconomic environment, however, remains uncertain and growth might be sluggish.

Nonetheless, companies in this volatile biotech industry continue to be in the spotlight as pharma/biotech goliaths are looking to bolster their product portfolios and pipelines through collaborations and buyouts amid generic competition for legacy drugs. Given the continuous need for innovative medical treatments, irrespective of the state of the economy, an investment in the biotech industry can be worth it, notwithstanding the inherent volatility and uncertain macroeconomic environment.

Biotech companies like BioMarin Pharmaceutical BMRN, Blueprint Medicines BPMC, Immunovant IMVT, Kymera Therapeutics KYMR and Ligand Pharmaceuticals LGND are poised to outperform the volatile sector.

Industry Description

The Zacks Biomedical and Genetics industry includes biopharmaceutical and biotechnology companies that develop high-profile drugs using path-breaking technology. These biologically processed drugs, which address virology, neuroscience, metabolism and rare diseases, are manufactured using live organisms.

As technology becomes paramount to improving global health, the main goal of biotech companies is to use innovative technology to create breakthrough treatments. Quite a few companies in this space are developing vaccines using modern technology. Given the dynamic and evolving nature of technology, the sector is perceived to be riskier than the large-cap pharma or drug industry.

4 Trends Shaping the Future of the Biotech Industry

Innovation, Execution Hold the Key: As only a few companies in this industry have approved drugs in their portfolio, the focus is primarily on the performance of high-profile drugs and pipeline development. Most companies spend millions and billions to create a drug with path-breaking technology, which results in significant research and development expenditure. Sometimes, modern treatments might come with side effects, which surface with time and the uptake might fail to meet the expectations. Hence, it takes several years before a biotech company turns profitable.

Additionally, successful commercialization is the key to higher drug uptake, as smaller biotechs generally lack the funds and expertise to reach the targeted population. This, in turn, prompts collaboration deals with either pharma or biotech bigwigs, wherein sales are shared or royalties are received.

Moreover, it may take quite a few years for any newly-approved drug to contribute significantly to its company’s top line.

M&A in Spotlight: Consolidation has always taken the center stage in the biotech industry. This is because leading pharma/biotech companies look to diversify their revenue base in the face of dwindling sales of their high-profile drugs. Acquisitions also make sense as developing a drug/technology from scratch is not just a costly but also a risky affair. After a lull of almost two years, pharma and pharma/biotech bigwigs are now looking to bolster their portfolios.

The influx of cash from big pharma/biotech companies further propels the biotech sector. Gilead Sciences recently acquired CymaBay Therapeutics to strengthen its liver disease portfolio. Bristol Myers acquired oncology-focused company Mirati Therapeutics, Karuna Therapeutics and RayzeBio. Vertex Pharmaceuticals is all set to acquire Alpine Immune Sciences.

While oncology and immuno-oncology are the key focus areas, treatments for obesity, rare diseases and gene-editing companies also hold potential, making them lucrative investment areas. An attractive pipeline candidate is the key lure for these companies.

Cost synergies in research and development are added benefits, as quite a few smaller biotech companies are using innovative technologies to develop drugs and treatments.

New Drug Approvals Boost Prospects: New drug approvals saw a surge in 2023 and the momentum continues. With increasing R&D spending in 2024 and most companies looking to diversify, new drug approvals are likely to see an acceleration going forward.

Pipeline Setbacks & Competition Hurt: Pipeline setbacks are key deterrents for biotech companies, given the exorbitant cost of developing drugs using expensive technology. Most drugs/therapies take years to gain a regulatory nod. An unfavorable outcome from a crucial trial on a promising candidate is a huge setback, particularly for smaller biotechs, which are mostly one-trick ponies.

The leading biotechs face other headwinds, including declining sales of high-profile drugs due to intensifying competition.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Biomedical and Genetics industry currently carries a Zacks Industry Rank #80, which places it among the top 32% of more than 250 Zacks industries. The rank mirrors a bright outlook for the space, probably due to the consistent demand for better medical drugs/treatments, even though the macroenvironment is challenging. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few biotech stocks that are well-positioned to beat the industry based on a strong portfolio/pipeline, let’s take a look at the industry’s stock market performance and current valuation.

Industry Versus S&P 500 & Sector

The Zacks Biomedical and Genetics industry is a 693-stock group within the broader Zacks Medical sector. It has underperformed the S&P 500 Composite and the Zacks Medical sector in the year so far.

The stocks in this industry fell 5.7% year to date against the Zacks Medical sector’s growth of 1%. The S&P 500 Composite has gained 8.1% in the said time frame.

Year to Date Price Performance

Industry's Current Valuation

Since most companies in the biotech sector do not have approved drugs, valuing these companies becomes a complex process. On the basis of the trailing 12-month price-to-sales ratio (P/S TTM), which is commonly used for valuing biotech companies with approved portfolios of drugs, the industry is currently trading at 2.49X compared with the S&P 500’s 4.01 and the Zacks Medical sector's 3.41.

Over the last five years, the industry has traded as high as 3.62X, as low as 1.94X and at a median of 2.71X, as depicted in the chart below.

Price/Sales TTM

5 Biotech Stocks Worth Buying

Ligand Pharmaceuticals’ business model is based on developing or acquiring royalty revenue-generating assets. Its Captisol formulation technology has allowed it to enter several licensing deals and generate royalties. LGND derives revenues from the sale of Captisol material to its partners, who have either licensed its Captisol-enabled drugs or licensed Captisol for their internal programs. Ligand maintains a broad global patent portfolio for Captisol with the latest expiration date in 2035. Other patent applications covering methods of making Captisol, if issued, extend to 2041.

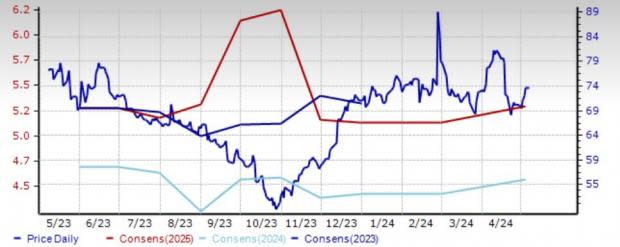

The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The Zacks Consensus Estimate for 2024 earnings per share has increased 14 cents to $4.56 in the past 60 days. Shares of the company have risen 3.5% in the past year.

Price and Consensus: LGND

Biomarin’s top line is being driven by strong demand for its dwarfism drug Voxzogo. The recent label expansion of Voxzogo in the United States and Europe for use in infants with achondroplasia will likely lead to a further boost in the drug’s sales. Its other drugs, like Vimizim and Palynziq injection, continue to drive growth. The approval of gene therapy treatment, Roctavian, also boosted its portfolio. The company is also working to expand Voxzogo’s label and the successful development of the same should be a great boost.

Biomarin currently carries a Zacks Rank #2 (Buy). The bottom-line estimate for 2024 has risen 12 cents in the past 30 days to $2.86.

Price and Consensus: BMRN

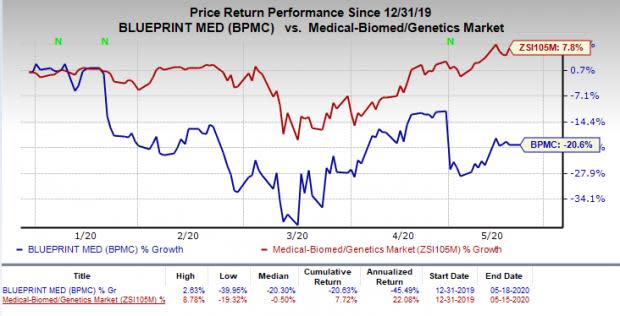

Blueprint’s lead drug Ayvakit (avapritinib) is approved for the treatment of unresectable or metastatic gastrointestinal stromal tumors, harboring a PDGFRA exon 18 mutation, including PDGFRA D842V mutations in adults. The drug has seen a solid uptake since its approval, given the market opportunity. The label expansion of avapritinib (advanced and indolent systemic mastocytosis) has further broadened its sales potential. Blueprint Medicines has other promising pipeline candidates, which are progressing well. The successful development and commercialization of any of the pipeline candidates will diversify its revenue base.

Loss estimates for 2024 have narrowed to $5.45 from $5.70 in the past 60 days. The company currently has a Zacks Rank #2. BPMC’s shares have risen 16.2% in the past year.

Price and Consensus: BPMC

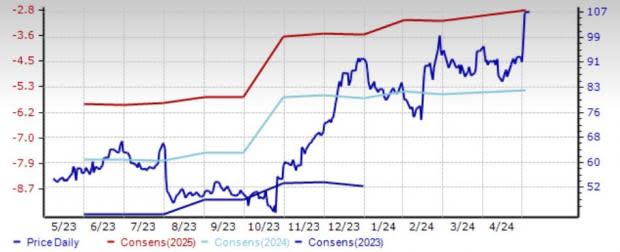

Immunovant, Inc. is a clinical-stage biopharmaceutical company that develops monoclonal antibodies for the treatment of autoimmune diseases. It is developing batoclimab, a novel, fully-human monoclonal antibody that selectively binds to and inhibits the neonatal fragment crystallizable receptor. The company is developing batoclimab as a fixed-dose subcutaneous injection for the treatment of autoimmune diseases mediated by pathogenic immunoglobulin G antibodies. Immunovant is also studying its new candidate, IMVT-1402, a next-generation FcRn inhibitor, in an early-stage study for the treatment of IgG-mediated autoimmune diseases. The successful development of these candidates should be a significant boost for the company.

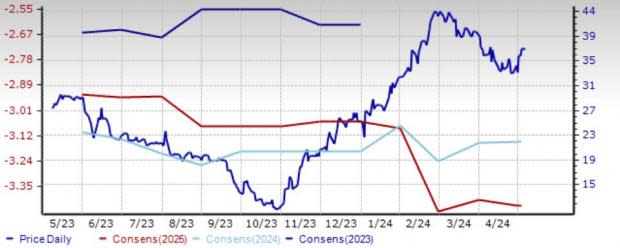

Immunovant currently carries a Zacks Rank #2. Loss estimates for 2024 have narrowed 11 cents to $1.78 per share in the past 90 days. The stock has surged 49.6% in the past year.

Price and Consensus: IMVT

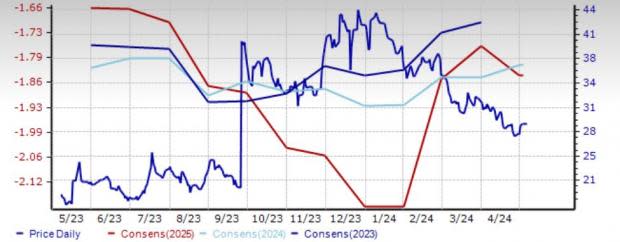

Kymera is using a proprietary targeted protein degradation platform to design novel protein degraders focused on the areas of immunology-inflammation and oncology. These small molecule protein degraders have unique advantages over existing therapies and should allow the company to address a large portion of the human genome that was previously intractable with traditional modalities. The pipeline progress with its current clinical-stage programs — IRAK4, STAT3, and MDM2 — is encouraging. Its collaboration with bigwig Sanofi provides the much-needed funds.

Loss estimates for 2024 have narrowed 6 cents to $3.15 per share in the past 60 days. The company currently has a Zacks Rank #2. KYMR’s shares have rallied 46.9% year to date.

Price and Consensus: KYMR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

Kymera Therapeutics, Inc. (KYMR) : Free Stock Analysis Report