With A -27.2% Earnings Drop Lately, Did Sandmartin International Holdings Limited (HKG:482) Underperform Its Industry?

Improvement in profitability and outperformance against the industry can be important characteristics in a stock for some investors. Below, I will assess Sandmartin International Holdings Limited’s (SEHK:482) track record on a high level, to give you some insight into how the company has been performing against its historical trend and its industry peers. View our latest analysis for Sandmartin International Holdings

Despite a decline, did 482 underperform the long-term trend and the industry?

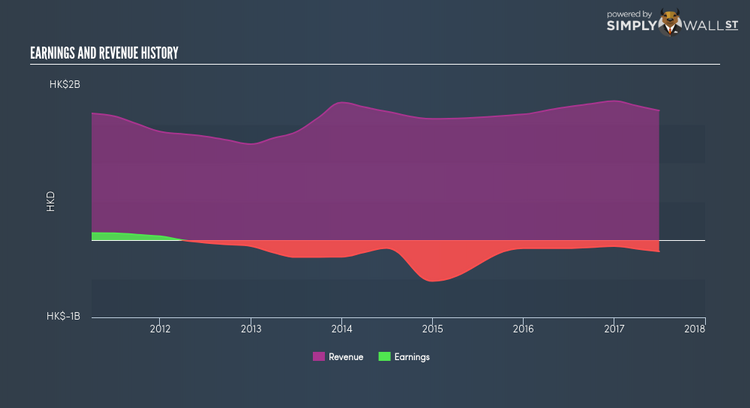

I prefer to use the ‘latest twelve-month’ data, which annualizes the latest 6-month earnings release, or some times, the latest annual report is already the most recent financial data. This method allows me to analyze many different companies on a similar basis, using the latest information. For Sandmartin International Holdings, its most recent twelve-month earnings is -HK$146.2M, which, in comparison to last year’s level, has become more negative. Given that these values may be relatively short-term, I’ve determined an annualized five-year value for Sandmartin International Holdings’s net income, which stands at -HK$100.1M. This doesn’t seem to paint a better picture, as earnings seem to have consistently been getting more and more negative over time.

Additionally, we can assess Sandmartin International Holdings’s loss by looking at what’s going on in the industry as well as within the company. Initially, I want to quickly look into the line items. Revenue growth over the past few years has grown by a mere 3.55%. Since top-line growth is also pretty flat, the key to profitability going forward would be managing costs. Inspecting growth from a sector-level, the HK communications industry has been growing its average earnings by double-digit 18.40% over the past twelve months, and a more muted 3.81% over the past five. This means any uplift the industry is deriving benefit from, Sandmartin International Holdings has not been able to realize the gains unlike its industry peers.

What does this mean?

Sandmartin International Holdings’s track record can be a valuable insight into its earnings performance, but it certainly doesn’t tell the whole story. Companies that incur net loss is always hard to forecast what will happen in the future and when. The most useful step is to examine company-specific issues Sandmartin International Holdings may be facing and whether management guidance has steadily been met in the past. You should continue to research Sandmartin International Holdings to get a better picture of the stock by looking at:

1. Financial Health: Is 482’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

2. Valuation: What is 482 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether 482 is currently mispriced by the market.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.