Yes, I'd Buy Amazon Stock on This Post-Earnings Dip. Here's Why

There's no denying it -- Amazon (NASDAQ: AMZN) just disappointed a whole bunch of shareholders. Not only did the e-commerce giant's second-quarter sales fall short of estimates, but its third-quarter revenue guidance is also shy of analysts' expectations. The stock's well down in response to the report, reaching a new multiweek low as a result of the tumble.

This sell-off, however, is ultimately a buying opportunity. Investors are so consumed by these two red flags that they're not seeing the bigger, bullish picture.

Here's the deal.

Three reasons to buy Amazon stock on this dip

On the off chance you're reading this and aren't already aware, for the three months ending in June, Amazon turned $148 billion worth of revenue into a per-share profit of $1.26. Those numbers are up from year-ago numbers of $134.4 billion and $0.65 per share (respectively), while earnings topped the expected $1.03. But even strong sales growth from the company's cloud computing and North American e-commerce arms weren't enough to push the top line to the projected $148.7 billion.

Aggravating the revenue miss is the company's lackluster guidance for the quarter now underway. Amazon says it's only looking for Q3 sales of between $154 billion and $158.5 billion. While that's 8% to 11% above last year's third-quarter comparison, the figure still doesn't compare favorably to analysts' consensus of $158.2 billion.

Investors flinched.

But this sudden wave of worry looks right past three bullish realities the market's likely to remember sooner than later. Here they are, in no particular order.

1. Amazon is still growing more than most

Yes, last quarter's top line was disappointing, as was the outlook for the third quarter. Keep it in perspective, though. Amazon's second-quarter sales were still up 10% year over year, roughly in line with the revenue growth of between 8% and 11% anticipated for the quarter now underway. Outside of the artificial intelligence and weight-loss drug industries, you'd be hard-pressed to find a company still driving as much growth as this one.

And that's not an assumption. A forecast from FactSet suggests the S&P 500's third-quarter sales will likely only improve to the tune of 5% year over year.

Connect the dots. Even if it's not completely immune to any and all challenges, Amazon is still a superior growth company, and still a better growth investment than most other stocks.

2. It offers superior bottom-line growth, too

Amazon's anticipated sales growth is apt to be very profitable, too. At the midpoint of the third quarter's operating income guidance of between $11.5 billion and $15 billion, the company is set to drive an 18% year-over-year improvement on Q3-2023's operating income of $11.2 billion. For comparison, FactSet says the S&P 500 is likely to see earnings growth of only 6.8% for the same period.

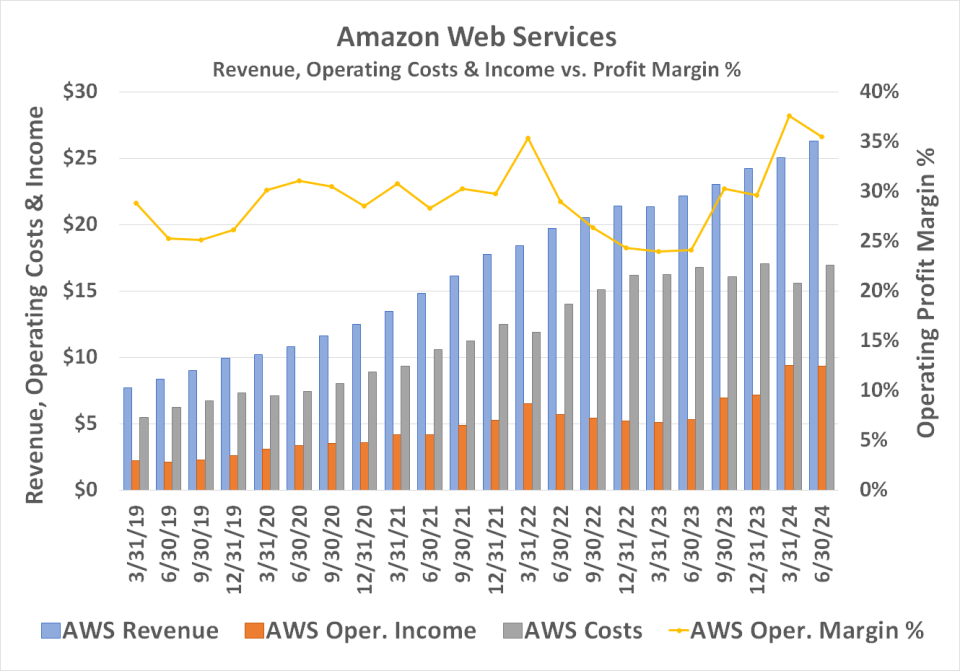

How is this company achieving what most others can't? Amazon's big growth drivers are also its highest-margin profit centers. Amazon Web Services saw sales growth of nearly 19% for the three months ending in June, with 35% of that figure ($9.3 billion) being turned into operating income.

Meanwhile, although the company doesn't disclose profit margin data for its nascent advertising operation, this is a business that monetizes the online shopping platform Amazon operates anyway. Of the $12.8 billion worth of ad sales reported for last quarter -- up 20% year over year -- a sizable chunk of it was likely converted into operating profit as well.

3. Amazon stock's current pullback isn't really about Amazon

Finally, while the knee-jerk bearish response to Amazon's second-quarter report and third-quarter guidance makes superficial sense, it may be less about the company and more about investors' current perceptions of the stock market's foreseeable future.

Think about it. Headlines have turned considerably more pessimistic in just the past few days, dragging the S&P 500 down from its mid-July peak on worries of a weakening economy. Even before Friday's poor jobs report for July, bond ratings agency Fitch expressed fresh concerns that loan defaults and delinquencies were set to rise in the latter half of the year. Since then, the International Monetary Fund has dialed back its full-year GDP growth forecast for the United States from 2.7% to 2.6% in front of expected 2025 growth of only 1.9%.

These are all legitimate concerns for investors, to be sure. But they can also leave stocks unfairly vulnerable to even just the mildest of bad news -- like Amazon's revenue letdown.

The good news is that such heightened bearish sentiment passes quickly enough. Once this wave of it is in the rearview mirror, don't be surprised to see Amazon stock perk up as investors recognize it's still a powerhouse.

Now's close enough

Is Amazon stock at its exact ultimate low right now? Maybe, maybe not. Nobody really knows.

What we do know is that Amazon's stock is currently down 20% from its early-July high, offering a healthy discount on shares of what is otherwise still a leading company, one with high-margin growth drivers like cloud computing and advertising, both of which should continue performing well even if the economy slows from here.

If you're a long-term investor waiting on a good entry point for a new position in this stock, don't overthink this dip. The rhetoric is far worse than Amazon's reality.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $615,516!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

Yes, I'd Buy Amazon Stock on This Post-Earnings Dip. Here's Why was originally published by The Motley Fool