William Blair Commentary: Market-Rotation Update

We want to share a brief update regarding the recent rotation in the market among capitalization segments and provide a glimpse into what we are currently seeing in the small/mid-cap and large-cap spaces.

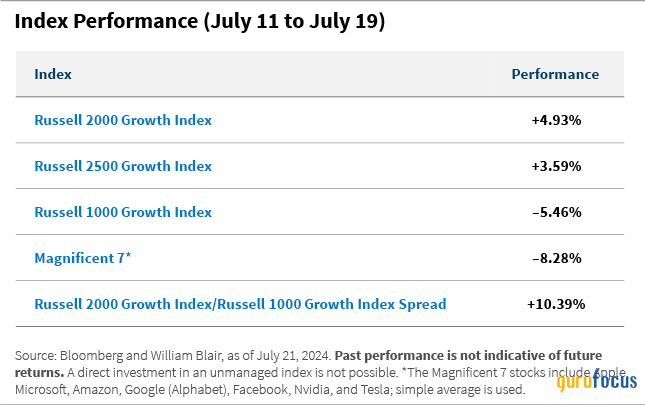

The seven trading days from July 11 to July 19 brought a significant rotation in the market among capitalization segments, with strong performance from smaller-cap stocks and a general broadening of market performance.

This rotation has not only been positive for smaller-cap indices, but could create a healthier backdrop for the overall market and active management in large-cap as performance in the larger-cap segment has been very narrow for the past several years, driven by a handful of mega-cap tech-focused stocks.

The rotation began on July 11, triggered by the cooler-than-forecast June Consumer Price Index (CPI) report, which showed a decline of 0.1% month-over-month.

Notably, the CPI report has bolstered optimism that policymakers will begin easing interest rates, with Wall Street pricing in a high probability for a rate cut in September and a second cut before year-end.

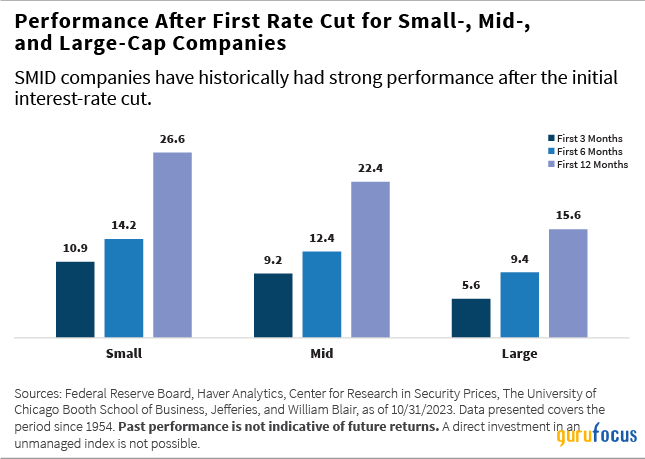

History reminds us that smaller-cap stocks have typically outperformed large-cap stocks after the initial interest-rate cut.

The recent rotation in the market is also a reminder that it only takes expectations to pivot, not an actual rate cut announcement, to help fuel smaller-cap performance.

From a larger-cap perspective, this period of market rotation also underscores the potential risks that passive investors could face if market performance continues to broaden. Over this timeframe, the Russell 1000 Growth Index ranked near the bottom quartile of the Morningstar large-cap growth universe. This indicates a better environment for relative performance by active management over this short period.

Seven trading days does not make a longer-term, cyclical trend. Investors could, at any time, return to a more risk-off market psychology as economic, political, or geopolitical events potentially influence market. This blog is intended to highlight our observations from recent market activity and the potential ramifications should it persist.

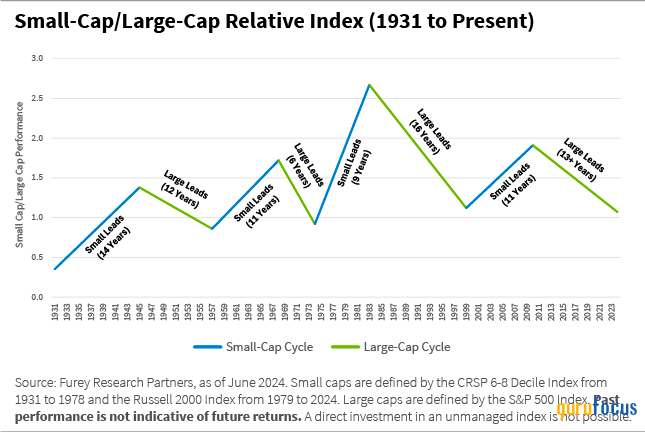

Finally, a reminder that investment cycles between large and small play out over extended time periods, as shown below. Simply because we have seen a breakneck rotation in the last week or so, it does not imply that investors still on the sidelines have missed the move. On the contrary, if history is any guide, the train hasn't left the station.

Aaron Socker is a portfolio specialist for William Blair's U.S. growth and core equity strategies.

The CRSP 6-8 Decile Index represents the performance of U.S. mid-cap stocks, specifically those in the sixth through eighth deciles by market capitalization as defined by the Center for Research in Security Prices (CRSP). The Russell 1000 Growth Index captures the performance of the large-cap growth segment of the U.S. equity market. The Russell 2000 Index measures the performance of the smallest 2,000 companies in the Russell 3000 Index, representing the U.S. small-cap sector. The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity market. The Russell 2500 Growth Index tracks the performance of the small- to midcap growth segment of the U.S. equity market. The S&P 500 Index represents the performance of 500 leading large-cap U.S. stocks, providing a broad snapshot of the overall market.

This article first appeared on GuruFocus.