Why SoundHound AI Stock Surged Today

SoundHound AI (NASDAQ: SOUN) stock posted big gains in Thursday's trading. The company's share price closed out the daily session up 7.1%, according to data from S&P Global Market Intelligence.

Despite the S&P 500 index falling roughly 0.5% and the Nasdaq Composite index falling 0.9% in the day's trading, many growth-dependent stocks saw significant gains Thursday. SoundHound and other artificial intelligence (AI) stocks with forward-looking valuations were able to post gains thanks to the latest economic report from the U.S. Department of Commerce.

In the report it published this morning, the Commerce Department estimated that gross domestic product (GDP) increased 2.8% annually in the second quarter. Meanwhile, the average economist forecast had called for growth of 1.9% in the period. The report was good news for SoundHound on multiple levels.

An economic "soft landing" would be great for SoundHound AI stock

The recent GDP data suggests that the U.S. economy may be heading for the "soft landing" that the Federal Reserve and other fiscal policy units/agencies/ have been trying to engineer. The recent data suggests that the economy may not need to enter into a recession in order to get inflation under control. The door remains open for the Fed to cut rates in September, and overall economic strength is looking better than anticipated. That's good news for SoundHound AI and other companies with highly growth-dependent valuations.

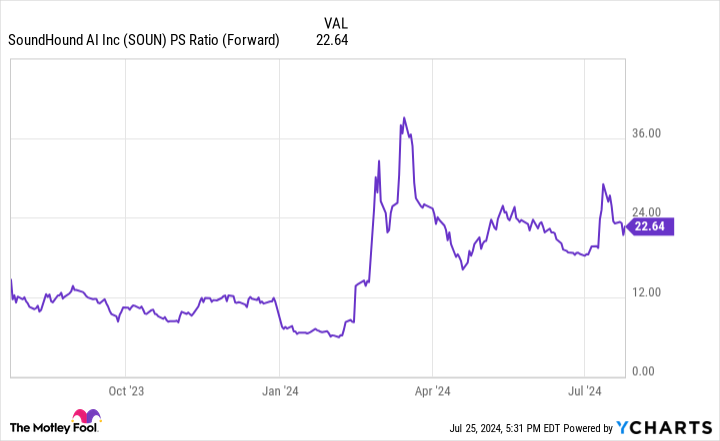

SoundHound has yet to post profits, and it's currently trading at roughly 22.6 times this year's expected sales. With that kind of heavily growth-dependent valuation profile, macroeconomic developments will likely have an outsized impact on the stock's near-term performance.

Strong consumer spending could support SoundHound's growth

In addition to suggesting a more favorable valuation backdrop, the GDP report may be flashing some positive signals for SoundHound's business. The better-than-expected Q2 economic data was driven largely by consumer spending.

Along those lines, many of the software specialist's customers are in the restaurant industry. The software specialist is also making a big push in the automotive space through its partnership with Stellantis. Strength in the consumer market could encourage key SoundHound customers to continue spending on growth initiatives and help the software specialist beat sales expectations.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $700,076!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why SoundHound AI Stock Surged Today was originally published by The Motley Fool