In This Article:

It has been about a month since the last earnings report for Entergy Corporation ETR. Shares have added about 3.1% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is ETR due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Entergy Q4 Earnings Top Estimates, Issues 18 View

Entergy reported fourth-quarter 2017 adjusted earnings of 76 cents per share, beating the Zacks Consensus Estimate of 42 cents by 81%. Moreover, the number improved 145.2% from the year-ago quarter’s figure of 31 cents.

On a GAAP basis, the company reported a loss of $2.66 per share compared with a loss of $9.88 a year ago. The difference between GAAP and operating earnings in the reported quarter was due to the effect of special items.

In 2017, Entergy reported adjusted earnings of $7.20 per share, beating the Zacks Consensus Estimate of $6.91 by 4.2%. Moreover, the number rose 1.3% from the year-ago figure of $7.11.

Segment Results

Utility, Parent & Other: The segment’s quarterly earnings were 41 cents per share compared with 35 cents in the prior-year quarter.

Entergy Wholesale Commodities (EWC): The segment reported operating earnings of 35 cents per share compared with loss of 4 cents in the year-ago quarter.

Highlights of the Release

Interest expenses were $662 million in 2017, down 0.6% from $666 million in the prior year.

In 2017, total retail customers served by the company increased 0.6% to nearly 2.9 million.

Financial Highlights

As of Dec 31, 2017, the company had cash and cash equivalents of $781 million compared with $1,188 million as of Dec 31, 2016.

Total debt, as of Dec 31, 2017, was $16.7 billion compared with $15.3 billion as of Dec 31, 2016.

For 2017, the company generated cash from operating activities of $2,624 million, down $2,999 million from the prior-year quarter.

Guidance

For 2018, Entergy issued operational earnings guidance per share in the band of $6.25-$6.85.

The Utility, Parent & Other adjusted earnings are expected in the range of $4.50-$4.90 per share.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

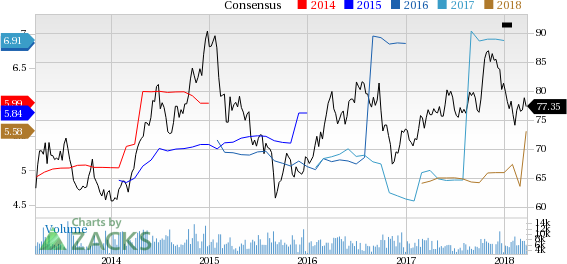

Entergy Corporation Price and Consensus

Entergy Corporation Price and Consensus | Entergy Corporation Quote

VGM Scores

At this time, ETR has an average Growth Score of C, however its Momentum is doing a bit better with a B. The stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.