Where Will Ford Stock Be in 10 Years?

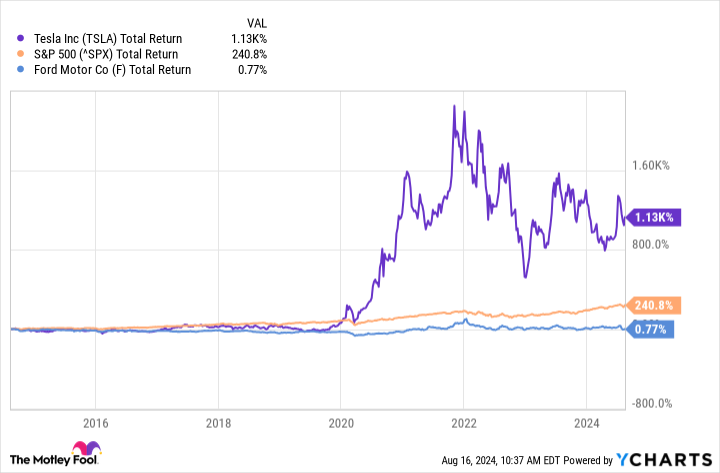

Returning almost nothing over the previous 10 years (even when including dividend payments), Ford Motor Company (NYSE: F) has been a pretty pathetic long-term investment. For context, the S&P 500 returned 241% over the same period, while upstart automaker Tesla grew by 1,100%.

While past performance doesn't predict the future, it can give some hints. Let's explore what the next decade could have in store for Ford as it seeks to consolidate and improve its business.

The EV boom became the EV bust

Like many legacy automakers, Ford was swept up in the much-hyped transition to electric vehicles (EVs), which promised to turn its lumbering internal-combustion-engine-powered business into something more exciting and innovative. But while the company is quickly adopting the new technology, it hasn't been much of a boon for the bottom line.

In the second quarter, Ford's new EV segment, Model E, lost $1.1 billion -- a staggering $46,000 per vehicle sold. That brings total segment losses to $2.5 billion this year, due in part to an industry price war as companies grapple with rising competition and soft demand.

There are several catalysts for the market weakness. For starters, high interest rates make cars less affordable because these big-ticket purchases are typically made with the help of credit. The expected Federal Reserve rate cuts could help the situation. But analysts at J.P. Morgan believe the U.S. economy has a 35% chance of entering recession by year's end, which would also hurt car buying demand.

What do the next 10 years have in store?

Over the long term, EV demand seems likely to bounce back and slowly replace demand for traditional ICE vehicles as battery technology improves and enabling infrastructure like charging stations are built out. However, it is still unclear what this trend will mean for Ford and other industry participants.

The past few years indicate that EV manufacturing is becoming less profitable. The new technology is also shifting the automotive industry's center of gravity to China, where manufacturers like BYD can produce EVs at shockingly low prices because of their vertical integration. BYD's cheapest car, the Seagull, sells for the equivalent of $9,700 in China.

While Washington's 100% tariff rate on Chinese EVs can keep ultra-competitive products like the Seagull out of the U.S. market, Ford could face margin-destructive price competition elsewhere in the world.

Is Ford stock a long-term buy?

If there is any silver lining for Ford stock investors, it may be the company's cash situation. Despite the ongoing weakness in its EV business, Ford generated around $2.5 billion in fourth-quarter operating income, which isn't too shabby. And it boasts a whopping $25 billion in cash and equivalents on its balance sheet.

Not only does Ford have enough money to power through any near-term industry challenges, but it will also have plenty left to return to investors. The company is known for implementing special dividends as part of its plan to distribute 40% to 50% of its free cash flow to investors. And shares boast a dividend yield around 5.8% at the time of this writing.

That said, dividends don't automatically make a stock a good investment -- especially if the share price remains flat or declines. The S&P 500 returns an annual average of 10% over long periods and Ford looks unlikely to top this in the next decade, even with its massive payout. The company faces too many serious long-term challenges to be considered a buy.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD Company, JPMorgan Chase, and Tesla. The Motley Fool has a disclosure policy.

Where Will Ford Stock Be in 10 Years? was originally published by The Motley Fool