Wells Fargo To Post Low-Single Digits Growth?

Wells Fargo & Co (NYSE: WFC) is to announce its second quarter financial results on Tuesday before the market opens. Expectations point towards a 3 percent year-over-year increase in earnings.

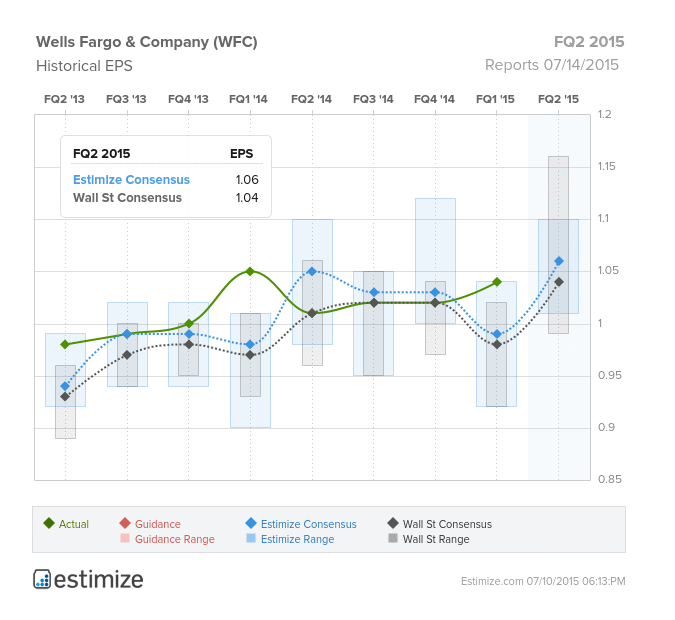

In the second quarter of 2014, the company reported earnings of $1.01 per share on revenue of $21.1 billion.

According to Esitmize, the Street is modeling consensus earnings of $1.04 per share on sales of $21.537 billion for the current quarter. The crowd is slightly more bullish and projects consensus earnings of $1.06 per share on revenue of $21.708 billion.

Wells Fargo has managed to beat estimates in most of the past eight quarters.

A Look At Large-Cap Banks

In a recent report, Morgan Stanley analyst Betsy Graseck shared a few bullish comments in relation to large-cap banks, saying, “bank shareholders should keep expectations low heading into Q2 earnings, but the forward-looking nature of the stock market could begin to boost bank stocks well ahead of fundamental improvements to the banking environment.”

“Higher rates, a strong spring selling season, and record M&A volumes all position banks well for 2H15 and beyond,” Graseck adds.

The analyst sees three major themes in the space:

Improving net interest margins and earnings, consequence from rising 10-year treasury yields.

Strong second quarter mortgage figures. The firm anticipates a 19 percent quarter-over-quarter increase in mortgage origination revenues for big banks.

“Booming M&A-related revenues resulting from the strongest M&A environment since the Financial Crisis.”

Latest Ratings for WFC

May 2015 | Susquehanna | Maintains | Neutral | |

Apr 2015 | Barclays | Maintains | Overweight | |

Apr 2015 | Macquarie | Maintains | Underperform |

View More Analyst Ratings for WFC

View the Latest Analyst Ratings

See more from Benzinga

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.