Warren Buffett's Strategic Reduction in Bank of America Shares

Overview of the Recent Transaction

On August 30, 2024, Warren Buffett (Trades, Portfolio), through Berkshire Hathaway, executed a significant transaction involving the sale of 21,076,473 shares of Bank of America Corp (NYSE:BAC). This move reduced the firm's holdings in BAC, impacting its portfolio by -0.3%. The shares were sold at a price of $40.24 each, adjusting the total shares held to 882,723,903, which now represents 11.38% of the firm's holdings in the traded stock.

Warren Buffett (Trades, Portfolio): Investment Titan

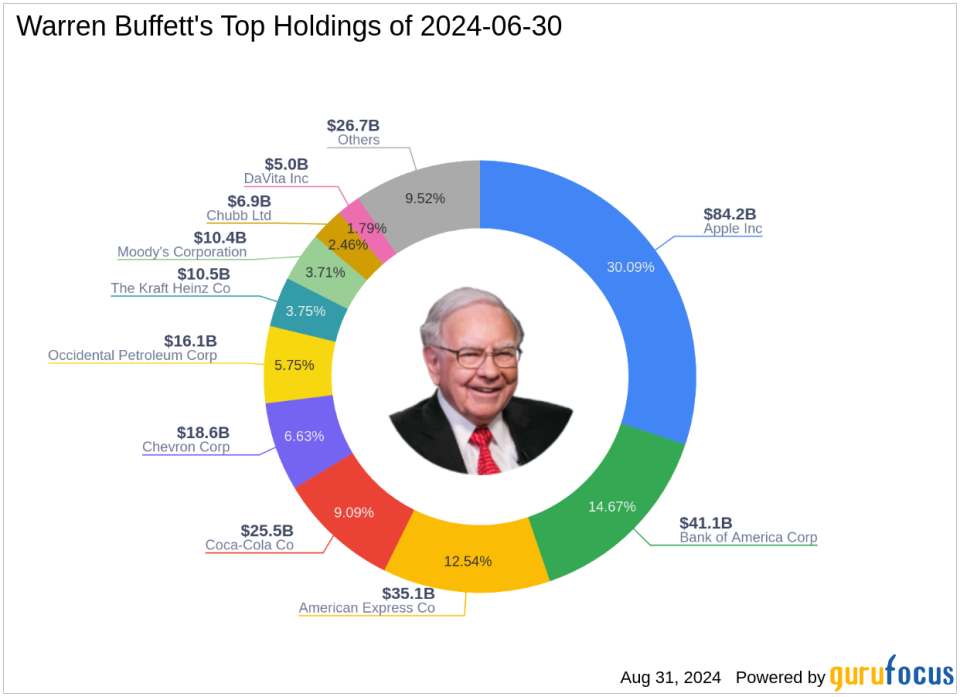

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a hallmark of investment success. As the chairman of Berkshire Hathaway, Buffett transformed a modest textile company into a powerhouse conglomerate. His investment philosophy, deeply rooted in Benjamin Graham's principles of value investing, emphasizes understanding a business deeply, investing with a margin of safety, and choosing companies with long-term value. Berkshire Hathaway's top holdings include giants like Apple Inc (NASDAQ:AAPL) and American Express Co (NYSE:AXP), reflecting a strong inclination towards financially sound companies.

Details of the Trade Action

The recent sale marks a shift in Buffett's strategy regarding Bank of America, where the firm now holds a reduced stake of 12.73% in its portfolio. This adjustment aligns with Buffett's cautious approach to portfolio management, ensuring each holding meets Berkshire's stringent criteria for value and potential.

Bank of America at a Glance

Bank of America, symbol BAC, is a leading financial institution in the United States, boasting a market capitalization of $316.2 billion. The company operates across various segments, including consumer banking and global markets, and has shown a robust GF Score of 80/100, indicating strong potential for future performance. Despite a challenging economic environment, BAC maintains a Profitability Rank of 6/10 and a Growth Rank of 7/10.

Market Context and Strategic Timing

The timing of Buffett's sale coincides with a period of market volatility and regulatory changes impacting the banking sector. This strategic reduction could be seen as a move to capitalize on recent price gains or to reallocate resources to more lucrative opportunities, reflecting Buffett's adaptive investment strategy.

Comparative Insights and Portfolio Alignment

Comparing this move to Buffett's other major holdings, it's evident that the firm is recalibrating its exposure to the financial services sector, which remains a top sector alongside technology. This realignment ensures that the portfolio remains diversified and aligned with Berkshire's long-term investment philosophy.

Implications for Investors

Buffett's decision to trim his position in Bank of America might signal to other investors the need for caution, particularly in the banking sector. It also underscores the importance of portfolio rebalancing and risk management in achieving investment success.

Broader Market Impact

Warren Buffett (Trades, Portfolio)'s investment moves are closely watched by the market. This recent transaction could influence broader market perceptions of the banking sector's stability and growth prospects, potentially leading to a reevaluation of investment strategies by other major investors.

This analysis of Warren Buffett (Trades, Portfolio)'s recent transaction provides valuable insights into his strategic thinking and offers a glimpse into the potential future direction of Berkshire Hathaway's investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.