Warren Buffett Just Sold Half of His Apple Stock. 3 Reasons Not to Panic.

The news that Warren Buffett's Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) sold half of its Apple (NASDAQ: AAPL) stock probably came as a shock to many investors. Although it often stood as the stock with the largest market cap in recent years, its growth played a significant role in the rise of Berkshire stock during that time.

Still, from another perspective, the sale is probably not as monumental as it seems. Three key points illustrate why investors should not panic because of this move.

1. Apple remains Berkshire's largest holding

Despite the size of the move, Berkshire Hathaway still owns approximately 400 million shares of Apple. At a value of roughly $84 billion, it made up about 29% of the Berkshire holdings at the end of the second quarter, far above Bank of America at 14%.

Also, even at a dramatically lower share count, Berkshire still holds a highly undiversified position in Apple stock. Buffett has long preached diversification, and last quarter's position of 789 million Apple shares meant that Apple made up a little less than half of the Berkshire portfolio.

Moreover, the remaining position implies a continued belief in the company. Even though it faces a competitive battle with its mega-tech peers in the artificial intelligence space, its leadership in smartphones and the power of the iOS ecosystem makes it a tech leader.

Furthermore, Apple boasts around $153 billion in liquidity, giving it one of the world's most stable balance sheets among publicly traded companies. That level of stability makes Berkshire's large position less risky, and with this recent sale, it is closer to having a diversified portfolio.

2. Apple stock had become (relatively) expensive

Additionally, Buffett and his team may have become concerned about its valuation. Its P/E ratio of 32 is hardly in the stratosphere, but its valuation has risen significantly over the years, increasing the likelihood that it realized most of the multiple expansion that was going to occur.

Investors should remember that Berkshire acquired the majority of its Apple shares between the first quarter of 2016 and the third quarter of 2018. At the beginning of 2016, Apple often traded at 10 times earnings.

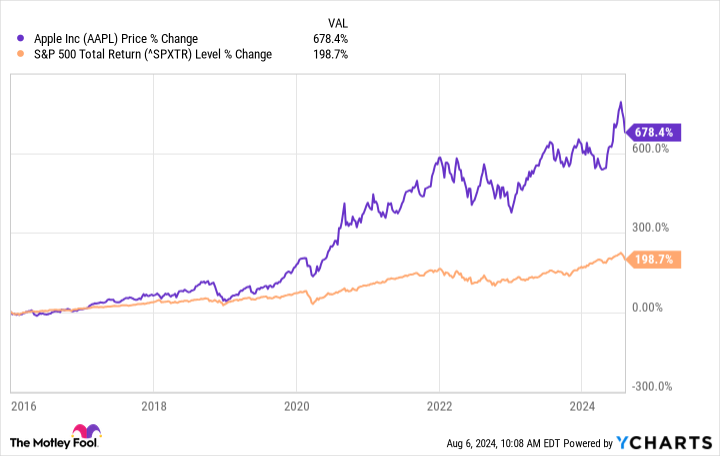

Its P/E ratio increased steadily during that time. Still, it took until the third quarter of 2018 for the earnings multiple to rise above 20. Thus, Berkshire benefited from significant multiple expansion, resulting in an approximate 700% increase in the stock since Buffett's team began buying. Since the S&P 500 delivered a total return of just under 200% since that time, Apple has been a clear winner for Berkshire.

3. Berkshire Hathaway's size means it needs the liquidity

Another reason for the sale may come with the difficulty of managing an investment company that is the size of Berkshire Hathaway. Its market cap now stands at about $890 billion as of the time of this writing.

Although growing to that level is undoubtedly an impressive feat, it comes with a key struggle. Thanks to the law of large numbers, achieving just 10% growth means the market cap has to grow by $89 billion. That is just below the average market cap of an S&P 500 stock, which is $92 billion.

In comparison, that average company has to increase by just $9.2 billion to achieve the same growth rate. This also means that a $9.2 billion acquisition that would be significant for an average company barely moves the needle for Berkshire.

That brings one back to Berkshire's $271 billion liquidity position. While that may seem excessive, it likely needs that much cash to make meaningful acquisitions. Hence, its liquidity position may not be as eye-popping as many investors and analysts assume.

Making sense of Berkshire Hathaway's sale of Apple

Ultimately, investors should consider the sale of Apple stock as an inevitable move rather than a game-changer.

Yes, the sale is massive by just about any measure. Nonetheless, the 400 million share position is still a weighty vote of confidence in Apple's future, making up a highly undiversified percentage of the Berkshire Hathaway portfolio. Also, Apple has become comparatively expensive, particularly when compared to the time it had begun to buy the stock.

Finally, Berkshire's massive size means it needs a considerable liquidity position to make any meaningful moves. Hence, instead of viewing this sale as historic for Berkshire, investors should see the move as business as usual for the investment giant.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Will Healy has positions in Berkshire Hathaway. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Just Sold Half of His Apple Stock. 3 Reasons Not to Panic. was originally published by The Motley Fool