Warren Buffett Just Sold 389,368,450 Shares of Apple Stock. Was That a Good Idea?

Since 1965, Warren Buffett built Berkshire Hathaway into one of the most successful investment powerhouses of all time. What's curious, however, is that the Oracle of Omaha built his fortune with a startlingly simple investing philosophy.

Investing like Buffett does not require a fancy degree or even time spent on a trading desk. Rather, adopting the principles of investing in companies with straightforward business models, consistent profits, and positive brand appeal, and holding onto strong conviction positions for many years can help you build generational wealth of your own.

Apple (NASDAQ: AAPL) stock has been a cornerstone of Berkshire's portfolio for years. However, Buffett caught some investors by surprise after recent filings revealed that Berkshire sold 389,368,450 shares of Apple during the second quarter.

To put this into context, this sale represented nearly half of Berkshire's position in the iPhone maker. Was this a good move, or did Buffett just make an irreversible oversight?

Let's break down the pros and cons of selling Apple stock right now, and assess what may have driven Buffett's decision.

The case for selling Apple stock

Let's start with the obvious: Berkshire's latest sale of Apple stock isn't anything new. The investment firm trimmed its position in Apple by about 13% earlier this year as well. During a shareholder conference back in May, Buffett strongly suggested that he thought changes to the tax code were on the horizon, which subsequently inspired some of his decision-making to take gains off the table.

Indeed, this reasoning made sense at the time. However, I think there are some other reasons influencing Berkshire's subsequent Apple sales.

Berkshire Hathaway initially started buying Apple stock during the first quarter of 2016. While I do not have the precise dates of Berkshire's investment, Apple stock has a total return of 855% since that January. This is nearly fourfold the S&P 500's total return during the same time period. Although it's nearly impossible to sell a stock at a perfect time, Apple's 19% return so far in 2024 is essentially identical to that of the S&P at the time of this article.

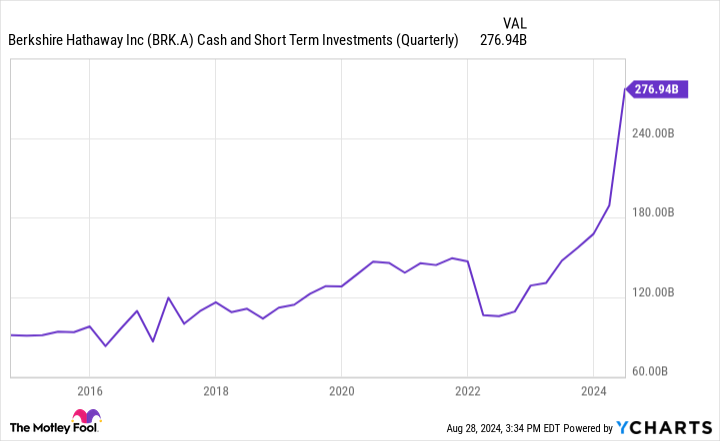

More importantly, I think investors might not be fully appreciating where Buffett is creating value for his shareholders outside of stocks right now. For the quarter ended June 30, Berkshire held $276.9 billion of cash and equivalents on its balance sheet. Berkshire's short-term investments include a massive $237.6 billion position in U.S. Treasury Bills (T-bills). One of the hallmarks of Buffett's investing style is that he likes consistency, and rolling over T-bills is an incredibly reliable strategy.

The case for not selling Apple stock

The most obvious reason I can think of for not selling Apple stock right now pertains to the artificial intelligence (AI) narrative. Earlier this year, Apple announced a partnership with OpenAI -- the developer of the popular tool ChatGPT. The impetus of this alliance is for Apple to bring a new wave of generative AI capabilities to its devices through the power of OpenAI.

Wedbush Securities analyst Dan Ives recently made the case that bringing AI to Apple's ecosystem will spur a new wave of demand for next-generation iPhones. Should Ives be proved correct, Apple's business could be on the verge of supercharging.

"I think this starts a historical period," says Wedbush's @DivesTech.

He breaks down what investors and potential buyers can expect from $AAPL's upcoming iPhone 16 event. pic.twitter.com/FzHNufUUB6-- Squawk on the Street (@SquawkStreet) August 27, 2024

Why it doesn't matter for Buffett

While I understand the theory put forth by Ives, my personal take is that Buffett is not fully enamored by the AI hype. Moreover, even though Berkshire sold roughly half its stake in Apple, the iPhone maker still represents about 30% of the total portfolio. For these reasons, I don't think Buffett is too worried about any missed profits because Berkshire stands to benefit from AI tailwinds anyway.

Furthermore, considering Buffett could have made a commensurate return investing in the S&P this year as opposed to having industry-specific exposures holding Apple, I can see why he took some money off the table and has opted for a more reliable investment in T-bills. Moreover, given the uncertainty around the upcoming presidential election (and therefore potential changes to the tax code) as well as any volatility this could inspire in the markets, I don't see Buffett's decision to offload a chunk of Apple stock to be poorly timed or misdirected. As always, it seems that the Oracle's decision was extremely calculated and positioned so that Berkshire can benefit no matter what happens.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Spatacco has positions in Apple. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Just Sold 389,368,450 Shares of Apple Stock. Was That a Good Idea? was originally published by The Motley Fool