Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever.

If you are an income investor, dividend yield is probably one of the first things you look at when examining a potential stock for your portfolio. That's logical, but yield alone isn't sufficient for determining if a company is good enough to provide decades of passive income.

For example, a stock like AGNC Investment (NASDAQ: AGNC) which has a huge 13% dividend yield, is a terrible choice for most passive income investors. Meanwhile, lower-yielding Realty Income (NYSE: O), Toronto-Dominion Bank (NYSE: TD), and Alexandria Real Estate Equities (NYSE: ARE) present three great options to add to your portfolio right now. Here's why.

The problem with ultra-high yields

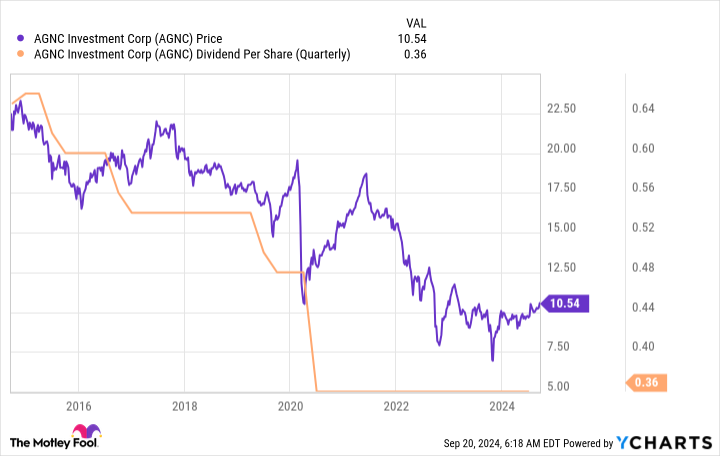

AGNC Investment isn't a bad company. But this mortgage real estate investment trust (REIT) is complex and focused on total return, not dividends. Yes, the yield is huge at over 13%, but don't get suckered in by the dividend yield. If you want to know why, just look at the graph below.

The dividend has been heading lower for a decade! The stock price has followed the dividend down, which is why, despite a terrible dividend history, the yield is so high. Sure, you are still collecting a dividend, but less income and a loss of capital are not what most passive-income investors really want.

1. Realty Income is a core holding

Realty Income, on the other hand, has increased its dividend every year for 29 consecutive years. The yield is a very compelling 5.1%. And the net lease REIT has a rock-solid investment-grade balance sheet.

It also happens to be the largest player in its property niche, with a gigantic portfolio of more than 15,400 assets. It is around four times larger than its next-closest peer by market cap. Its portfolio spans North America and Europe, giving it plenty of levers for growth.

To be fair, Realty Income is a slow and steady tortoise, but it can provide a solid foundation for your income-focused portfolio.

2. Toronto-Dominion Bank is a contrarian play

Toronto-Dominion Bank, or just TD Bank, is one of the largest banks in Canada. That country's banking regulations are very strict and create conservative cultures within Canadian banks like TD Bank.

The tight rules also effectively give the largest banks entrenched positions. So, on the whole, TD Bank is very reliable, noting that it has paid a dividend every year since 1857. Most companies haven't even existed that long. The dividend yield is an attractive 4.6%, which is toward the high end of the bank's historical yield range.

Why is the yield so high for such a conservative and reliable dividend stock? Well, TD Bank is dealing with some legal and regulatory issues related to its internal controls around money laundering. It isn't good news, and it appears that a few bad apples have gotten the bank in hot water.

However, the company believes the problem will be resolved by the end of 2024. Growth might be slow for a little while, but given the company's long history of success, it seems like this is a contrarian play that most passive-income investors should consider right now.

3. Alexandria Real Estate Equities is getting tarred with the wrong brush

It is hard to place Alexandria Real Estate Equities in a category. On one hand, this REIT owns healthcare assets, which likely have a bright future. On the other hand, it owns offices, which have been performing terribly since the pandemic.

Wall Street appears to be erring on the side of caution and treating Alexandria as an office REIT, pushing the shares down and the yield up to a historically high 4.2%. You should take the opposite view and look at it as a healthcare REIT.

The nuance here is important. Alexandria owns medical research facilities. Yes, these are offices, but they are also laboratories. You can't divorce the lab space from the office space, as both are vital to the development of new medical advances. To simplify things, researchers can't really plug away at a computer writing up their findings in the same place where they play with the chemicals.

Alexandria Real Estate Equities is a pure play in the medical research sector and has a 14-year history of annual dividend increases. The time to buy this misunderstood REIT is now if you want decades of reliable income.

Don't go for broke with high dividend yields

If you are looking to generate decades of reliable income, you really have to be careful not to get caught up in a hunt for yield. You need to find companies with good yields and proven track records that show they can support their dividends over the long term. Realty Income, TD Bank, and Alexandria all provide just that today.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has positions in Realty Income and Toronto-Dominion Bank. The Motley Fool has positions in and recommends Alexandria Real Estate Equities and Realty Income. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever. was originally published by The Motley Fool