(Bloomberg) -- When Pagerduty Inc. hired investment banks for its initial public offering earlier this year, Morgan Stanley turned the conversation to another possible outcome: a sale of the startup. The Wall Street giant wanted to make sure it would still be an adviser if Pagerduty ended up getting acquired instead of listing on the New York Stock Exchange as planned.

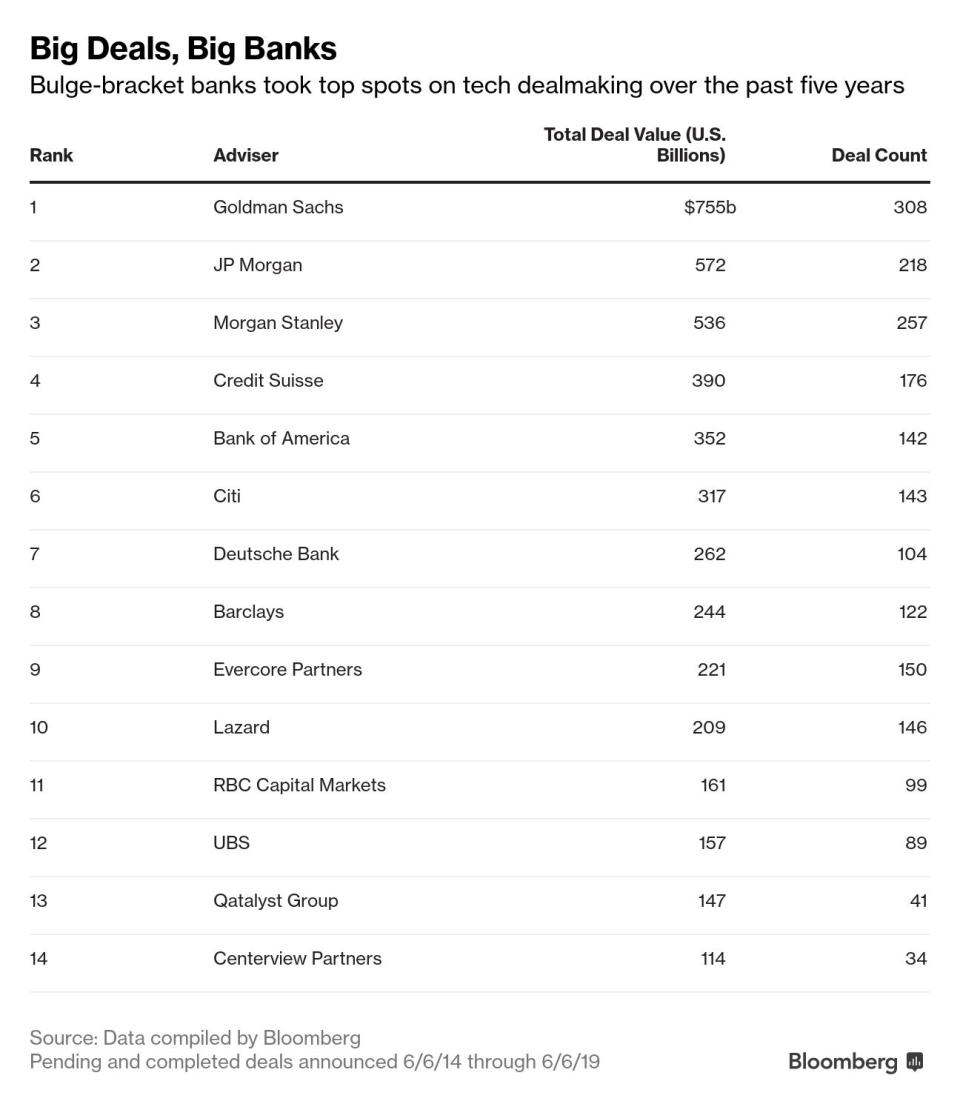

Morgan Stanley’s bid for reassurance was driven in part by an increasing threat from boutique investment banks, in particular Frank Quattrone’s Qatalyst Partners, which have become adept at finding acquisition deals for technology companies in the final stages of IPOs. That means big fees for Qatalyst and other boutiques such as Centerview Partners, and higher rankings on league tables that measure banking clout. Meanwhile, Morgan Stanley and bulge-bracket peers such as Goldman Sachs Group Inc. and JPMorgan Chase & Co. risk being left with no reward after months of work prepping companies for public listings.

Boutique firms don’t pull this off regularly, and they still advise on far fewer deals. But they’ve done enough to unsettle Wall Street’s largest firms. Morgan Stanley and other IPO underwriters are now asking some clients for reassurances that the banks will still be included – and paid – as advisers even if listings fall through in favor of acquisitions, according to people familiar with the situation. Qatalyst and Morgan Stanley declined to comment.

These requests typically take the form of a handshake agreement, said the people, who asked not to be identified discussing private negotiations. But sometimes the pacts are written into underwriting agreements. The chief executive officer of a startup that held one of last year’s most-successful IPOs said he signed one of these clauses because he planned to stick to the IPO and believed an acquisition was a moot issue. Morgan Stanley underwrote that offering. With more venture-backed companies set to list soon -- including cybersecurity firm CrowdStrike, customer-feedback company Medallia, and data-management startup Rubrik – millions of dollars in banking fees are at stake.

It’s not only Morgan Stanley that is losing out. Biotech company Peloton Therapeutics Inc. was acquired by Merck & Co. for as much as $2.2 billion on the eve of its IPO earlier this month. Peloton tapped Centerview for M&A advice. It’s unclear whether the three IPO underwriters, J.P. Morgan, Citigroup Inc. and Jefferies Financial Group Inc., were involved in the purchase negotiations. At least one of these banks got no fees for their work. The banks declined to comment.

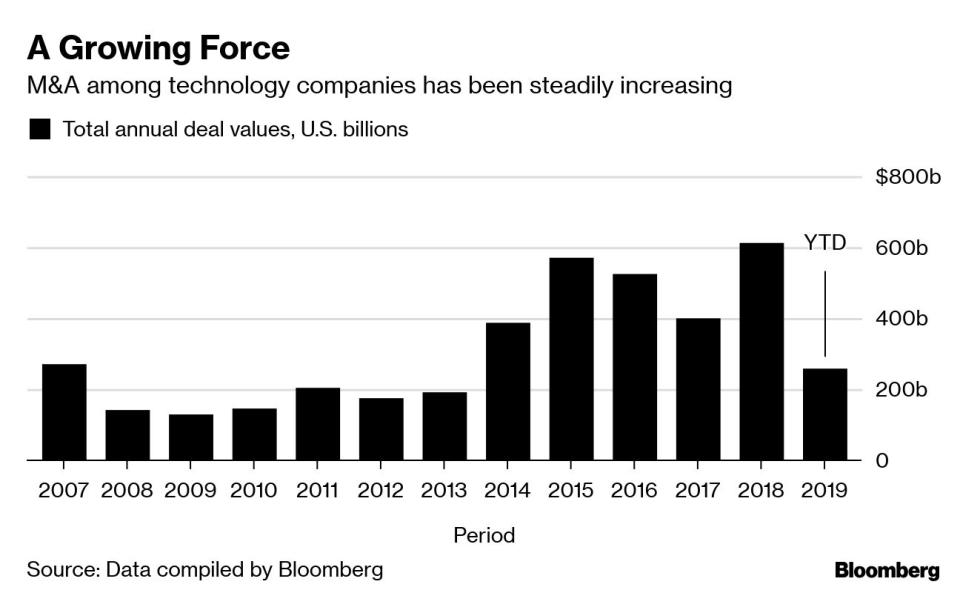

The phenomenon shows how the rise of the technology industry is changing how deals are done. Giant tech companies, with hundreds of billions of dollars in cash, are looking for acquisitions, so a sale is more of an option these days – particularly for enterprise tech companies that often have more predictable growth trajectories by the time they get to the IPO stage. Antitrust scrutiny may cool some larger deals. But the industry has still become a major source of investment banking fees, so tech companies have more leverage when they’re negotiating with banks. If startups want to choose a separate M&A adviser, who cares if they hurt their IPO bankers’ feelings?

Two years ago, analytics company AppDynamics called off its IPO just before a listing led by Morgan Stanley that was set to value AppDynamics at around $2 billion. Instead, networking giant Cisco Systems Inc. agreed to acquire the company for $3.7 billion in cash and assumed equity awards. The deal was arranged by Qatalyst and caught Morgan Stanley by surprise.

And late last year, SAP SE agreed to buy survey-software company Qualtrics International Inc. for $8 billion just days before an IPO. Qualtrics had been planning to list at a valuation of about $5 billion, aided by Morgan Stanley. Instead, Qatalyst swooped in and arranged the sale. Morgan Stanley was ultimately involved in the transaction, but was not the lead adviser.

Another transaction shows how the process can work in Morgan Stanley’s favor. When financial-planning service Adaptive Insights Inc. was bought by Workday Inc. in 2018, just days before its IPO, Morgan Stanley simply transitioned to a new role as adviser on the sale rather than underwriter of the listing – and got fees to match.

“The IPO syndicate had done a lot of work,” Tom Bogan, Adaptive’s CEO, said in a recent interview. “I thought it was appropriate that they be recognized with the proper economics.”

M&A fees are often bigger than IPO advisory fees because the whole company is being sold in an acquisition, while in most public listings only a portion of the business is offered. Banks also see IPOs as the first of what they hope will be a string of lucrative transactions with a public company, including secondary share offerings, debt sales, and the young company’s future acquisitions.

After Cisco bought AppDynamics, the startup and some of its venture capital backers crafted a deal where Morgan Stanley was paid in consideration for IPO work done, two people close to the situation said.

"Legally, we didn't have to pay them fees because we didn't do the IPO, but we actually paid them the full fees because they did all of the work, so it was kind of fair," Jyoti Bansal, founder of AppDynamics, said.

Greylock Partners and Lightspeed, which each made more than $600 million backing AppDynamics, supported the move. But it was contentious and not all the venture board members agreed, believing that the nature of investment banking includes losing some deals even at late stages, the people said. They declined to be identified because of the sensitivity of the situation.

Qatalyst was co-founded by longtime banker Frank Quattrone in 2008. He stepped back to the executive chairman role in 2016 and George Boutros, a former colleague from their time together at Credit Suisse First Boston, became chief executive offer.

The duo have developed a controversial reputation in Silicon Valley by bidding up the price of acquisition targets. But the firm still advises on big deals, including Oracle Corp.’s $9.3 billion acquisition of NetSuite and Microsoft Corp.’s $28 billion purchase of LinkedIn, both in 2016. Last week, Google bought IPO candidate Looker Data Sciences Inc. for $2.6 billion and Qatalyst advised the startup on the sale.

“We have to understand what it is that motivates an acquirer to want an asset,” Boutros said in a 2016 Bloomberg interview. “Where is your leverage as a seller?”

In a typical IPO, the underwriters are emblazoned at the top of regulatory filings for all to see. With the pre-IPO deals Qatalyst works on, the firm operates in the background. The startups typically don’t formally hire Qatalyst as an adviser in advance, according to people familiar with the matter. Instead, Qatalyst does its own analysis of which companies could benefit from buying the startup, arranges introductions, and makes the case to both parties – even if they haven’t invited the attention.

A common IPO approach has been to pursue a "dual track" – simultaneously exploring a sale while going public. In recent years, Qatalyst has persuaded some companies that they need a separate M&A adviser during the IPO process. The pitch of boutiques such as Qatalyst is that banks hired as IPO underwriters won't focus on the stock offering properly if they are distracted by the possibility of more-lucrative M&A.

Bulge-bracket bankers say the outcome is better – a high price for the company, be it in an IPO or an M&A deal – if the same bank handles both. One banker compared advising on M&A without an inside read on IPO valuation to fighting with one hand tied behind one’s back. They also argue that boutique banks like Qatalyst aren’t as independent as they portray themselves in pitches because these firms only get paid when there’s an acquisition.

Qatalyst was informally shopping CrowdStrike Holdings Inc. about six months ago, according to four people familiar with the matter. The cybersecurity company held talks with Cisco. The networking giant mulled an acquisition, but did not make a formal offer, one of the people said. Cisco declined to comment.

CrowdStrike, which was valued at more than $3 billion in a funding round last year, plans to hold an IPO in coming weeks. Goldman Sachs, J.P. Morgan, Bank of America Corp. and Barclays Plc are leading the offering.

To contact the authors of this story: Sarah McBride in San Francisco at smcbride24@bloomberg.netLiana Baker in New York at lbaker75@bloomberg.net

To contact the editor responsible for this story: Alistair Barr at abarr18@bloomberg.net

For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.