Verizon Communications Stock Is Lagging the S&P 500, and This Is How Many Years It Has Been Since It Last Beat the Market

Verizon Communications (NYSE: VZ) is a big name in telecommunications. It's one of the leading telecom providers, and for investors, it's also a reliable dividend stock to own. But one thing it hasn't typically been is a good growth stock or a market-beating investment to own. This year, its shares are up just 8%, which is mild compared with the S&P 500, which has rallied 17% thus far in 2024.

Unfortunately, that has been par for the course for Verizon. While it can occasionally produce modest gains, it hasn't usually outperformed the broad market. But just how poorly it has done may surprise you.

Verizon's stock has outperformed the S&P 500 in just two of the past 10 years

A lack of capital appreciation has made Verizon a fairly undesirable stock for investors to own over the past decade. And not only has Verizon underperformed the market regularly, its returns have also often been negative. It hasn't beaten the S&P 500 since 2018, and looking at the stock's return year to date, it's likely to underperform the market this year as well.

Year | Verizon stock return | S&P 500 return |

|---|---|---|

2023 | -4.3% | 24.2% |

2022 | -24.2% | -19.4% |

2021 | -11.6% | 26.9% |

2020 | -4.3% | 16.3% |

2019 | 9.2% | 28.9% |

2018 | 6.2% | -6.2% |

2017 | -0.8% | 19.4% |

2016 | 15.5% | 9.5% |

2015 | -1.2% | -0.7% |

2014 | -4.8% | 11.4% |

Source: YCharts.

Only once has Verizon even generated a double-digit gain despite its lackluster results. You might have expected to see a big bounce back after a particularly bad year, but that hasn't happened with Verizon, at least not yet. It has rallied this year, but it has not made up for the fairly sizable losses it has incurred since 2020.

Is Verizon's stock due for a big year in 2025?

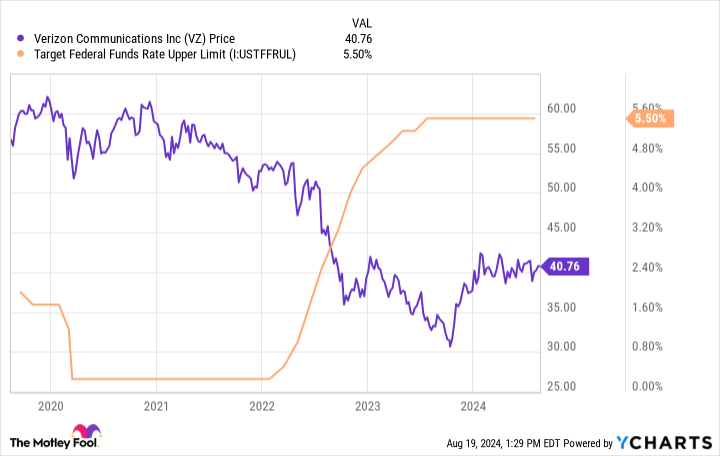

It may be tempting to look at Verizon's recent results and dismiss the stock as a bad buy heading into next year. But the past doesn't predict the future. And there are potential catalysts that could send the stock higher next year. The obvious one is interest rate cuts.

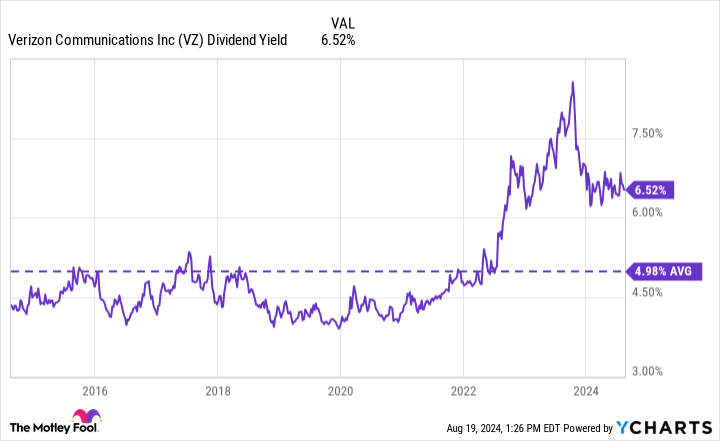

Right now, Verizon's stock yields 6.5%, which is a far higher payout than the stock normally averages.

VZ Dividend Yield data by YCharts.

Although tempting, investors haven't been rushing out to buy the high yielding dividend stock, and that's because there are other asset classes generating decent returns (e.g., bonds) in a high interest rate environment without the added risk that comes along with investing in equities. However, once rates begin to come down, that equation could change.

One could argue the stock has underperformed in recent years because interest rates have been high. If this argument holds true, Verizon may be one of the hottest stocks to own once interest rates cool off, and may happen as early as next month with the Federal Reserve mulling cuts in interest rates.

Verizon is also more than just a speculative play. The company has generated strong operating profits totaling at least $28 billion in each of the past four years. It has accumulated more than $23 billion in free cash flow over the past two years. At a forward price-to-earnings multiple of just nine, the stock is also trading at a considerable discount.

Should you buy Verizon stock right now?

Verizon's stock hasn't been doing well in recent years, but that doesn't mean it isn't overdue for a big rally. Given its solid results and attractive valuation, this could be an underrated stock to buy heading into next year. As investors look for safer stocks to own as rates come down and fears rise about a possible recession, Verizon could become a much more coveted stock in the near future. Its high yield gives investors plenty of incentive to remain patient with the stock.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Verizon Communications Stock Is Lagging the S&P 500, and This Is How Many Years It Has Been Since It Last Beat the Market was originally published by The Motley Fool