Is the VanEck Semiconductor ETF Still a Millionaire Maker?

Not every winning investment strategy requires great stock picking. Sometimes, it just requires recognizing a trend, finding the right investment product, and sticking with it.

Such is the case with the semiconductor industry. It has been around for decades, and companies in it have been making investors richer that whole time.

One of the easiest ways to invest in this sector is through a popular exchange-traded fund (ETF) called the VanEck Semiconductor ETF (NASDAQ: SMH).

What is the VanEck Semiconductor ETF?

The VanEck Semiconductor ETF was started in May 2000. The fund is operated by VanEck, a New York-based investment management firm with over $100 billion in assets under management.

The fund tracks the MVIS US-Listed Semiconductor 25 Index, which is narrowly focused on that industry, following the 25-largest U.S.-listed -- but not necessarily U.S.-based -- semiconductor companies. As such, the ETF's portfolio is somewhat top-heavy with three megacaps -- Nvidia, Taiwan Semiconductor Manufacturing, and Broadcom -- comprising about 43% of its overall exposure.

Company | Symbol | Percentage of Assets |

|---|---|---|

Nvidia | NVDA | 21.27% |

Taiwan Semiconductor Manufacturing | TSM | 13.83% |

Broadcom | AVGO | 8.49% |

Advanced Micro Devices | AMD | 4.95% |

Texas Instruments | TXN | 4.85% |

ASML Holding | ASML | 4.59% |

Applied Materials | AMAT | 4.21% |

Lam Research | LRCX | 3.91% |

Analog Devices | ADI | 3.85% |

Qualcomm | QCOM | 3.84% |

Source: VettaFi.

Viewed from a growth vs. value perspective, it's clear this is not just a growth-oriented fund -- it's a hypergrowth-oriented fund. Its current dividend yield is just 0.4%, so income-oriented investors can safely steer clear.

As for fees, the fund has an expense ratio of 0.35% -- meaning a $10,000 investment in the fund will result in $35 per year in fees. While that's not excessive, it's far from the lowest expense ratio around . For example, the Vanguard Information Technology ETF , a similar fund with a slightly broader focus on the overall tech sector, has an expense ratio of only 0.1%.

How has the VanEck Semiconductor ETF performed?

It's certainly possible to criticize this fund for its concentrated holdings and so-so expense ratio, but one thing that's difficult to nit-pick about is its performance.

To put it bluntly, the VanEck Semiconductor ETF has blown away the competition.

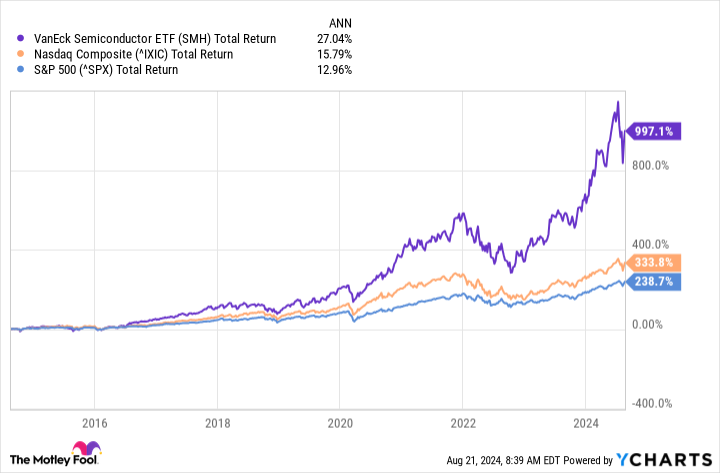

Consider how it has stacked up against a few of the benchmark indexes over the last 10 years, for example.

Simply put, this fund has walloped them. It has generated an astounding total return of nearly 1,000% -- meaning a $100,000 investment made in it in 2014 would now be worth close to $1.1 million.

Indeed, the fund has achieved a compound annual growth rate of 27% over the last 10 years, compared to 13% for the S&P 500 and 16% for the Nasdaq Composite.

Is the VanEck Semiconductor ETF still a buy now?

All in all, this fund has many of the characteristics investors should be looking for. That said, it isn't for every investment portfolio. As noted earlier, the fund generates very little income due to its meager dividend yield. Moreover, value-focused investors should steer clear of the fund due to its concentration in high-growth and high-risk stocks.

However, for investors who are focused on growth rather than income, or for long-term investors who are willing to ride out periods of sharp volatility, this fund is worth considering.

Should you invest $1,000 in VanEck ETF Trust - VanEck Semiconductor ETF right now?

Before you buy stock in VanEck ETF Trust - VanEck Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and VanEck ETF Trust - VanEck Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jake Lerch has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Is the VanEck Semiconductor ETF Still a Millionaire Maker? was originally published by The Motley Fool