This Utility Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy?

The utility sector is not exactly known for being a hot performer, but that didn't stop NextEra Energy (NYSE: NEE) from beating the S&P 500 index in the first six months of 2024. This impressive showing, however, needs to be taken with a grain of salt. Yes, NextEra Energy is a well-run utility with a fast-growing business. But it should only be bought by a certain type of investor.

A look at NextEra Energy's impressive first half

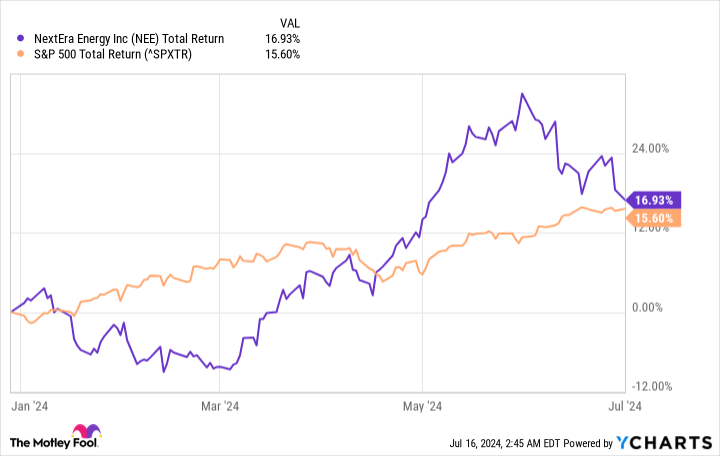

In the first six months of 2024, NextEra Energy's stock price gained roughly 16.5%. By comparison, the S&P 500 rose a slightly less impressive 14.5%. And the Utilities Select Sector SPDR ETF (NYSEMKT: XLU) climbed just 7.5% or so. Clearly, NextEra Energy was a standout, including within the utility sector, which is important to take note of. It means that there was likely something more going on than a rising tide lifting all boats.

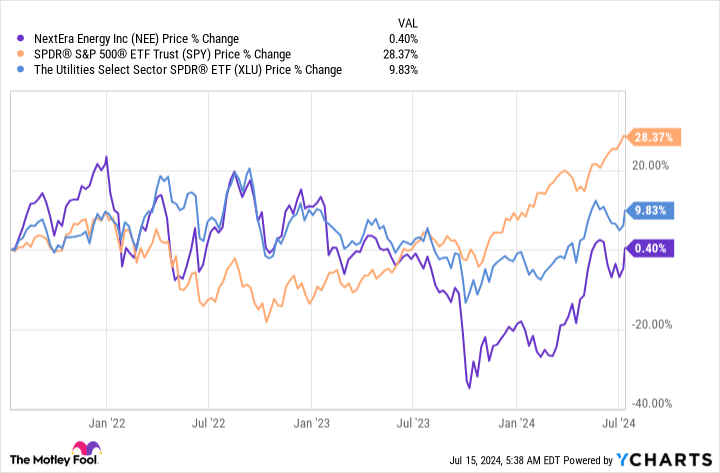

So what was driving NextEra higher? Pushing the performance examination back a little further to three years helps to highlight the key catalyst behind NextEra Energy's surprisingly strong showing in the first half of 2024. As the chart below highlights, NextEra Energy drastically underperformed both the S&P 500 index and the average utility stock thanks to a steep decline in 2023. In fact, even after the big six-month advance, NextEra Energy stock has basically gone nowhere for three years, while the average utility gained 9% and the S&P rose 28%.

Simply put, NextEra Energy's outperformance in the first half of 2024 was really just a recovery from a steep drop. It could continue to outperform from here, but investors probably shouldn't go in expecting a repeat.

NextEra Energy is well run and growing strongly

To be fair, NextEra Energy is a highly respected utility. Its business foundation is Florida Power & Light, one of the largest regulated utilities in the United States. Florida is an advantaged market, as it has benefited from in-migration for many years. That supports the company's requests for rate increases and capital spending plan approvals. On top of that foundation, NextEra Energy has built one of the world's largest renewable power companies, with a huge position in both solar and wind.

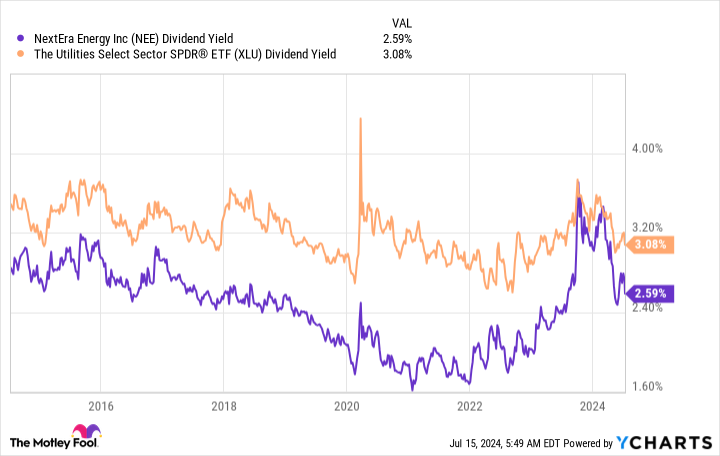

Over the past decade, NextEra Energy has increased its dividend at a huge 10% annualized clip. That's an impressive figure for any company, but is truly astounding for a utility. That's what led to NextEra Energy being a Wall Street darling that was afforded a very rich price, as highlighted by a dividend yield that hovered around 1.75% between 2020 and 2022. That was dramatically below the yield on the average utility, as the chart below indicates.

The deep share-price decline after interest rates increased reflected investors' worrying about all utilities. But it also reflected investors dumping one of the hottest stocks in the utility sector. It's not an uncommon event for the most highly valued stocks to see the steepest declines when Wall Street gets scared. At this point, using dividend yield as a rough gauge of valuation, NextEra Energy's valuation appears to be about middle of the road over the past decade. That said, it is again priced at a premium to the average utility, which suggests that further upside is probably limited.

Dividend growth investors should buy NextEra Energy

Impressively, NextEra Energy is telling investors to expect earnings to rise between 6% and 8% per year through 2027, with dividend growth of 10% per year through 2026. So the core business story here hasn't changed. But investors have again given the stock a premium valuation, so the big recovery opportunity is likely gone. It wouldn't be a good idea to buy the shares expecting the second-half return to look as strong as the first-half showing. And yet dividend growth is likely to remain robust, which means that, all told, NextEra Energy is most appropriate for dividend growth investors. Those seeking attractive yields or value stocks will be better off elsewhere.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

This Utility Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy? was originally published by The Motley Fool