This Utilities Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy?

Utility stocks tend to be quiet performers. They typically deliver steady earnings and dividend growth, which adds up to decent but often unspectacular returns. That was the case in the first half of this year. As measured by the Utilities Sector SPDR ETF, utilities delivered a 7.6% gain in the first half (and a 9.3% total return when adding in dividend income). While solid, they underperformed the S&P 500's 14.5% gain and 15.3% total return.

However, there was one huge outlier among utility stocks: Constellation Energy (NASDAQ: CEG). Shares of the leading nuclear energy producer surged more than 70%. Here's a look at what fueled its rally and whether it's still a buy.

Accelerating growth

Constellation Energy unveiled its financial outlook for 2024 and beyond in late February. The leading clean energy producer expects to grow its base earnings by at least 10% annually through the end of the decade. It also expects to deliver robust dividend growth. It boosted its payout by 25% this year, which exceeded its 10% annual growth target. The company also launched a new $1 billion share repurchase program.

That forecast has Constellation Energy on track to grow much faster (and for much longer) than its peers in the utility sector. For example, leading clean energy-focused utility NextEra Energy expects to grow its adjusted earnings by 6% to 8% annually through 2027 while increasing its dividend by around 10% per year through at least 2026. That's one of the better growth forecasts in the sector. Many other utilities project 5% to 7% annual earnings growth with dividend increases that, at best, match their earnings growth rate.

Another catalyst powering the company's strong first-half returns is the growing expectation that nuclear energy will play an important role in powering data centers related to artificial intelligence. Those facilities use significantly more power than traditional data centers, which are power-hungry facilities in their own right. Constellation Energy is working to secure power purchase agreements with large technology companies backing its nuclear facilities. These deals could enhance its already robust growth outlook.

A pricey utility stock

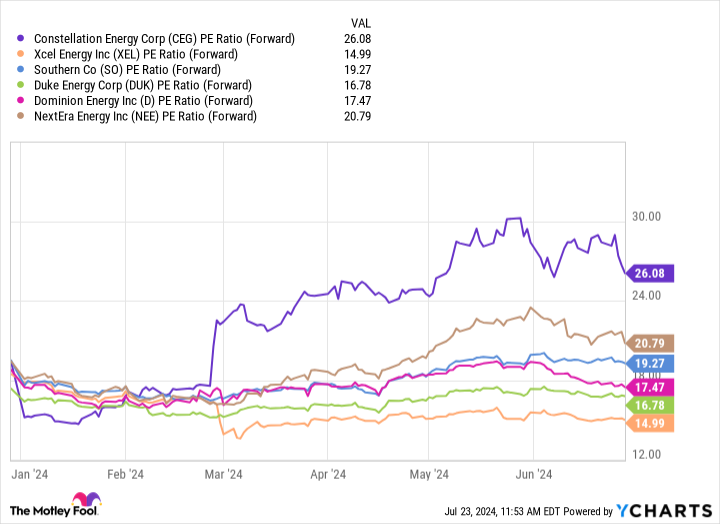

All the enthusiasm surrounding Constellation Energy's future has the stock riding high. Maybe too high. Investors have bid the stock up to such a degree that it trades at a forward P/E ratio of 26 times. That's a lot more expensive than its peers in the utility sector:

It's also higher than the S&P 500 (nearly 23 times forward P/E), though not as pricey as the growth-focused Nasdaq-100 (almost 29 times).

On the one hand, Constellation deserves to trade at a premium valuation. It's growing much faster than its utility peers (and many other companies). Further, its current forward P/E in the mid-20s is about where NextEra Energy traded a few years ago. So, while it's not a screaming bargain by any means, it's not excessively expensive, especially for a company growing at such an above-average rate.

However, its pricey valuation is one of the factors behind its low dividend yield (recently around 0.7%). It's well below the S&P 500's dividend yield (1.3%) and its peers in the utility sector (NextEra's is 2.8%, while others offer even higher yields). Constellation also has a low dividend payout ratio, which allows it to fund more growth internally and return additional money to investors via share repurchases.

High-powered growth ahead

Constellation Energy expects to deliver double-digit earnings growth through the end of the decade, which is faster growth than its utility sector peers. That drove investors to bid up its stock in the first half so that it trades at a premium to its rivals and the broader market. The company certainly could have the fuel to continue outperforming, especially if it captures additional AI-related growth opportunities. Because of that, it could still be an enticing option for growth-focused investors to buy. However, given its pricey valuation and low dividend yield, it might not be the best utility stock to buy if you desire income and lower-volatility returns.

Should you invest $1,000 in Constellation Energy right now?

Before you buy stock in Constellation Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Matt DiLallo has positions in NextEra Energy. The Motley Fool has positions in and recommends Constellation Energy and NextEra Energy. The Motley Fool recommends Dominion Energy and Duke Energy. The Motley Fool has a disclosure policy.

This Utilities Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy? was originally published by The Motley Fool