US Growth Companies With High Insider Ownership

The U.S. stock market has recently seen a mixed performance, with the Dow Jones Industrial Average hitting record highs while the Nasdaq Composite fell slightly. Amid this volatility, investors are increasingly looking for growth companies with high insider ownership, as these stocks often indicate strong management confidence and alignment with shareholder interests. In today's market environment, such attributes can be particularly valuable for identifying resilient investment opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

On Holding (NYSE:ONON) | 28.4% | 24.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 60.9% |

BBB Foods (NYSE:TBBB) | 22.9% | 66.5% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

California BanCorp

Simply Wall St Growth Rating: ★★★★★☆

Overview: California BanCorp, with a market cap of $476.91 million, operates as the holding company for Bank of Southern California, N.A., providing various banking services.

Operations: California BanCorp generates $87.33 million in revenue from its Commercial Banking segment.

Insider Ownership: 16.5%

Earnings Growth Forecast: 113.3% p.a.

California BanCorp, recently rebranded from Southern California Bancorp, is experiencing significant executive changes and has been added to multiple Russell indices. Despite a forecasted annual earnings growth of 113.3% and revenue growth of 50.8%, the company faces challenges such as declining profit margins and substantial dilution over the past year. Insider transactions show more buying than selling in recent months, indicating potential confidence in future performance despite recent net charge-offs and lower net income compared to last year.

Bilibili

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of $5.66 billion.

Operations: The company's revenue segment from Internet Information Providers amounts to CN¥23.95 billion.

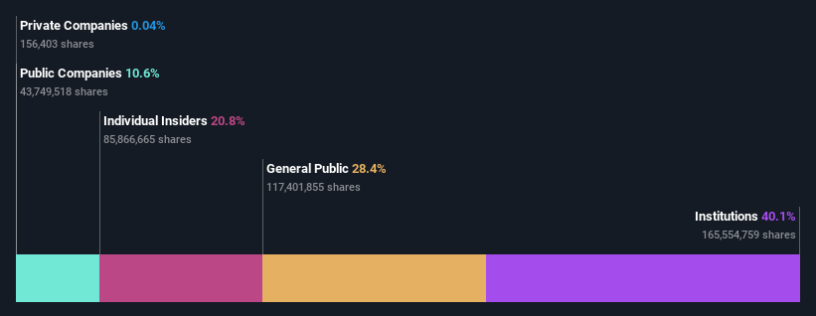

Insider Ownership: 20.7%

Earnings Growth Forecast: 80.5% p.a.

Bilibili Inc. reported a notable reduction in net loss for Q2 2024, from CNY 1.55 billion to CNY 608.7 million year-over-year, with revenue increasing to CNY 6.13 billion from CNY 5.30 billion. Despite slower forecasted revenue growth of 11.5% annually, its earnings are expected to grow significantly at an annual rate of 80.5%. The company is trading at a substantial discount to its estimated fair value and is anticipated to become profitable within three years, reflecting strong insider confidence and potential for future growth.

Frontier Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of approximately $770 million.

Operations: The company's revenue segment includes providing air transportation for passengers, generating $3.61 billion.

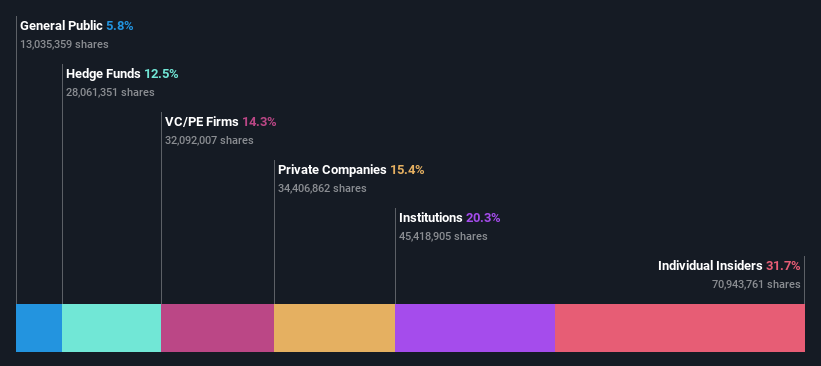

Insider Ownership: 34.7%

Earnings Growth Forecast: 110.2% p.a.

Frontier Group Holdings, Inc. shows mixed results with Q2 2024 revenue at US$973 million and net income dropping to US$31 million from US$71 million year-over-year. Despite this, the company is forecasted to achieve annual profit growth of 110.19% and a high return on equity of 31.3% within three years. Revenue is expected to grow at 12.1% annually, outpacing the broader U.S market’s growth rate of 8.8%, indicating strong insider confidence in its future performance.

Next Steps

Dive into all 177 of the Fast Growing US Companies With High Insider Ownership we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:BCAL NasdaqGS:BILI and NasdaqGS:ULCC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com