Unveiling Three US Stocks That May Be Trading Below Their Estimated Fair Values

Amid a turbulent week where major U.S. stock indices like the S&P 500 and Nasdaq Composite experienced notable declines, largely driven by a selloff in technology stocks, investors may find potential opportunities in undervalued stocks. In such market conditions, identifying stocks that trade below their estimated fair values could offer attractive entry points for those looking to invest.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

UMB Financial (NasdaqGS:UMBF) | $94.71 | $189.13 | 49.9% |

MVB Financial (NasdaqCM:MVBF) | $22.00 | $42.73 | 48.5% |

Oddity Tech (NasdaqGM:ODD) | $40.12 | $78.79 | 49.1% |

Sachem Capital (NYSEAM:SACH) | $2.61 | $5.21 | 49.9% |

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA) | $21.23 | $41.72 | 49.1% |

Fluence Energy (NasdaqGS:FLNC) | $15.96 | $31.72 | 49.7% |

Smartsheet (NYSE:SMAR) | $48.29 | $95.83 | 49.6% |

Sea (NYSE:SE) | $68.35 | $134.03 | 49% |

TAL Education Group (NYSE:TAL) | $10.09 | $19.84 | 49.1% |

MediaAlpha (NYSE:MAX) | $14.18 | $27.75 | 48.9% |

Let's explore several standout options from the results in the screener.

Align Technology

Overview: Align Technology, Inc. specializes in designing, manufacturing, and marketing Invisalign clear aligners and iTero intraoral scanners and services for orthodontists and general practitioner dentists globally, with a market cap of approximately $18.94 billion.

Operations: The company's revenue is primarily derived from two segments: Clear Aligner, generating $3.23 billion, and Systems and CAD/CAM Services, contributing $0.69 billion.

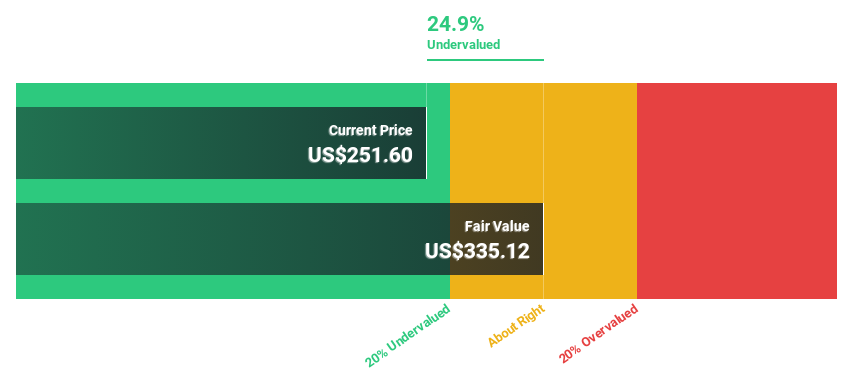

Estimated Discount To Fair Value: 24.9%

Align Technology is currently trading at US$251.6, which is 24.9% below its estimated fair value of US$335.12, indicating a significant undervaluation based on discounted cash flow analysis. Despite this, the company's earnings are expected to grow by 16.28% annually, outpacing the US market projection of 14.7%. Recent inclusion in multiple Russell indexes and positive adjustments in corporate governance underscore its strategic positioning for growth, although its revenue growth forecast of 8.8% per year slightly lags behind more aggressive market averages.

Citizens Financial Group

Overview: Citizens Financial Group, Inc. is a bank holding company in the United States offering retail and commercial banking products and services, with a market capitalization of approximately $18.57 billion.

Operations: The company generates revenue primarily through its Consumer Banking and Commercial Banking segments, with earnings of $5.13 billion and $2.66 billion respectively.

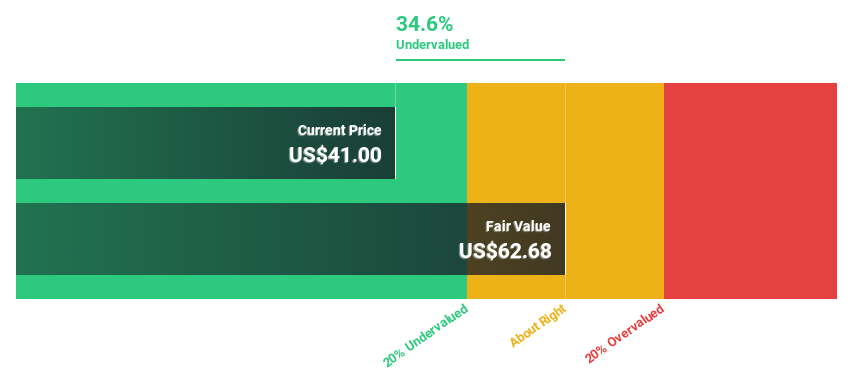

Estimated Discount To Fair Value: 34.6%

Citizens Financial Group is trading at US$41, notably below its fair value of US$62.68, reflecting a significant undervaluation based on discounted cash flow analysis. While its return on equity is expected to remain low at 8.3%, the company's earnings are projected to increase by 22.57% annually, surpassing the US market average growth rate. Despite a dip in profit margins from 27.2% to 16.9% over the past year, CFG maintains a stable dividend yield of 4.1%. Recent activities include a substantial fixed-income offering and an increase in their equity buyback plan, enhancing shareholder value amidst ongoing financial adjustments and executive changes.

Western Alliance Bancorporation

Overview: Western Alliance Bancorporation, operating as the bank holding company for Western Alliance Bank, offers a range of banking products and services mainly in Arizona, California, and Nevada with a market cap of $8.37 billion.

Operations: The company generates revenue primarily through its Commercial and Consumer Related segments, with figures of $1.24 billion and $1.46 billion respectively.

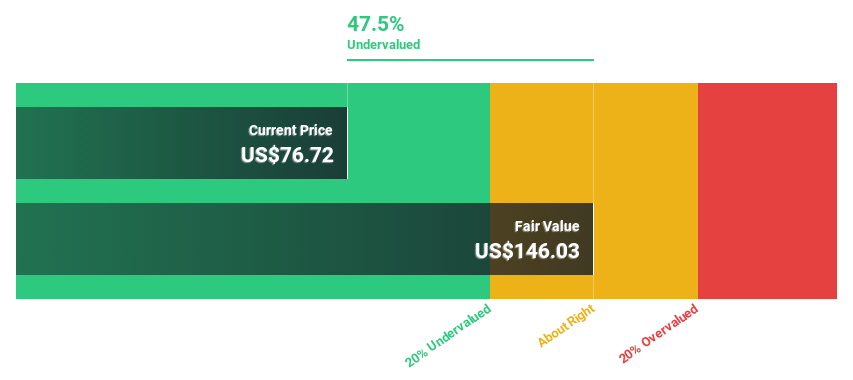

Estimated Discount To Fair Value: 47.5%

Western Alliance Bancorporation, with a current trading price of US$76.72, is perceived as undervalued against a fair value estimate of US$146.03 based on discounted cash flow analysis. Despite recent challenges, including increased net loan charge-offs and a slight decrease in quarterly net income to US$193.6 million from US$215.7 million last year, the bank's revenue growth outpaces the market at 11.2% annually compared to the market's 8.6%. Moreover, its earnings are expected to grow significantly by 20.5% per year over the next three years, suggesting potential for recovery and profit expansion despite current headwinds.

Where To Now?

Click through to start exploring the rest of the 178 Undervalued US Stocks Based On Cash Flows now.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ALGN NYSE:CFG and NYSE:WAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com