This Undervalued Stock Could Join Amazon in the $2 Trillion Club

"I believe in buying great companies -- especially companies that are undervalued, and/or underappreciated."

-- Peter Lynch

It doesn't matter what you're buying -- clothes, groceries, a home -- everyone wants a good deal. And the same is true with stocks. No one wants to overpay for an investment.

Yet, identifying whether a stock is overvalued or undervalued is more complex than it may seem. Granted, every stock has a price, but that isn't enough to determine value.

For example, Meta Platforms (NASDAQ: META) has a price -- a market cap, that is -- of about $1.2 trillion at the moment. But it appears undervalued, and its market cap could surge to more than $2 trillion soon.

Meta Platforms' valuation hints at opportunity

To understand why Meta Platform's stock is undervalued, you must first understand the company's business model: It is one of two companies that between them control the lion's share of the digital advertising market (Alphabet, the parent company of Google, being the other).

In fact, in the first quarter, Meta reported over 3 billion daily active users -- roughly 38% of the global population. This massive user base allows it to place countless ads across its platforms, most notably on Facebook and Instagram. Meta generated $35.6 billion of ad revenue in the first quarter alone.

Best of all for the company and its shareholders, much of that revenue is converted into profits. Meta's net income rose to $12.4 billion in Q1 -- up 117% from a year earlier.

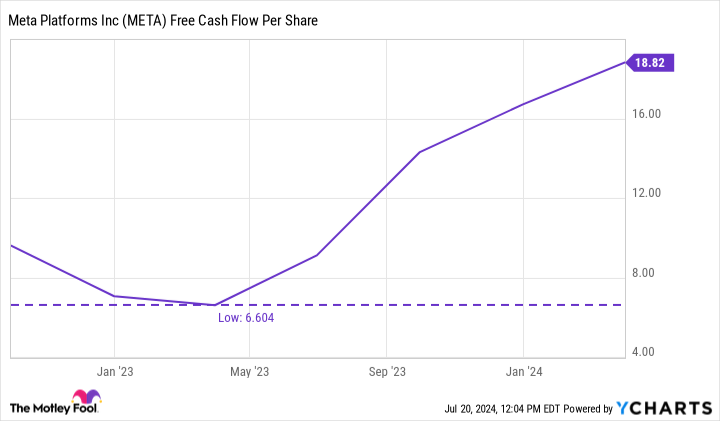

Similarly, Meta's free cash flow is growing, too. Over the last 12 months, the company has reported nearly $50 billion in free cash flow. On a per-share basis, Meta now delivers $18.82 in free cash flow, up from $6.60 less than two years ago.

Ultimately, it's Meta's free cash flow that makes the company's stock a bargain right now.

Meta's free cash flow per share and how it stacks up

In the final analysis, all common stocks offer investors the same value proposition. When investors buy a stock, they gain an ownership stake in a portion of the company's future profits and cash flows.

That's why understanding valuation metrics is so important when investing in individual stocks -- investors have to know how to make apples-to-apples comparisons.

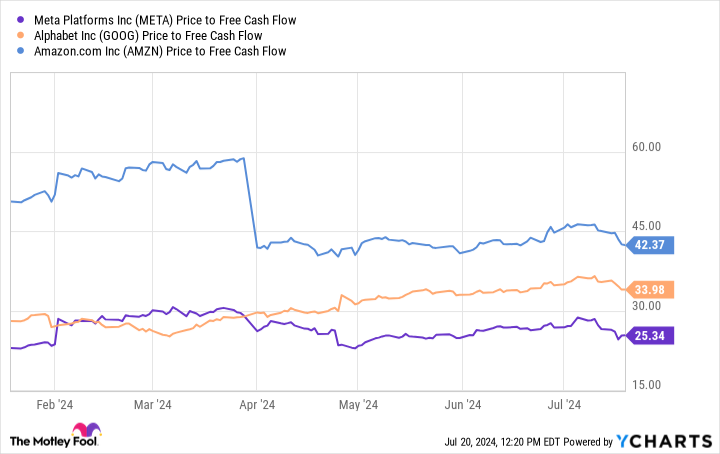

In the case of Meta Platforms, the valuation metric that stands out is its price-to-free-cash-flow ratio, which gauges its ability to generate cash for shareholders. Here's how Meta's ratio stacks up against a couple of its megacap peers.

As you can see, Meta has remained cheaper than Alphabet over the last six months and is well below Amazon's ratio. This all matters because, as Amazon founder Jeff Bezos has noted, rising free cash flow per share is crucial to the long-term success of any business. Often, the faster a company grows its free cash flow, the faster its stock price will rise. Based on its free cash flow growth, Meta's stock price should be higher.

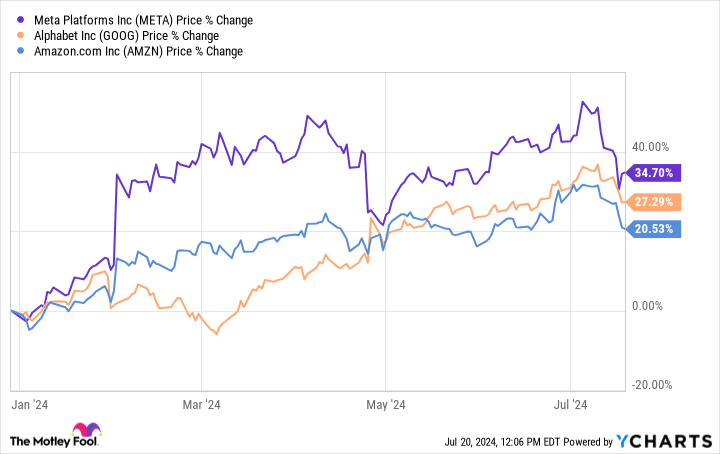

And you can see this when it comes to Meta's recent stock performance. Year to date, Meta is up 35%, Alphabet is up 27%, and Amazon is up 21%.

Could Meta Platforms reach the $2 trillion club?

For Meta to reach a $2 trillion market cap, its stock would need to rise by about 67%. Not only do I think that's possible, I believe it is likely.

Meta went public in 2012. Over the last 12 years, its stock price has grown by 1,150% -- a compound annual rate of 23%. If its growth from here matches that average rate, Meta's market cap will hit $2 trillion in early 2027.

That timeline may be a bit too ambitious, as Meta has suffered some setbacks over the last few years, including a 77% share price plunge back in 2022. Nevertheless, the company has more than recovered from that bear market and remains one of the world's premier digital advertising companies. In addition, it is investing tens of billions into innovative technologies like artificial intelligence, augmented reality, and the metaverse.

In summary, Meta Platforms may take longer than three years to reach the $2 trillion club, but it's still likely to get there one day.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Fool has a disclosure policy.

This Undervalued Stock Could Join Amazon in the $2 Trillion Club was originally published by The Motley Fool