UiPath Stocks is Falling After Earnings and the Company Is Boosting Its Buyback Plan

Omar Marques / SOPA Images / LightRocket via Getty Images

Key Takeaways

UiPath beat profit and sales estimates on increasing demand for its artificial intelligence automation products.

The software provider raised its full-year sales and annual recurring revenue forecasts, though to levels near Wall Street's expectations.

UiPath increased its stock buyback program by $500 million. Its shares have fallen this year.

UiPath (PATH) shares slipped Friday, handing back early morning gains, even as the enterprise automation and artificial intelligence (AI) software provider posted better-than-anticipated results and raised its revenue guidance.

UiPath reported fiscal 2025 second quarter adjusted earnings per share (EPS) of $0.04, with revenue up 10.1% to $316.3 million. Both exceeded estimates.

The company now sees full-year revenue in a range of $1.42 billion to $1.425 billion, up from a previously issued $1.405 billion to $1.410 billion. While that guidance marks an increase, it's still near Wall Street's current expectation, according to Visible Alpha data.

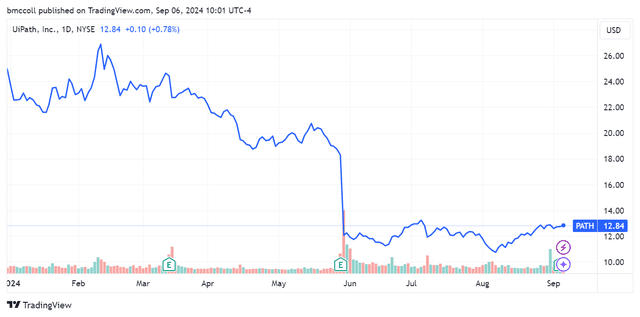

UiPath stock was recently dow nearly 3%. It's down about 50% in 2024 so far. The company said it was increasing its stock repurchase program by half a billion dollars, giving it an overall authorized total of $554 billion.

Annual recurring revenue (ARR) rose 19% to $1.55 billion, and net new ARR was $43 million. Subscription services revenue jumped 21.7% to $194.7 million.

“Conversations with customers and partners deepen our conviction that there is an increasing need for AI and automation," founder and CEO Daniel Dines said.

TradingView

Read the original article on Investopedia.