TSX Growth Companies With High Insider Ownership In May 2024

As the Canadian market continues to navigate through a period of optimism, buoyed by a broader bull market that began in October 2022, investors are increasingly looking at diversification and long-term growth opportunities beyond the initial tech surge. This environment sets an intriguing stage for exploring TSX-listed growth companies with high insider ownership, which can offer unique advantages in aligning management’s interests with those of shareholders, especially in sectors poised to benefit from ongoing technological advancements and economic shifts.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Artemis Gold (TSXV:ARTG) | 31.8% | 45.6% |

Ivanhoe Mines (TSX:IVN) | 12.4% | 38.5% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

Let's dive into some prime choices out of from the screener.

Aya Gold & Silver

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is a company focused on the exploration, evaluation, and development of precious metals projects in Morocco, with a market capitalization of approximately CA$1.95 billion.

Operations: The company primarily generates revenue through its precious metals exploration and development projects in Morocco.

Insider Ownership: 10.2%

Earnings Growth Forecast: 51.6% p.a.

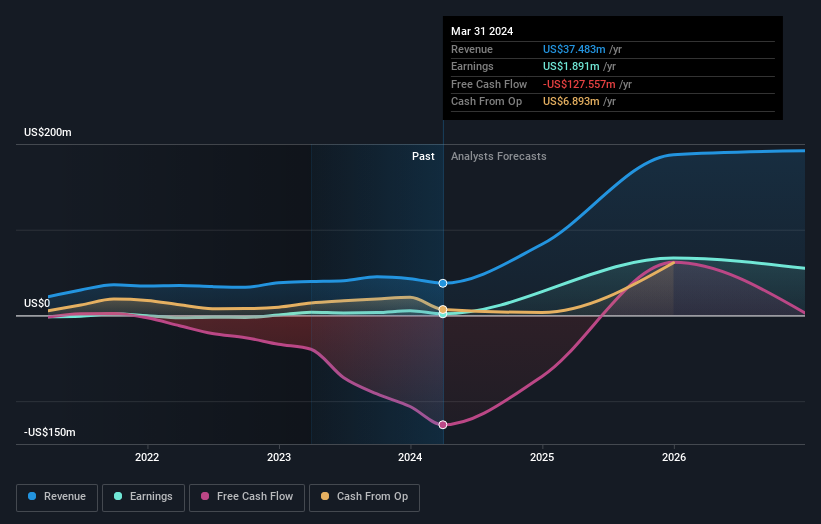

Aya Gold & Silver Inc., a Canadian growth company with high insider ownership, faces challenges and opportunities. Recent financials show a downturn, with Q1 2024 sales dropping to US$5.08 million from US$10.44 million year-over-year and transitioning from a net income of US$1.07 million to a net loss of US$2.54 million. However, the firm's aggressive exploration strategy, evidenced by significant extensions at its Boumadine project and securing new permits, underscores potential for future expansion despite current profitability pressures.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market cap of approximately CA$3.01 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

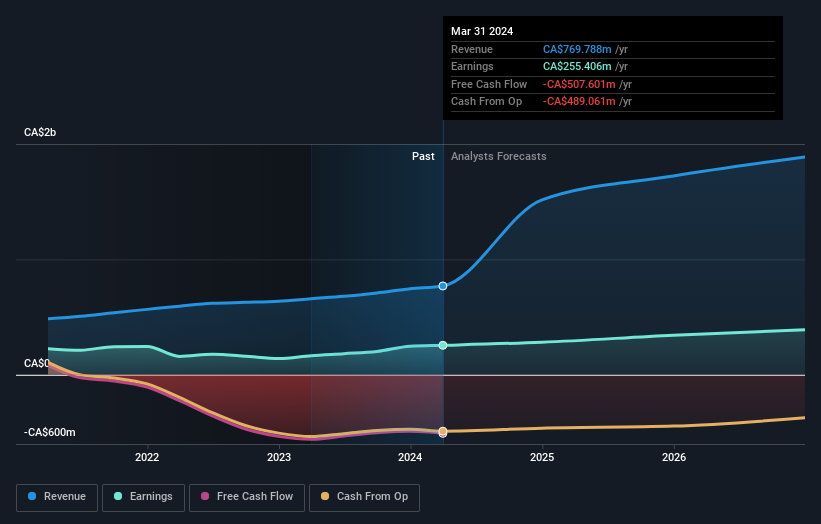

goeasy Ltd., a Canadian growth company with high insider ownership, recently appointed Patrick Ens as President of its easyfinancial and easyhome brands. This strategic move could enhance leadership amidst goeasy's financial performance, which shows robust revenue growth from CAD 287.3 million to CAD 357.11 million year-over-year and a net income increase to CAD 58.94 million in Q1 2024. However, the firm's dividend sustainability is questionable as it is not well covered by cash flows, and debt levels are concerning relative to operating cash flow. Despite these challenges, analysts predict a potential stock price rise of 24.5%, reflecting confidence in goeasy’s future prospects under new leadership.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$25.01 billion.

Operations: The firm primarily generates revenue from the mining, development, and exploration of minerals and precious metals in Africa.

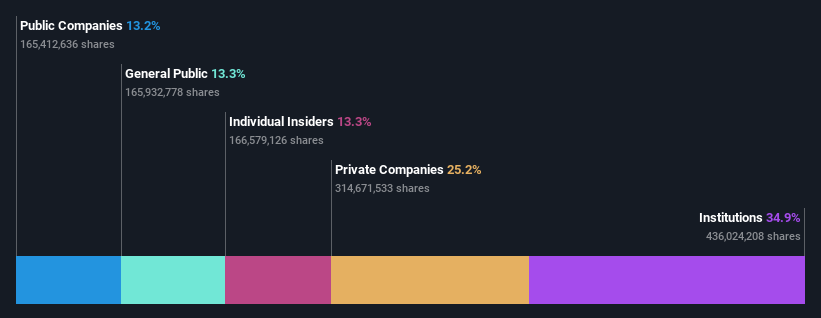

Insider Ownership: 12.4%

Earnings Growth Forecast: 38.5% p.a.

Ivanhoe Mines, a Canadian growth company with high insider ownership, is actively pursuing mergers and acquisitions to expand its copper production capabilities, particularly in the Western Forelands. Despite a recent net loss of US$65.55 million in Q1 2024, the company's revenue and earnings are expected to grow significantly at annual rates of 48.1% and 38.51%, respectively. However, shareholder dilution occurred over the past year, which could raise concerns about equity value preservation amidst these expansions.

Next Steps

Click through to start exploring the rest of the 29 Fast Growing TSX Companies With High Insider Ownership now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AYA TSX:GSY and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com