Trex (NYSE:TREX) Misses Q2 Sales Targets, Stock Drops 15%

Composite decking and railing products manufacturer Trex Company (NYSE:TREX) fell short of analysts' expectations in Q2 CY2024, with revenue up 5.6% year on year to $376.5 million. Next quarter's revenue guidance of $225 million also underwhelmed, coming in 22.9% below analysts' estimates. It made a GAAP profit of $0.80 per share, improving from its profit of $0.71 per share in the same quarter last year.

Is now the time to buy Trex? Find out in our full research report.

Trex (TREX) Q2 CY2024 Highlights:

Revenue: $376.5 million vs analyst estimates of $387.9 million (2.9% miss)

EPS: $0.80 vs analyst estimates of $0.78 (3.1% beat)

Revenue Guidance for Q3 CY2024 is $225 million at the midpoint, below analyst estimates of $291.8 million

The company dropped its revenue guidance for the full year from $1.23 billion to $1.14 billion at the midpoint, a 6.9% decrease

Gross Margin (GAAP): 44.7%, up from 43.9% in the same quarter last year

Adjusted EBITDA Margin: 34.6%, up from 32.8% in the same quarter last year

Free Cash Flow of $158.2 million is up from -$211.8 million in the previous quarter

Market Capitalization: $8.20 billion

“Second quarter sales increased at a mid-single-digit rate led by our premium products, including Trex Transcend® Lineage and Trex Signature® decking, where sell-through continued to track at a double-digit rate and contractor lead-times averaged six to eight weeks,” said Bryan Fairbanks, President and CEO.

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE:TREX) makes wood-alternative decking, railing, and patio furniture.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Trex's sales grew at an excellent 12.5% compounded annual growth rate over the last five years. This shows it expanded quickly, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trex's recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.3% over the last two years.

This quarter, Trex's revenue grew 5.6% year on year to $376.5 million, missing Wall Street's estimates. The company is guiding for a 25.9% year-on-year revenue decline next quarter to $225 million, a reversal from the 61.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

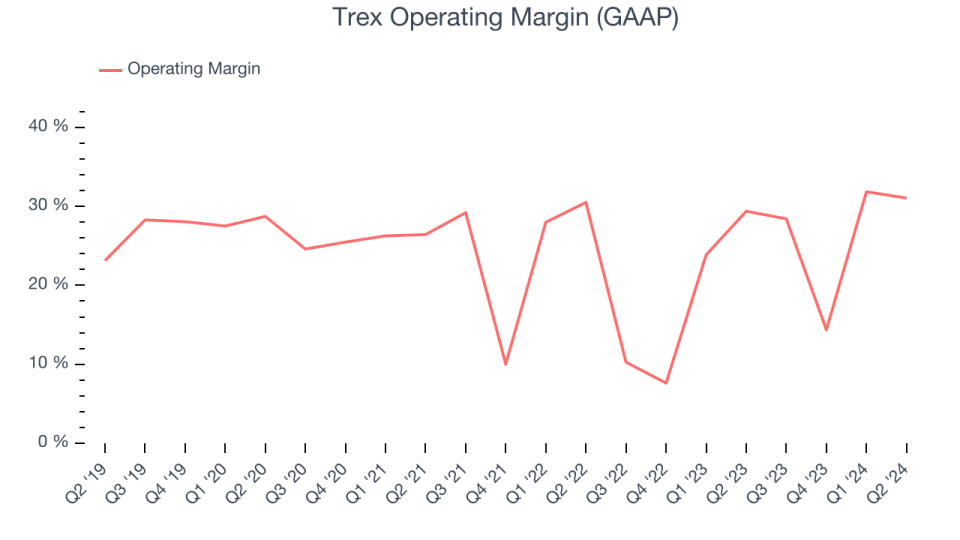

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Trex has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.4%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Trex's annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Trex generated an operating profit margin of 31.1%, up 1.7 percentage points year on year. This increase was encouraging, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

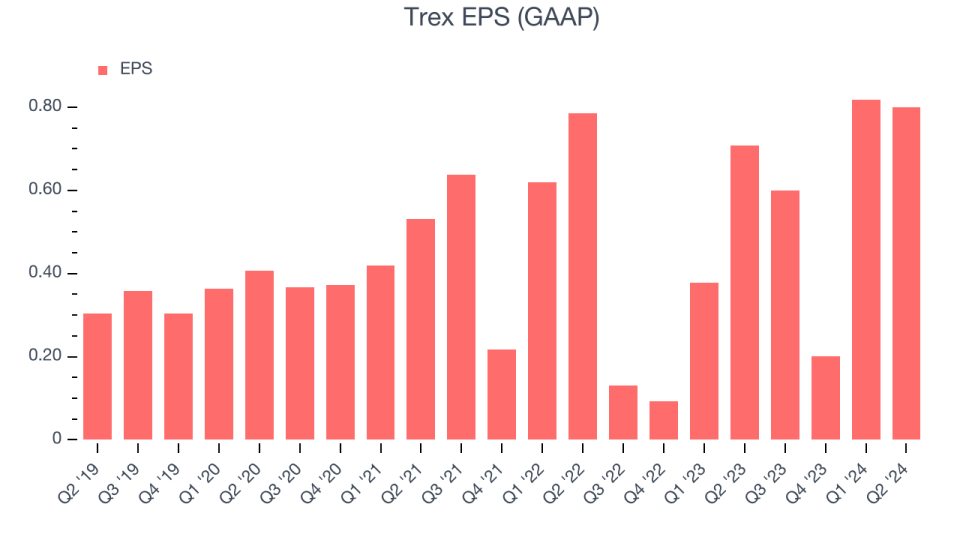

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

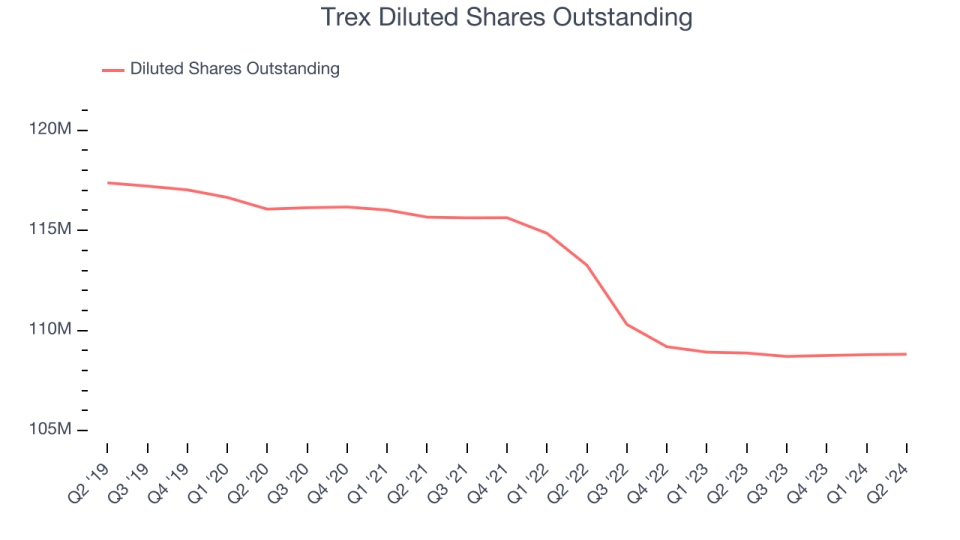

Trex's EPS grew at an astounding 18.5% compounded annual growth rate over the last five years, higher than its 12.5% annualized revenue growth. However, this alone doesn't tell us much about its day-to-day operations because its operating margin didn't expand.

Diving into the nuances of Trex's earnings can give us a better understanding of its performance. A five-year view shows that Trex has repurchased its stock, shrinking its share count by 7.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Trex, its two-year annual EPS growth of 3.5% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q2, Trex reported EPS at $0.80, up from $0.71 in the same quarter last year. This print beat analysts' estimates by 3.1%. Over the next 12 months, Wall Street expects Trex to perform poorly. Analysts are projecting its EPS of $2.42 in the last year to shrink by 2.2% to $2.37.

Key Takeaways from Trex's Q2 Results

It was good to see Trex beat analysts' EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its revenue guidance for next quarter fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Trex. The stock traded down 15% to $65.10 immediately after reporting.

Trex may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.