Traders Need Fed’s Rate-Cut Signal to Keep Stocks Rallying

(Bloomberg) -- Wall Street is betting that Federal Reserve Chair Jerome Powell will confirm that interest-rate cuts are coming at the central bank’s annual confab in Jackson Hole, Wyoming. But as the debate shifts from “will they or won’t they?” to “how big will they go?” — stock traders may be left wanting.

Most Read from Bloomberg

A Floating Island in Baltimore Raises Hope for a Waterfront Revival

‘Train Lovers’ Organize to Support Harris and Walz in Presidential Bid

Part of Downtown Montreal Is Flooded After Water Pipe Breaks

“If traders hear cuts are coming, stocks will react favorably,” said Eric Beiley, executive managing director of wealth management at Steward Partners Global Advisory. “If we don’t hear what we want, that would trigger a big selloff.”

This is the challenge for money managers who’ve just plunged back into Big Tech stocks in droves, chasing the S&P 500 Index ever higher. Markets are fully expecting the Fed to begin reducing borrowing costs at its upcoming meeting in September. But Powell could easily remain tight-lipped about the timing of rate cuts when he speaks Friday. And it would be very much in his character to take a cautious, non-committal approach to revealing just how much rates may fall when the Fed is done with its easing.

“Markets are so confident that rate cuts are coming very soon,” Beiley said. “It would be a huge surprise if Powell didn’t reinforce that’s the path ahead.”

That “surprise” could threaten to upend the S&P 500’s furious $3.3 trillion rebound after a global growth scare in early August sparked the worst selloff of the year. Bulls have since regained control, with the equities benchmark on a seven-session winning streak as investors plowed $5.5 billion into US equities in the week through Wednesday, according to EPFR Global data cited by Bank of America Corp.

But some Wall Street pros are warning investors not to expect much clarity from the Fed chief.

“Looking at past Jackson Hole speeches, it’s not likely we’ll get a very prescriptive remarks from Powell,” said Tom Hainlin, national investment strategist at US Bank Wealth Management.

The Fed chair will likely imply that tight monetary policy is no longer warranted, according to Bill Dudley, a Bloomberg Opinion columnist and former head of the New York Fed. But he doesn’t expect Powell to signal the size of the first cut, particularly since there’s a jobs report on Sept. 6 for central bankers to consider before their next policy decision on Sept. 18.

“His tone is crucial,” said Stephanie Lang, chief investment officer at Homrich Berg. “If he shocks the market and is hawkish, stocks will react negatively.”

To be clear, traders fully expect a rate reduction at the next Fed meeting. But they aren’t sure how big it will be. And with few officials scheduled to speak in the coming days, the stakes are high for Powell’s remarks. This is why options traders expect the S&P 500 to swing over 1% in either direction on Friday, based on the cost of at-the-money puts and calls, according to Citigroup Inc.

That said, fingers are crossed on Wall Street that the brunt of this summer’s pain has passed, with the S&P 500 2% from its all-time high. Traders see a calm market ahead, with open interest in options that bet on a decline in the Cboe Volatility Index hovering near the highest level since June 2022 relative to contracts that bet on gains, data compiled by Bloomberg show.

Of course, traders have pared their jumbo-sized bets for a September rate reduction on signs of a resilient economy, pricing in roughly 30 basis points of easing next month. That means the perceived market risk from Jackson Hole is receding with investors no longer expecting aggressive cuts, which historically have been used to stem slowing growth, according to US Bank’s Hainlin.

“We want to know what the Fed’s rate path actually looks like, if it’s one cut per meeting or if it’s still data dependent on jobs and inflation prints,” Hainlin said. “But he probably won’t say that. It’s more likely that traders will get that info at the Fed’s September meeting.”

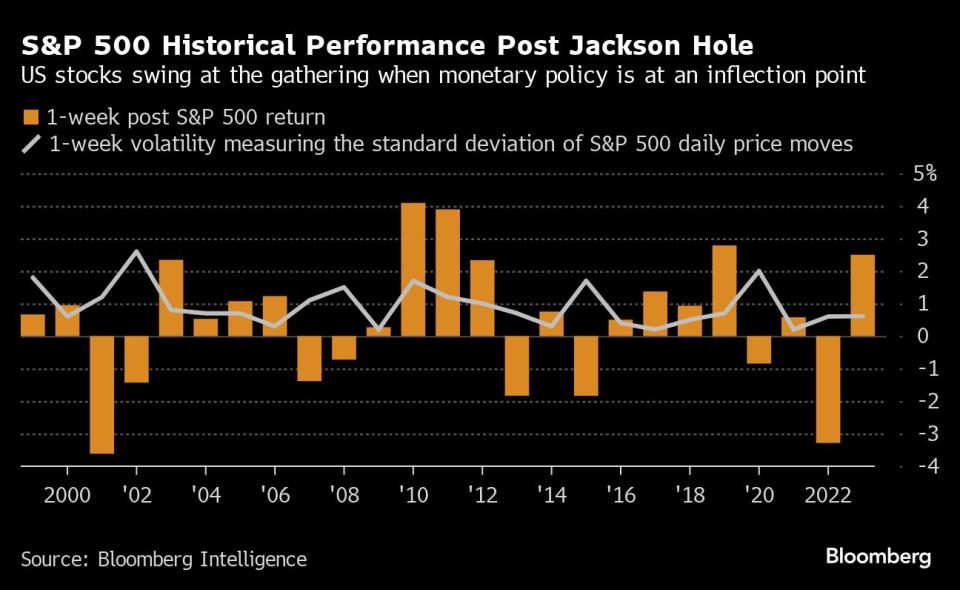

A Fed chair’s speech at Jackson Hole typically isn’t a big catalyst for the stock market unless it comes before a crucial shift in monetary policy — like now. Since 2000, the S&P 500 has climbed 0.4% on average in the week following the gathering, data compiled by Bloomberg Intelligence show.

It’s Powell’s appearance at Jackson Hole in August 2022, when he warned that the Fed would need to keep monetary policy restrictive to battle inflation, that’s still fresh in traders’ minds. Stocks plunged 3.4% that day and lost another 3.3% in the week following his remarks.

This time around, however, investors are hopeful the Fed has achieved its goal of engineering a soft landing by taming runaway prices without triggering severe economic pain. So the expectation is for the opposite — a dramatic liftoff.

With three policy-setting meetings left in 2024, traders are betting that the Fed will respond to signs of labor weakness by cutting rates as inflation retreats back toward its 2% target. Underlying consumer prices eased for a fourth month in July, while robust retail sales data signaled Americans’ spending remains strong, which would allow officials to pursue a less aggressive policy.

“Powell doesn’t need to scare markets,” Homrich Berg’s Lang said. “He needs to give confidence that inflation is ebbing and officials are comfortable with bringing restrictive rates to a more neutral level.”

--With assistance from Elena Popina and Matt Turner.

Most Read from Bloomberg Businessweek

Singapore's Wooden Building of the Future Has a Mold Problem

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

Surgeons Cut a Giant Tumor Out of My Head. Is There a Better Way?

Sports Betting Is Legal, and Sportswriting Might Never Recover

New Breed of EV Promises 700 Miles per Charge (Just Add Gas)

©2024 Bloomberg L.P.