TPG's (NASDAQ:TPG) Dividend Is Being Reduced To $0.44

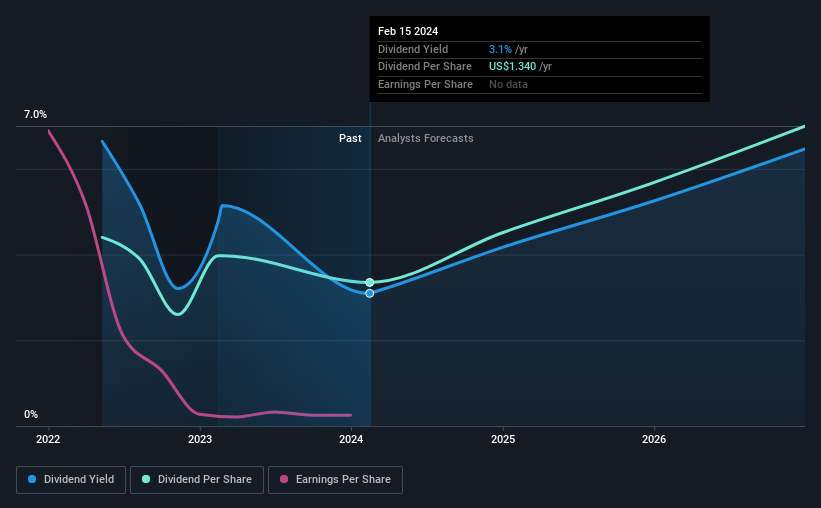

TPG Inc. (NASDAQ:TPG) is reducing its dividend from last year's comparable payment to $0.44 on the 8th of March. The dividend yield of 3.1% is still a nice boost to shareholder returns, despite the cut.

See our latest analysis for TPG

TPG's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, TPG's profits didn't cover the dividend, but the company was generating enough cash instead. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 43% which is fairly sustainable.

TPG's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. The annual payment during the last 2 years was $1.76 in 2022, and the most recent fiscal year payment was $1.34. This works out to a decline of approximately 24% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Is Doubtful

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Over the last 12 months, earnings are down by 9.6%. While this is not ideal, one year is a short time in business, and we wouldn't want to get too hung up on this. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

We should note that TPG has issued stock equal to 17% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think TPG is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for TPG that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.