Tortoise Creates ETF From Closed-End Funds

Tortoise Capital Advisors plans to enter the actively managed ETF space by merging three struggling closed-end funds to create the Tortoise Power and Energy Infrastructure ETF.

Overland Park, Kan.-based Tortoise has $8 billion under management and sees the three closed-end funds that combine for $313 million as an ideal entry point to active ETFs.

The new ETF, which is now in the proxy drafting stage and could be available by November, has already proved fortuitous to investors in the closed-end funds slated for the conversion.

The funds being merged into the ETF are the Tortoise Power & Energy Infrastructure Fund (TPZ), the Tortoise Energy Independence Fund (NDP) and the Tortoise Pipeline & Energy Fund (TTP).

All three funds have seen their discounts to the underlying net asset values shrink from the mid-teens to the 5% range since the conversion was announced on Aug. 6.

On the date of full conversion to the new ETF, the discount will disappear, and all funds will be priced at their respective net asset values.

“When you have smaller funds that are trading at discounts you get pressure from investors to do something,” said Tortoise Chief Executive Tom Florence.

Once combined into a single ETF, the surviving strategy will be represented by that of TPZ, which combines securities of power and energy infrastructure companies through a blend of bonds and dividend-paying stocks.

TPZ's Solid Gains

Even with the discount to net asset value, which investors in closed-end funds don’t want, TPZ has generated a solid 28.7% gain this year, following a 20.7% gain last year, ranking it in the first percentile over both those periods, according to Morningstar.

In addition to the narrowing discount-to-NAV, investors who stick around in the ETF wrapper will also see an expense ratio drop to an estimated 85 basis points from the current 95 basis points.

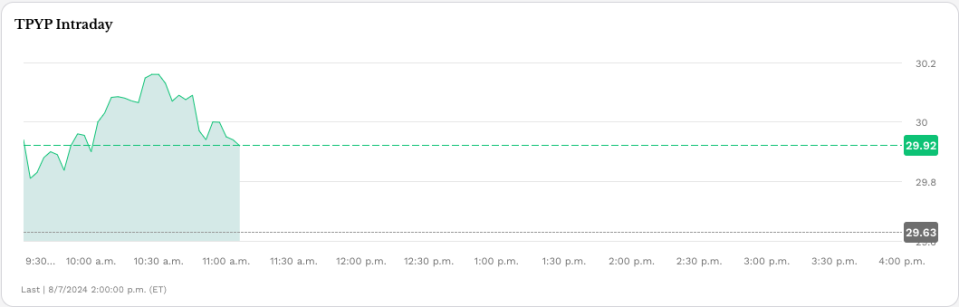

The soon-to-be introduced ETF will be Tortoise’s first active ETF, but not its first ETF. It also manages the passive $589 million Tortoise North American Pipeline ETF (TPYP) and the $53 million Ecofin Global Water ESG ETF (EBLU).

The bulk of Tortoise’s assets are in mutual funds ($3.5 billion) and separately managed accounts ($3 billion).

“This is our first move into the active ETF space, but it’s not our last move into the active ETF space,” Florence said. “Investment firms need to package products appropriately, and I expect us to do more in the ETF space.”