Top Swedish Growth Companies With High Insider Ownership In August 2024

As global markets continue to show resilience, the Swedish market has been no exception, with strong performances in various sectors. In this context, growth companies with high insider ownership are particularly appealing due to their potential for robust performance and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Truecaller (OM:TRUE B) | 29.5% | 21.6% |

Fortnox (OM:FNOX) | 21.1% | 22.6% |

Biovica International (OM:BIOVIC B) | 18.8% | 73.8% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

Yubico (OM:YUBICO) | 37.5% | 43.7% |

BioArctic (OM:BIOA B) | 34% | 102.8% |

KebNi (OM:KEBNI B) | 37.8% | 86.1% |

Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

InCoax Networks (OM:INCOAX) | 18.1% | 115.5% |

We're going to check out a few of the best picks from our screener tool.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) develops biological drugs for central nervous system disorders in Sweden and has a market cap of SEK14.05 billion.

Operations: BioArctic AB generates SEK252.21 million in revenue from its biotechnology segment.

Insider Ownership: 34%

Earnings Growth Forecast: 102.8% p.a.

BioArctic, a growth company with high insider ownership, is forecasted to achieve significant revenue growth of 39.6% annually and become profitable within three years. Despite recent volatility in its share price, it trades at 76.7% below estimated fair value and analysts expect a substantial price increase. Recent approvals of Leqembi for Alzheimer's treatment in multiple countries bolster BioArctic's prospects, supported by strong clinical trial results and strategic partnerships with Eisai.

EQT

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK405.21 billion.

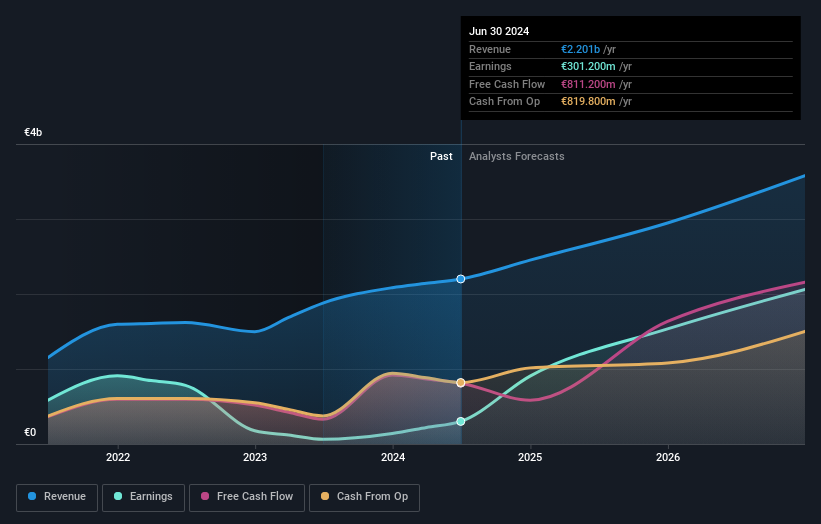

Operations: The company's revenue segments include Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

Insider Ownership: 30.9%

Earnings Growth Forecast: 56.8% p.a.

EQT, with substantial insider ownership, is poised for significant earnings growth at 56.8% annually, outpacing the Swedish market's 16%. Recent M&A activities highlight its strategic expansion ambitions, including potential bids for Compass Education and Karo Healthcare. Despite some large one-off items impacting results, EQT reported a notable rise in net income to €282 million for H1 2024 from €120 million the previous year. The company also initiated a share repurchase program to optimize capital structure.

Medicover

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK27.63 billion.

Operations: Medicover generates revenue primarily through its Healthcare Services (€1.32 billion) and Diagnostic Services (€610 million) segments.

Insider Ownership: 11.1%

Earnings Growth Forecast: 38.6% p.a.

Medicover, with strong insider ownership, is forecasted to grow earnings at 38.6% annually, significantly outpacing the Swedish market. Despite recent CFO changes and a challenging financial position regarding interest payments, Medicover's revenue is expected to exceed €2.2 billion by 2025. The company reported H1 2024 sales of €1.01 billion and net income of €12.5 million, reflecting substantial year-over-year growth in both metrics amidst strategic executive transitions and confirmed guidance updates.

Take a closer look at Medicover's potential here in our earnings growth report.

Upon reviewing our latest valuation report, Medicover's share price might be too optimistic.

Key Takeaways

Get an in-depth perspective on all 93 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:EQT and OM:MCOV B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com