Top German Dividend Stocks To Consider In August 2024

As global markets grapple with economic uncertainties, the German DAX index has faced significant declines, reflecting broader concerns about growth and inflation within the Eurozone. Despite these challenges, dividend stocks remain a compelling option for investors seeking steady income streams amid market volatility. In this context, selecting robust dividend stocks becomes crucial. Companies with strong fundamentals and reliable payout histories can provide stability and potential returns in uncertain times.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.62% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 5.04% | ★★★★★★ |

OVB Holding (XTRA:O4B) | 4.79% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.31% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 5.94% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.58% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.88% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.24% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.42% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.42% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

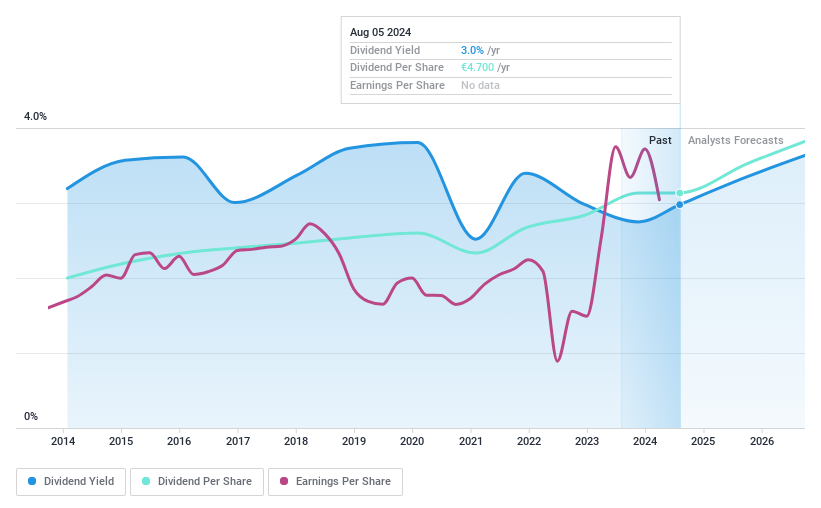

Siemens

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Siemens Aktiengesellschaft is a technology company specializing in automation and digitalization across various regions globally, with a market cap of approximately €121.16 billion.

Operations: Siemens generates revenue from several segments: Portfolio Companies (€3.24 billion), Siemens Financial Services (€385 million), Mobility (€10.96 billion), Digital Industries (€20.99 billion), Siemens Healthineers (€21.87 billion), and Smart Infrastructure (€20.43 billion).

Dividend Yield: 3%

Siemens offers a reliable dividend yield of 3.03%, though it is lower than the top 25% of German dividend payers. The company's dividends have been stable and growing over the past decade, with a payout ratio of 51.5% covered by earnings and cash flows (36.8%). Recent strategic moves include selling its motors business for €3 billion and forming alliances to expand in sustainable energy storage, potentially enhancing future revenue streams.

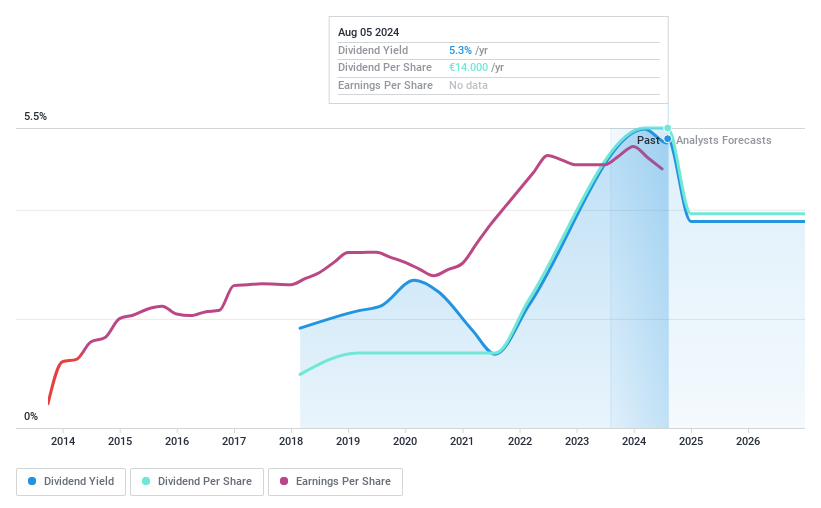

Logwin

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market cap of €760.11 million.

Operations: Logwin AG's revenue is primarily derived from its Solutions segment (€275.78 million) and Air + Ocean segment (€954.25 million).

Dividend Yield: 5.3%

Logwin AG has shown consistent dividend payments over the past 6 years, with a payout ratio of 57% covered by earnings and 59.4% by cash flows. However, recent earnings reports indicate a decline in sales to €643.5 million and net income to €31.86 million for H1 2024, compared to the previous year. Despite this, Logwin's dividend yield remains attractive within the top quartile of German dividend payers at 5.3%.

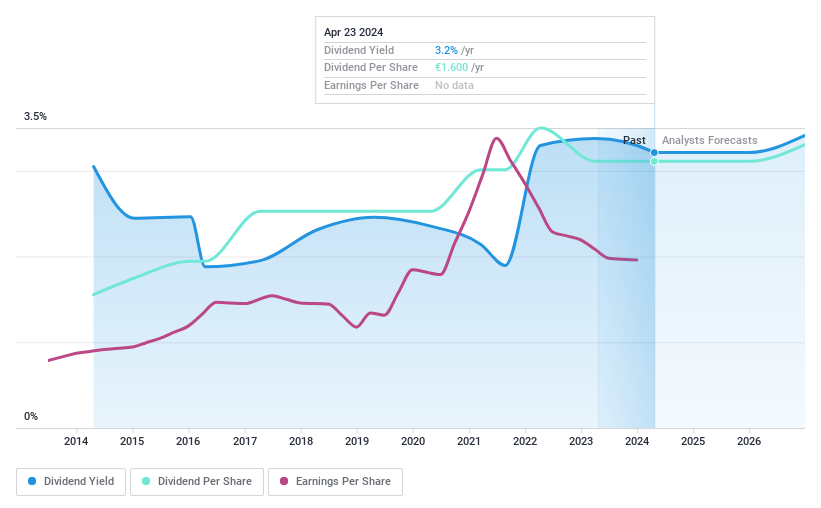

Uzin Utz

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €236.07 million.

Operations: Uzin Utz SE's revenue segments include €73.33 million from the USA, €83.83 million from Western Europe, €36.31 million from Netherlands - Wholesale, €25.98 million from Southern/Eastern Europe, €210.21 million from Germany - Laying Systems, €82.87 million from Netherlands - Laying Systems, €32.53 million from Germany - Machinery and Tools, and €35.16 million from Germany - Surface Care and Refinement.

Dividend Yield: 3.4%

Uzin Utz offers a reliable dividend, consistently growing over the past decade with minimal volatility. Its current yield of 3.42% is lower than the top 25% of German dividend payers but remains attractive due to its stability. The payout ratio of 35.7% and cash payout ratio of 23.9% indicate strong coverage by earnings and cash flows, ensuring sustainability. Additionally, a price-to-earnings ratio of 10.5x suggests good value compared to the broader market.

Navigate through the intricacies of Uzin Utz with our comprehensive dividend report here.

Our valuation report unveils the possibility Uzin Utz's shares may be trading at a premium.

Next Steps

Get an in-depth perspective on all 31 Top German Dividend Stocks by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:SIE XTRA:TGHN and XTRA:UZU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com