Here Are My Top 5 Ultra-High-Yield Dividend Stocks to Buy Hand Over Fist

One of the cornerstones of a diversified portfolio should be dividend stocks.

Dividend stocks are important because the passive income they generate can mitigate some of the losses you might experience due to stock price volatility. Additionally, supplementing your portfolio with a steady stream of dividend income can come in handy when you're in need of cash.

Let's explore five stocks that are proven, reliable dividend payers and assess why now looks like a good time scoop up shares in each.

1. Hercules Capital: 9.9% dividend yield

One of the best sources of dividend income hails from business development companies (BDCs). BDCs are structured such that 90% of their taxable income is paid out to shareholders in the form of a dividend each year.

Hercules Capital (NYSE: HTGC) is a leading BDC that specializes in high-interest loans to businesses in the technology, life sciences, and energy sectors. Since BDCs are making loans, it's imperative the portfolio companies are able to pay back the principal and interest.

Per the company's filings, a debt investment is categorized as a non-accrual "when it is probable that principal, interest, or fees will not be collected according to contractual terms."

The table below illustrates non-accruals as a percentage of Hercules' total portfolio:

Category | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

|---|---|---|---|---|---|

Loans on non-accrual as a % of Total Investments at Cost | 0.6% | 0.4% | 2.7% | 1% | 1.2% |

Data Source: Hercules Investor Relations

Considering only about 1% of Hercules' total portfolio is considered to be at risk, I'd say the company is managed quite well.

Not only does Hercules offer a juicy dividend yield of 9.9%, but the overall long-term performance of the stock is equally impressive. Over the last 10 years, Hercules stock has a total return of 278%.

The chart above illustrates that a $10,000 investment in Hercules a decade ago would now be worth over $37,000. Not only does this underscore the importance of reinvesting dividends, but it also makes a good case for Hercules as a long-term prospect.

2. Horizon Technology: 11.4% dividend yield

Generally, start-ups will initially seek funding from private equity or venture capital firms during their early days. However, during each financing round, employees and founders at the start-up become diluted because the investment firms acquire equity in the business in exchange for capital.

This is what makes BDCs so appealing. Since debt is non-dilutive, companies often forgo raising equity as the business reaches maturity.

Horizon Technology (NASDAQ: HRZN) is another BDC in the technology and healthcare realm. The company competes heavily with Hercules, and offers a similar suite of venture debt term loans used for acquisition capital or cash runway.

One unique feature about Horizon is that its deal terms often come with warrants. While Horizon makes its bread and butter from interest on the repayment of its loans, warrants provide an extra kicker to benefit on the upside should one of its portfolio companies get acquired or go public.

Right now, Horizon Technology trades at a price-to-book (P/B) multiple of 1.2. By contrast, rival Hercules Capital has a P/B of 1.6.

At just $11 per share, Horizon stock is trading in the middle of its 52-week range. Considering its discount compared to the company's closest competitor and a sizzling 11% yield, now looks like a tempting time to scoop up shares.

3. Ares Capital: 8.9% dividend yield

The last BDC on my list is Ares Capital (NASDAQ: ARCC). While BDCs such as Hercules and Horizon focus on high-growth sectors, Ares takes a different approach.

The company generally works with lower middle market businesses that are passed up by large investment banks or advisory firms. The other feature that makes Ares unique is that it offers a deeper variety of financial instruments compared to most BDCs.

While BDCs tend to specialize in term loans and revolving lines of credit, Ares has the financial horsepower to complete more sophisticated transactions, including leveraged buyouts, recapitalizations, and restructurings.

Similar to Hercules, Ares' portfolio is consistently strong. As of March 31, the company's non-accrual rate was only 1.7%. This is far lower than the average rate of 3.8% among the BDC broader landscape.

This performance speaks volumes about the quality of Ares's due diligence and the company's ability to execute across a wide range of financial products.

Over the last decade, Ares has a total return of 230% -- handily topping the S&P 500.

Considering its differentiators over other leading BDCs, coupled with a strong long-term performance and ultra-high dividend yield of 9%, Ares stock might be worth putting on your radar.

4. Altria: 8.5% dividend yield

There are many other ways to find dividend stocks outside of BDCs. One great place to start is the Dividend Kings list.

Dividend Kings are an extremely rare breed of companies that have both paid and risen their dividend for at least 50 consecutive years.

Among the longest-standing Dividend Kings is tobacco company Altria (NYSE: MO). Altria owns a number of cigarette and tobacco brands including Marlboro and Black & Mild.

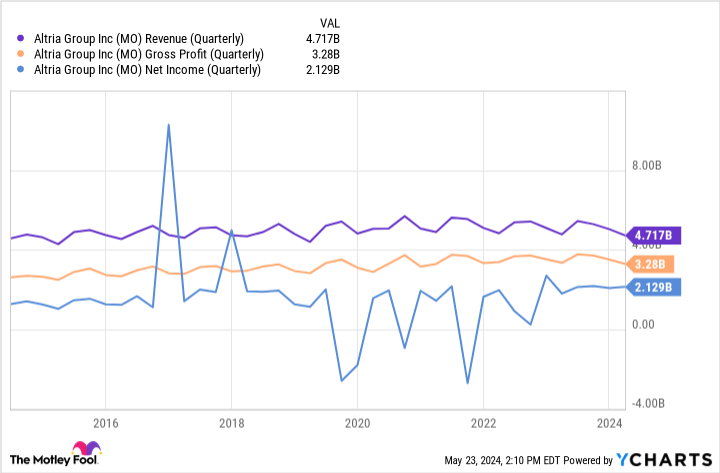

I'd understand if the chart above gives you some trepidation. The ebbs and flows of Altria's revenue and operating profits doesn't exactly bode well for the company.

However, Altria is going through something of a renaissance right now. While sales of traditional tobacco products such as cigarettes are in decline, the company has identified some emerging growth opportunities that are showing some encouraging forward progress.

Namely, Altria is investing heavily into "smokeless tobacco" products such as vaping and nicotine pouches. These products are igniting new sources of growth for Altria, helping the company penetrate retail markets and begin writing the early chapters of a turnaround story.

Although it will take some time for Altria to return to accelerating sales and profits, I think the company is making necessary strategic moves to maintain a leadership position among tobacco brands. More importantly, considering this is not the first time in Altria's history that it's needed to navigate shifts in consumer trends, I'm optimistic that the company will sustain its dividend for the long run.

5. Western Midstream Partners: 9.3% dividend yield

Another good source of passive income can be found in master limited partnerships (MLPs). MLPs are intriguing businesses because they essentially act as pass-through entities for investors (limited partners).

Investors in MLPs can take advantage of certain tax benefits as any losses the business faces are passed on to LPs. Moreover, MLPs pay out a good portion of their income to investors each quarter. These payments are known as distributions, and are essentially the same as a dividend.

I recently wrote a piece on Western Midstream (NYSE: WES) stock, and why I think billionaire investor Bill Gross might see the stock as a hedge to fixed income. Gross made a name for himself in the bond industry, and so it's likely that when he invests in stocks he looks for steady growth opportunities.

Another feature that makes MLPs compelling investments is that they tend to be more insulated from commodity-based volatility in the broader energy sector because they enter into long-term fixed-fee contracts with their customers.

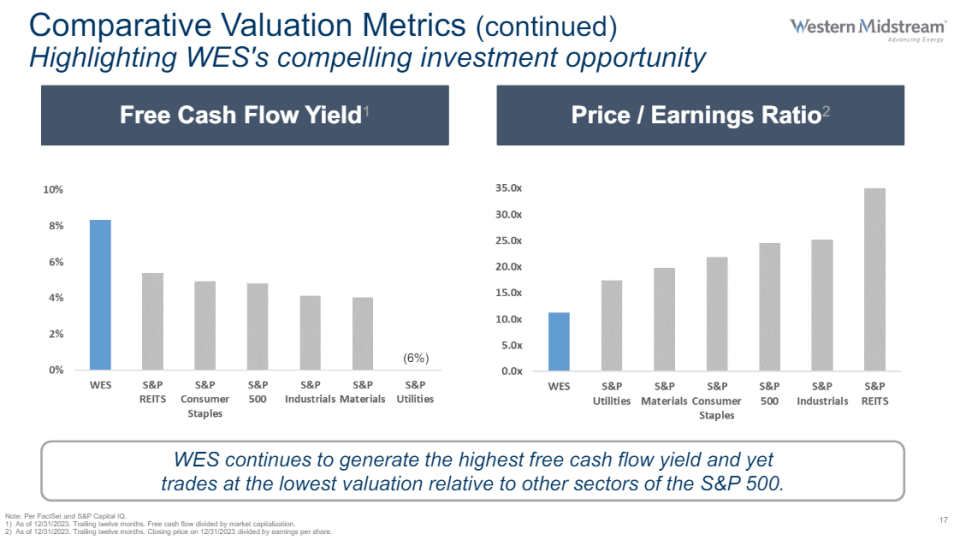

The charts above illustrate Western Midstream's price-to-earnings (P/E) ratio as well as its free cash flow yield. The obvious theme here is that Western Midstream generally sustains notably higher free cash flow compared to industry-adjacent opportunities in utilities, industrials, and materials. Yet despite these results, Western Midstream's P/E trades at a notable discount.

I think this dynamic makes Western Midstream particularly compelling because the company is consistently generates cash flow, which it then uses to periodically raise distribution payments. However, the disparity between Western Midstream's valuation multiples compared to other cash-flow generating opportunities is tough to ignore.

Considering the company offers a dividend yield of 9% and trades notably lower than its cohorts, investors may want to scoop up some shares.

Should you invest $1,000 in Hercules Capital right now?

Before you buy stock in Hercules Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hercules Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Here Are My Top 5 Ultra-High-Yield Dividend Stocks to Buy Hand Over Fist was originally published by The Motley Fool