Top 5 Cloud Computing Stocks Set to Provide Sparkling Returns

Cloud computing refers to the on-demand seamless access of computing resources such as servers, storage, databases, networking, software, analytics and intelligence over the Internet (the cloud) on a pay-per-use pricing model. It marks a paradigm shift from traditional on-premises infrastructure storage to remote cloud-based storage facilities and relies heavily on virtualization and automation technologies.

Instead of buying, owning and maintaining physical data centers and servers, organizations access a virtual pool of shared resources on an as-needed basis from a cloud service provider. This lowers operating costs, increases productivity with greater agility and flexibility, and improves scalability with higher economies of scale.

We have narrowed our search to five cloud computing-centric stocks that are set to provide stellar returns in the mid to long term. These stocks are: Datadog Inc. DDOG, Domo Inc. DOMO, Okta Inc. OKTA, Olo Inc. OLO and Workday Inc. WDAY.

These stocks have seen positive earnings estimate revisions in the past 30 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cloud Computing Industry in Nutshell

Cloud computing is a system primarily comprising of three services: software-as-a-service (SaaS), infrastructure-as-a-service (IaaS), and platform-as-a-service (PaaS). SaaS provides license of a software application to customers using a pay-as-you-go model or on-demand.

IaaS provides operating systems to servers and storage through IP-based connectivity as part of an on-demand service. PaaS is a platform for creating software delivered through the Internet.

Datadog Inc.

Datadog is benefiting from new customer additions and increased adoption of its cloud-based monitoring and analytics platform, driven by accelerated digital transformation and cloud migration across organizations. DDOG’s solid adoption of Synthetics and Network Performance Monitoring products is expected to aid customer wins in the near term.

Contributions from a solid cloud partner base, including Google Cloud, Microsoft Azure and Amazon Web Services, remain a key growth driver for DDOG besides an expanding portfolio. Considering the abovementioned factors, we expect 2024 net sales to increase 22% from 2023.

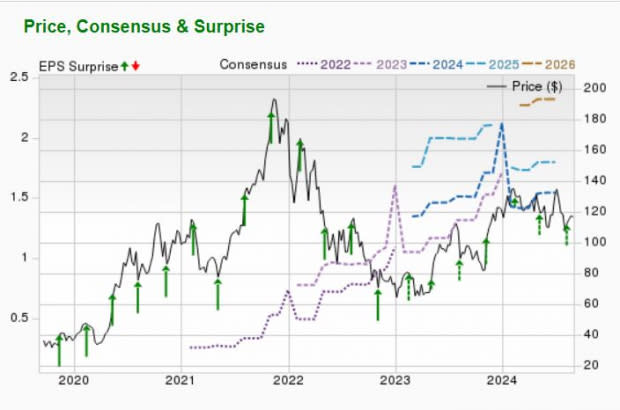

Solid Price Upside for DDOG Stock

Datadog has an expected revenue and earnings growth rate of 23.4% and 23.5%, respectively, for the current year. The average price target of brokerage firms represents an increase of 29.1% from the last closing price of $108.65. The brokerage target price is currently in the range of $98-$160.

Image Source: Zacks Investment Research

Domo Inc.

Domo operates a cloud-based business intelligence platform in North America, Western Europe, Canada, Australia, and Japan. DOMO’s platform digitally connects the chief executive officer to the frontline employee with various people, data, and systems in an organization, as well as gives them access to real-time data and insights, and allow them to manage business via various browsers and visualization engines accessible across laptops, TV screens, monitors, tablets, and smartphones.

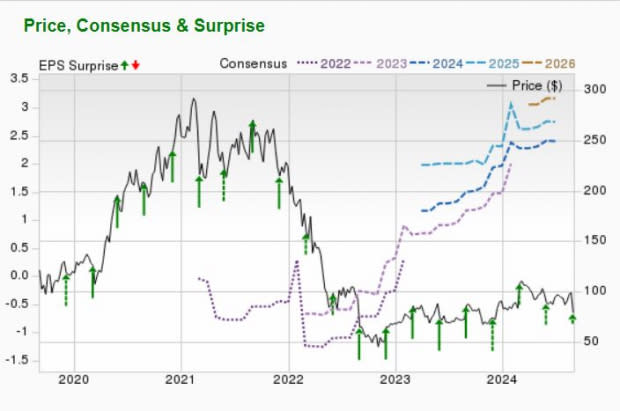

DOMO Shares Provide Robust Price Potential

DOMO has an expected revenue and earnings growth rate of 2.6% and 22.4%, respectively, for next year (ending January 2026). The average price target of brokerage firms represents an increase of 27.3% from the last closing price of $7.66. The brokerage target price is currently in the range of $7-$16.

Image Source: Zacks Investment Research

Okta Inc.

Okta operates as an identity partner in the United States and internationally. OKTA offers a suite of products and services used to manage and secure identities, such as Single Sign-On, which enables users to access applications in the cloud or on-premises from various devices.

OKTA’s Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data, while API Access Management enables organizations to secure APIs. Access Gateway enables organizations to extend Workforce Identity Cloud, and Okta Device Access enables end users to securely log in to devices with Okta credentials. OKTA also provides Universal Directory, a cloud-based system of record to store and secure user, application, and device profiles for an organization.

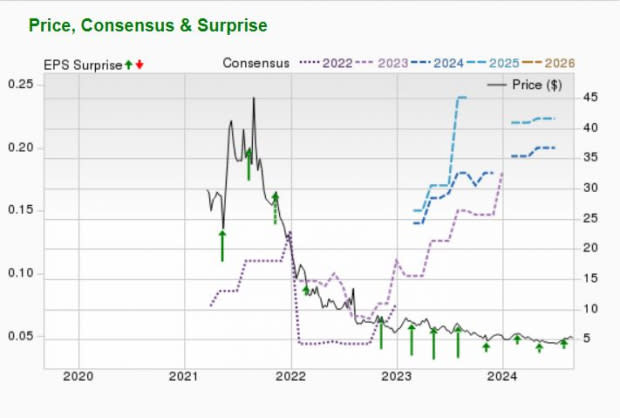

Enormous Price Upside for OKTA Stock

Okta has an expected revenue and earnings growth rate of 13.1% and 60%, respectively, for the current year (ending January 2025). The average price target of brokerage firms represents an increase of 40.8% from the last closing price of $75.26. The brokerage target price is currently in the range of $75-$140.

Image Source: Zacks Investment Research

Olo Inc.

Olo operates an open SaaS platform for restaurants in the United States. OLO’s platform enables on-demand digital commerce operations, which cover digital ordering, delivery, front-of-house management, and payments. OLO’s solutions include Order, a suite of solutions powering restaurant brands' on-demand commerce operations, enabling digital ordering, delivery, and channel management through ordering, dispatch, rails, switchboard, network, virtual brands, kiosk, catering, and sync modules.

OLO’s Engage offers a suite of restaurant-centric marketing solutions optimizing guest lifetime value by strengthening and enhancing restaurants' direct guest relationships, through the guest data platform, marketing, sentiment, and host modules. OLO’s Pay, provides a frictionless payment platform that enables restaurants to grow and protect their digital business through a customer payment experience that offers advanced fraud prevention to improve authorization rates for valid transactions, and increase basket conversion through its Olo Pay module.

Astonishing Price Potential for OLO Shares

Olo has an expected revenue and earnings growth rate of 22.7% and 40%, respectively, for the current year. The average price target of brokerage firms represents an increase of 67.3% from the last closing price of $5.11. The brokerage target price is currently in the range of $8-$10.

Image Source: Zacks Investment Research

Workday Inc.

Workday has benefited from solid customer wins, strategic expansions and strong contract renewals. WDAY is benefiting from healthy demand for financial and human capital management solutions in various end markets, including education, financial services and healthcare. WDAY’s collaboration with Salesforce to develop a leading-edge AI-powered solution will likely enhance workplace efficiency and employee satisfaction.

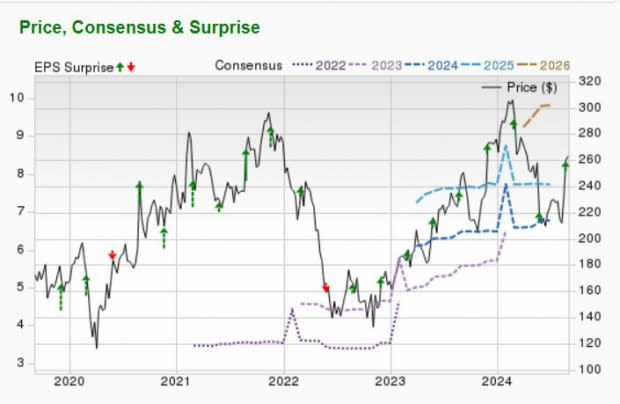

WDAY Stocks Has Strong Price Potential

Workday has an expected revenue and earnings growth rate of 15.6% and 18.8%, respectively, for the current year (ending January 2025). The average price target of brokerage firms represents an increase of 11.5% from the last closing price of $258.60. The brokerage target price is currently in the range of $190-$352.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

Olo Inc. (OLO) : Free Stock Analysis Report

Domo, Inc. (DOMO) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report