Tom Gayner's Strategic Moves in Q2 2024 Highlight Franco-Nevada Corp's Prominence

Insight into the Investment Shifts of Markel Corp's Co-CEO

Tom Gayner (Trades, Portfolio), the Co-Chief Executive Officer of Markel Corporation, has recently disclosed his investment activities for the second quarter of 2024 through the latest 13F filing. With a career that began at Markel in 1990, Gayner has developed a robust investment philosophy focusing on businesses with strong returns, reputable management, and effective capital reinvestment strategies. His tenure at Markel has been marked by strategic portfolio management aimed at long-term value creation, a principle that is evident in his latest investment choices.

New Additions to the Portfolio

During the second quarter of 2024, Tom Gayner (Trades, Portfolio) expanded his portfolio by adding new stocks, notably:

Franco-Nevada Corp (NYSE:FNV), purchasing 245,000 shares, which now represent 0.29% of the portfolio, amounting to $29.04 million.

UL Solutions Inc (NYSE:ULS), acquiring 36,000 shares, making up approximately 0.01% of the portfolio, valued at $1.52 million.

Significant Increases in Existing Positions

Gayner also strategically increased his stakes in several companies, with major adjustments in:

Old Dominion Freight Line Inc (NASDAQ:ODFL), adding 84,500 shares, bringing the total to 279,500 shares. This adjustment increased the share count by 43.33%, impacting the portfolio by 0.15%, with a total value of $49.36 million.

Yum Brands Inc (NYSE:YUM), with an additional 70,350 shares, bringing the total to 86,502 shares. This represents a 435.55% increase in share count, valued at $11.46 million.

Complete Exits

In a move to optimize the portfolio, Tom Gayner (Trades, Portfolio) completely sold out of:

Stericycle Inc (NASDAQ:SRCL), disposing of all 38,000 shares, which previously had a -0.02% impact on the portfolio.

Reductions in Holdings

Adjustments were also made to reduce positions in certain stocks, including:

CVS Health Corp (NYSE:CVS), where 285,000 shares were sold, resulting in an 85.84% decrease in shares and a -0.22% portfolio impact. CVS traded at an average price of $62.55 during the quarter and has seen an 8.94% return over the past three months and a -22.48% return year-to-date.

Electronic Arts Inc (NASDAQ:EA), reducing the stake by 31,000 shares, which is a 38.37% decrease, impacting the portfolio by -0.04%. EA's average trading price was $131.75 this quarter, with a 16.10% return over the past three months and a 9.19% year-to-date return.

Portfolio Overview and Sector Allocation

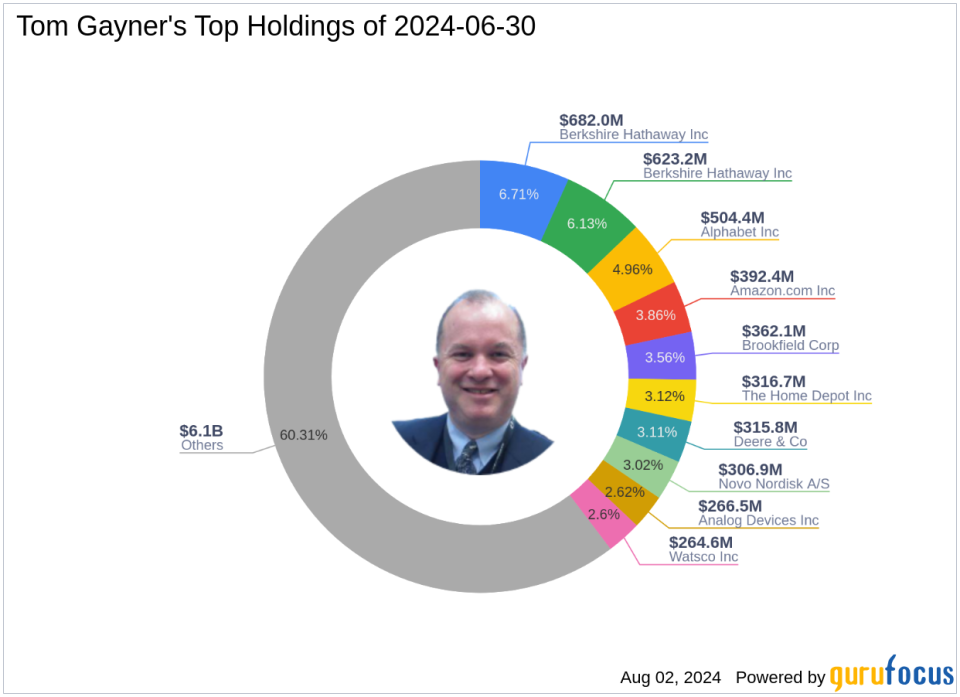

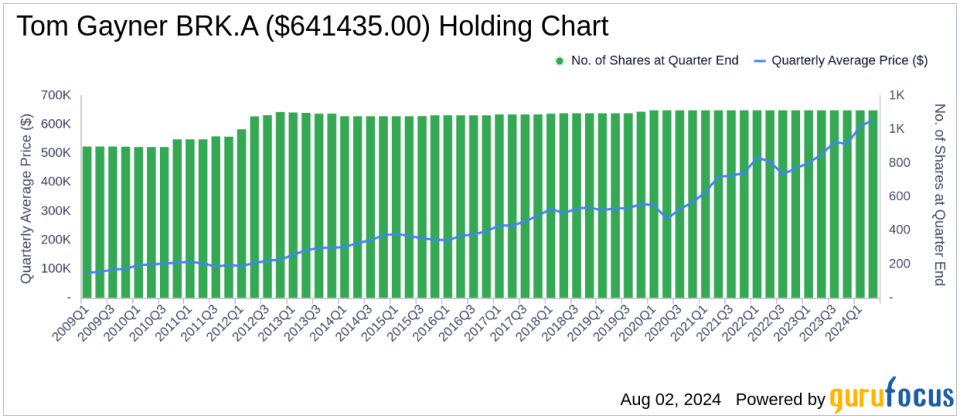

As of the second quarter of 2024, Tom Gayner (Trades, Portfolio)'s investment portfolio includes 134 stocks. The top holdings are notably concentrated in major corporations such as Berkshire Hathaway Inc (BRK.A and BRK.B), Alphabet Inc (NASDAQ:GOOG), Amazon.com Inc (NASDAQ:AMZN), and Brookfield Corp (NYSE:BN). These selections underscore his focus on companies with robust business models and strong market positions.

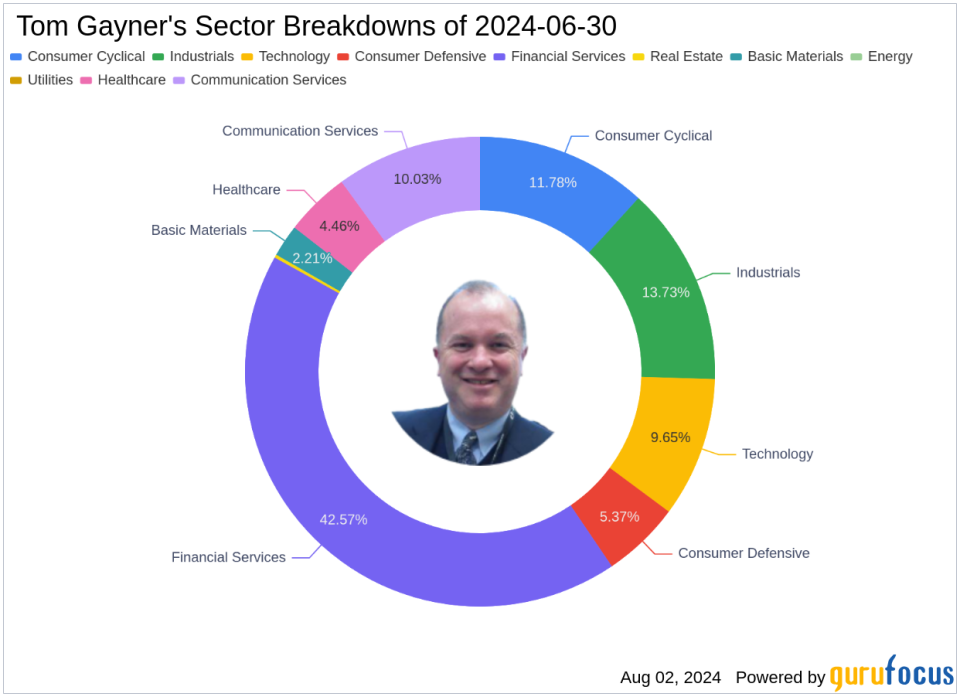

The portfolio is primarily distributed across nine industries, with significant allocations in Financial Services, Industrials, Consumer Cyclical, and Technology, reflecting a diversified approach aimed at capitalizing on sector-specific growth opportunities.

Tom Gayner (Trades, Portfolio)'s recent 13F filing reveals a calculated approach to portfolio management, emphasizing strategic buys, prudent increases, and timely exits. His moves are closely watched by investors seeking insights into value investing and long-term wealth accumulation strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.