Time Inc enacts plan to boost bonuses of top execs in case of sale

The 94-year-old legacy media company that houses magazine titles like Time, Fortune, Sports Illustrated, and People may be very close to a sale. Bloomberg reported this week that Time Inc (TIME) has asked potential bidders to submit their offers by next week.

While it is still possible that Time Inc may not sell, the chance of a sale is serious enough that the company quietly filed an SEC 8-K form on Feb. 1 to amend its change-in-control severance plan.

The filing went largely unnoticed by business media, but it protects bonuses for top executives in the event that the company sells, and it extends the severance period and accelerates stock vesting for top executives in the event that they are fired after a sale.

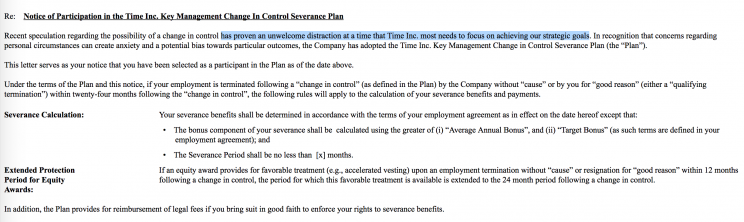

The reason for the change? “Recent speculation regarding the possibility of a change in control has proven an unwelcome distraction,” the company said in an addendum (Exhibit 10.1) to the 8-K form.

In other words: it is an effort to calm nerves in its senior offices.

Meanwhile, the rank-and-file staffers are far from calm: in the last couple of months, Time Inc cut (or gave buyouts to) at least seven editorial staffers from Money Magazine. A longtime staffer from the publication calls it a “gutting.”

Money is just one of many Time Inc publications that have lost longtime senior staffers in the past two months. And last month, Time Inc combined the photo and art departments of Money, Fortune, and Time.

Revised bonus and severance plan

The changes to Time Inc’s severance plan are designed to give “certain enhanced benefits to key management employees who the Company determines are most likely to be impacted by a change in control (primarily the Company’s executive officers).”

That likely means just C-suite business execs, and not the editors of Time Inc’s 22 magazines.

Time Inc declined to comment on exactly which employees would receive the bonus and severance boost.

So, what do the changes to the plan entail?

For “all eligible executives,” these are the changes, according to the Exhibit 10.1 form (bolding is ours):

(i) The calculation of the bonus component of salary continuation will be based on target bonus in lieu of “average annual bonus” if using target bonus results in a higher benefit

(ii) The severance period shall be no less than 12 months (the “Minimum Severance Period”) or such longer period set forth in the participant’s current employment agreement with the Company (the “Contract Severance Period”) and

(iii) The period that a qualifying termination will result in favorable treatment (e.g., accelerated vesting) of equity awards (to the extent such treatment is provided) shall be extended from 12 months following a change in control to 24 months following a change in control.

In addition, the Plan promises each participant payment of his or her legal fees in the event the participant brings suit in good faith to enforce his or her rights under the Plan or under any existing plan, policies or agreements enhanced pursuant to the Plan. Richard Battista, the Company’s president and chief executive officer, and Susana D’Emic, the Company’s executive vice president and chief financial officer, will each receive the enhancements provided under the form participation notice.

That is: bigger bonuses, bigger severance pay in case of termination, and reimbursement of legal fees if a terminated executive sues the company.

The company specifically divulged in its 8-K that the board of directors has enhanced the severance period for CFO Susana D’Emic from 18 months to 24 months, if she is terminated within 24 months of a change in control. The severance period for CEO Rich Battista has not been changed from his existing contract.

The revisions to the severance plan also allow Time Inc “to establish an enhanced severance period” for any terminated employee it chooses.

To be sure, Time Inc is not the first company to amend its bonus and/or severance structure leading up to a potential change in control. BJ’s Wholesale Club filed a change-in-control severance agreement in 2011 before it sold; Etsy filed one in 2014 before it went public; and Yahoo (parent of Yahoo Finance) recently filed one in anticipation of its sale to Verizon.

But Time Inc has a documented history of giving big bonuses to departing execs. Laura Lang, who departed in 2013 and was CEO for only 15 months, walked away from Time Inc with $19 million; the New York Post reported that the payout made Time Incers “furious.” Joe Ripp, CEO for three years, left with a $5.2 million payout.

Who wants Time Inc?

Bloomberg reports that five bidders have “expressed interest in acquiring all of” Time Inc, and that they include Meredith Corp. (MDP), the publicly traded, $2.8 billion-market-cap media company based in Iowa, and, separately, a private investor group led by Edgar Bronfman, former CEO of Warner Music Group.

Bronfman’s group also includes the investor Leonard Blavatnik. Bronfman and Blavatnik, together, already made an offer for Time Inc back in November for $18 to $20 per share, it was widely reported, that Time Inc rejected.

Bloomberg’s report did not name the other three interested bidders. Yahoo Finance has confirmed that Meredith and Bronfman have made their interest clear. But there are some doubts, according to sources at Time Inc, that there are three additional bidders.

In December, the New York Post reported that Hearst was interested in buying some, but not all, of the Time Inc magazines—InStyle, Real Simple, and Cooking Light “in particular.”

Meredith had been interested in the same titles (that is: not the news titles like Fortune and Time) back before Time Warner spun off Time Inc in 2014. That deal fell through, and it now looks less likely that Time Inc would want to sell off its titles piecemeal.

Time Inc is also considering outside investment from private investors (likely for a majority stake), a source there says, and could still end up remaining independent and taking on no investment. The company is working with bankers from Morgan Stanley and Bank of America to review its options.

Time Inc had no official comment on speculation about a sale.

What have employees been told?

With the potential sale process heating up, one Time Inc employee tells Yahoo Finance, “the place is in paralysis.”

Employees have not been told anything new since December, when CEO Battista sent out a companywide holiday note saying, “We’ve all seen the continuing speculation around whether someone might try to do a deal with Time Inc… I am aware and appreciate that the speculation can be a distraction—unfortunately, that is the world in which public companies live—and we shouldn’t be surprised if it continues… The best thing everyone can do is to continue your first-rate work.”

In the meantime, Time Inc has publicly ramped up its digital activity in the past two years, acquiring Adelphic, Bizrate Insights, HelloGiggles, FanSided, and MySpace parent company Viant, as well as launching new digital ventures like Coinage, Extra Crispy, Well Done, and Motto.

Time Inc also makes many digital partnerships with outside outlets such as Fox Sports, but last month it abruptly ended its partnerships with two sports media blogs; the drama was the subject of a Yahoo Finance investigation.

Last month, the company reported slight misses on revenue and earnings for the fourth quarter, but its digital advertising revenue rose 63%.

Disclosure: The author worked at Fortune, a Time Inc title, before joining Yahoo.

—

Daniel Roberts is a writer at Yahoo Finance, covering sports business, media, and tech. Follow him on Twitter at @readDanwrite.

Read more:

Who wants a piece of Time Inc?

Inside the ugly breakup of Sports Illustrated, The Cauldron, and Chat Sports