Three TSX Growth Companies With High Insider Ownership And Earnings Growth Of 15%

In the past year, the Canadian market has shown a robust increase of 12%, while maintaining stability over the last week. In this context, stocks like those of growth companies with high insider ownership and consistent earnings growth become particularly attractive, especially when earnings are expected to grow by 14% annually.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.4% | 68.1% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

Ivanhoe Mines (TSX:IVN) | 12.4% | 37.8% |

Almonty Industries (TSX:AII) | 12.5% | 82.1% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

Here's a peek at a few of the choices from the screener.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of CA$2.98 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

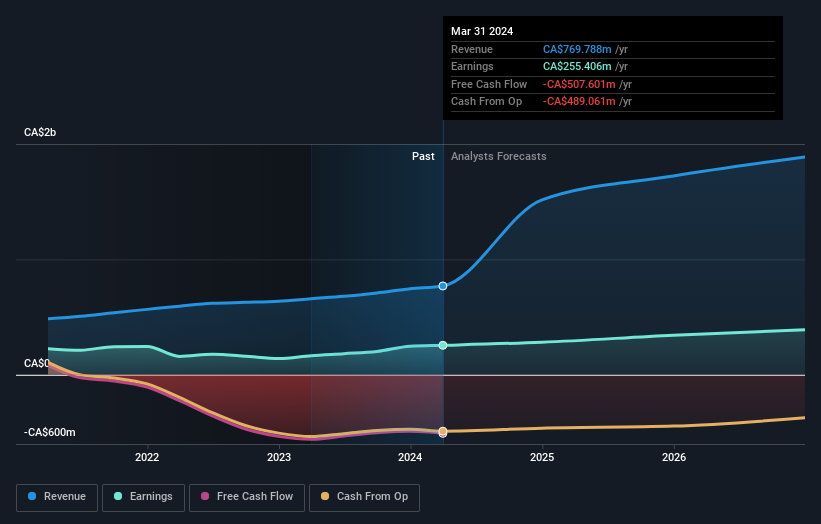

goeasy Ltd., a Canadian company, is poised for significant growth with revenue expected to increase by 32.7% annually, outpacing the market's 6.9%. Despite this robust growth, the stock trades at 43.8% below its estimated fair value and analysts predict a potential price rise of 25.9%. However, challenges persist as dividends are poorly covered by cash flows and debt levels are concerning relative to operating cash flow. The recent appointment of Patrick Ens as President could inject new strategic insights into its operations.

Delve into the full analysis future growth report here for a deeper understanding of goeasy.

Our valuation report unveils the possibility goeasy's shares may be trading at a discount.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in identifying, acquiring, and developing gold properties, with a market capitalization of approximately CA$2.16 billion.

Operations: The company generates its revenue through the development of gold properties.

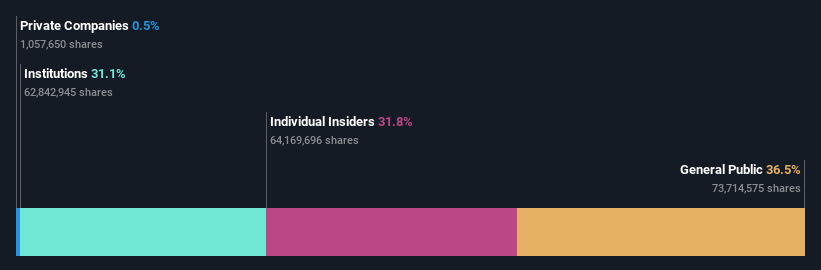

Insider Ownership: 31.8%

Earnings Growth Forecast: 45.6% p.a.

Artemis Gold, a Canadian growth company with high insider ownership, is expected to see substantial revenue growth of 50.8% per year and become profitable within the next three years. Recent insider transactions show more buying than selling, albeit not in large volumes. However, the company reported a significant increase in its quarterly net loss from CA$1.81 million to CA$6.65 million year-over-year and has diluted shareholder value over the past year. On a positive note, construction at its Blackwater Mine is on track with about 73% completion as of March 2024, supporting future operational capabilities and revenue potential.

VersaBank

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VersaBank, operating in Canada and the United States, offers a range of banking products and services with a market capitalization of approximately CA$347.92 million.

Operations: VersaBank generates revenue primarily through its digital banking segment, which brought in CA$102.91 million, and its DRTC segment, focused on cybersecurity services and banking technology development, contributing CA$10.37 million.

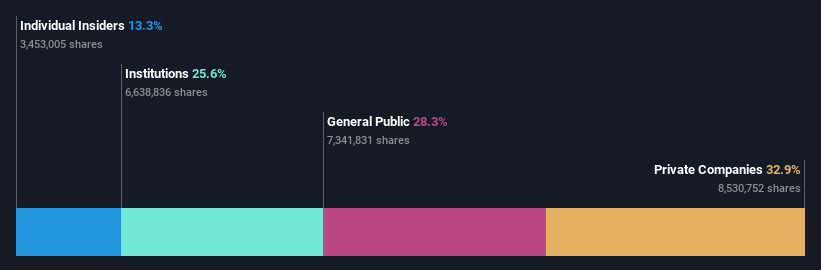

Insider Ownership: 13.3%

Earnings Growth Forecast: 24% p.a.

VersaBank, a Canadian growth company with significant insider ownership, is forecasted to outpace the national market with its revenue and earnings growth rates of 18.8% and 24% per year respectively. Recent financials show a robust year-over-year increase in net income from CA$9.42 million to CA$12.7 million, alongside stable insider activity with more purchases than sales over the past three months. The bank also maintains a low allowance for bad loans at 16%, underscoring strong risk management practices amidst its expansion.

Take a closer look at VersaBank's potential here in our earnings growth report.

The valuation report we've compiled suggests that VersaBank's current price could be quite moderate.

Where To Now?

Explore the 34 names from our Fast Growing TSX Companies With High Insider Ownership screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:GSYTSXV:ARTG and TSX:VBNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com