Swedish Growth Companies With High Insider Ownership For June 2024

As global markets navigate through a landscape marked by fluctuating inflation rates and cautious monetary policies, Sweden's market presents a unique set of opportunities, particularly in growth companies with high insider ownership. Such firms often demonstrate robust alignment between management’s interests and those of shareholders, potentially offering stability amidst broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.5% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

InCoax Networks (OM:INCOAX) | 18% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Here's a peek at a few of the choices from the screener.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of approximately SEK 21.85 billion.

Operations: The company generates revenue primarily from the development of biological drugs targeting central nervous system disorders.

Insider Ownership: 35.1%

Earnings Growth Forecast: 50.5% p.a.

BioArctic, a Swedish biopharmaceutical company, is navigating a transformative phase with significant insider ownership. Recently approved in South Korea for its Alzheimer's treatment, Leqembi®, BioArctic demonstrates robust growth prospects with an expected revenue increase of 40.7% annually. Despite a challenging financial quarter with substantial losses compared to the previous year, the company's strategic alliances and innovative pipeline underscore its potential in Alzheimer’s research and treatment markets. Analysts anticipate the stock price could rise significantly, reflecting confidence in its future profitability and market position.

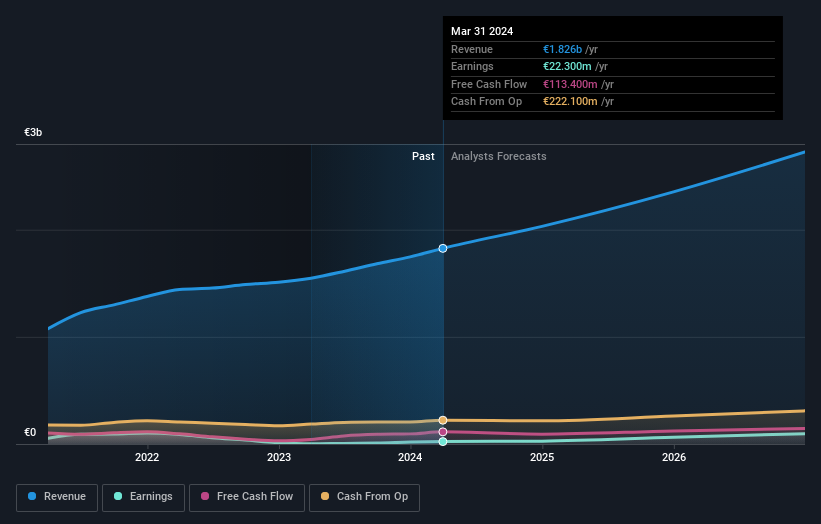

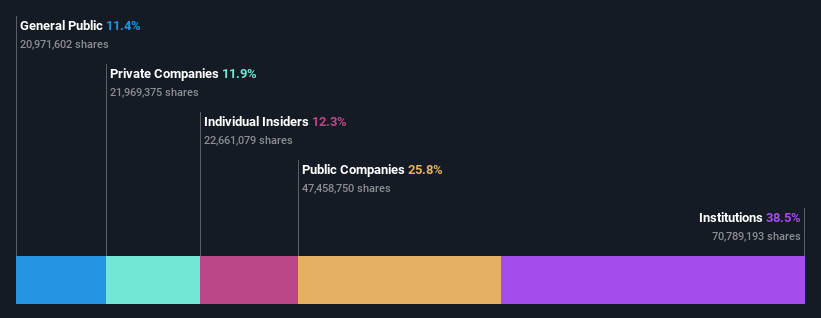

Medicover

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB operates in the healthcare and diagnostic services sector, serving clients in Poland, Sweden, and other international markets, with a market capitalization of approximately SEK 29.69 billion.

Operations: The company generates revenue primarily through two segments: Diagnostic Services, which brought in €585.20 million, and Healthcare Services, contributing €1.26 billion.

Insider Ownership: 11.1%

Earnings Growth Forecast: 38.2% p.a.

Medicover, a Swedish healthcare provider, has shown substantial earnings growth of 1492.9% over the past year with expectations to continue this trend, forecasting a 38.2% annual increase in earnings. Despite these strong growth indicators and trading at 51.3% below its estimated fair value, the company faces challenges such as significant one-off items impacting earnings quality and interest payments not being well covered by earnings. Recent financial reports indicate a strong start to 2024 with first-quarter sales rising to €498.8 million from €419.3 million year-over-year and net income increasing significantly to €6.2 million from €1.5 million.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB is a hotel property company that focuses on owning, operating, and leasing hotel properties, with a market capitalization of approximately SEK 35.19 billion.

Operations: The company generates revenue primarily through two segments: own operation, which brought in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Earnings Growth Forecast: 46.3% p.a.

Pandox AB, a Swedish hotel operator, has exhibited strong earnings growth with expectations of significant increases over the next three years. Despite this, challenges persist such as poor dividend coverage by earnings and substantial one-off items affecting financial outcomes. Recent reports show a robust first quarter in 2024 with revenue rising to SEK 1.5 billion and net income improving dramatically to SEK 447 million from a loss the previous year.

Unlock comprehensive insights into our analysis of Pandox stock in this growth report.

The valuation report we've compiled suggests that Pandox's current price could be quite moderate.

Next Steps

Gain an insight into the universe of 85 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:MCOV BOM:PNDX B and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com