Swedish Exchange Growth Companies With Up To 35% Insider Ownership

As global markets navigate through fluctuating conditions, with recent reports indicating rising inflation across Europe and mixed economic signals from major economies, the Swedish stock market presents unique opportunities for investors. Particularly, growth companies in Sweden with high insider ownership are drawing attention for their potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.5% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

InCoax Networks (OM:INCOAX) | 18% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

Let's review some notable picks from our screened stocks.

Medicover

Simply Wall St Growth Rating: ★★★★☆☆

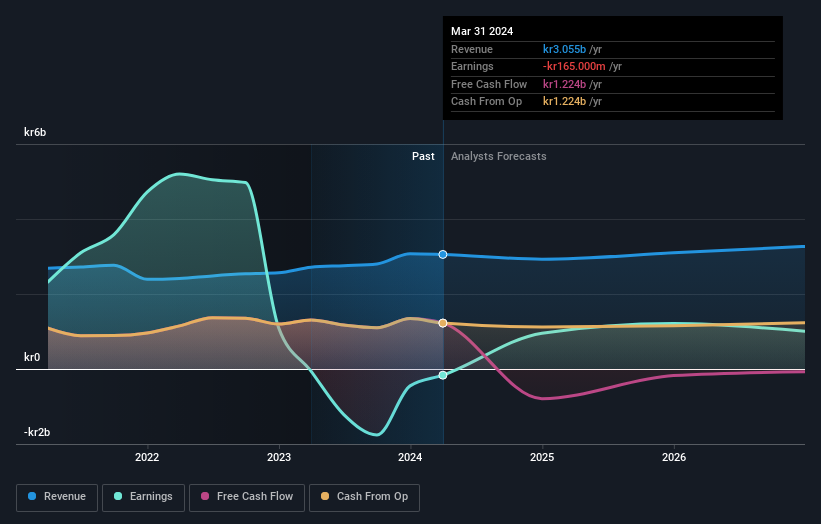

Overview: Medicover AB operates in providing healthcare and diagnostic services across Poland, Sweden, and various international locations, with a market capitalization of approximately SEK 30.53 billion.

Operations: The company's revenue is primarily derived from healthcare services, generating €1.26 billion, and diagnostic services contributing €585.20 million.

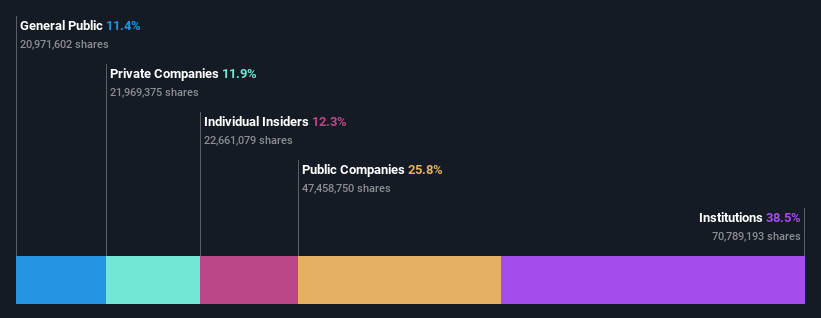

Insider Ownership: 11.1%

Medicover, a growth company with high insider ownership in Sweden, has shown promising financial performance. Recently, the company projected its 2025 revenue to exceed €2.2 billion and reported significant year-over-year earnings growth in Q1 2024 to €6.2 million from €1.5 million. Despite trading at a substantial discount to its fair value and expectations of robust annual earnings growth well above the market average, concerns remain about interest coverage and the impact of one-off items on profitability.

Click to explore a detailed breakdown of our findings in Medicover's earnings growth report.

Upon reviewing our latest valuation report, Medicover's share price might be too optimistic.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB is a hotel property company that owns, operates, and leases hotel properties, with a market capitalization of approximately SEK 35.23 billion.

Operations: The company generates revenue primarily through two segments: own operation, which brings in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Pandox, exhibiting strong potential in Sweden's growth sector with high insider ownership, is poised for significant earnings expansion, forecasted at 46.3% annually. Despite robust Q1 2024 results with net income swinging to SEK 447 million from a prior loss and revenue climbing to SEK 1.5 billion, challenges persist. The company's profit margins have contracted sharply to 1.1%, and its dividend coverage remains weak, reflecting underlying financial strains despite visible top-line growth.

Delve into the full analysis future growth report here for a deeper understanding of Pandox.

Our valuation report here indicates Pandox may be undervalued.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 34.95 billion.

Operations: The company generates its revenue primarily from two key regions in Sweden, with SEK 1.89 billion from Gothenburg and SEK 0.92 billion from Stockholm.

Insider Ownership: 35%

Wallenstam, a Swedish growth company with high insider ownership, is expected to become profitable within three years, outpacing average market growth. Despite this positive outlook and a recent surge in Q1 2024 net income to SEK 333 million from SEK 48 million year-over-year, challenges remain. Insider activity has been mixed with significant selling over the past three months, overshadowing any substantial buying. Additionally, interest payments are poorly covered by earnings, raising concerns about financial stability amidst growth.

Click here and access our complete growth analysis report to understand the dynamics of Wallenstam.

Our expertly prepared valuation report Wallenstam implies its share price may be too high.

Seize The Opportunity

Take a closer look at our Fast Growing Swedish Companies With High Insider Ownership list of 82 companies by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:MCOV B OM:PNDX B and OM:WALL B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com