SoftBank Raises $1.86 Billion Overseas as It Boosts AI Bets

(Bloomberg) -- SoftBank Group Corp. raised about $1.86 billion via dollar and euro bond sales in one of the biggest foreign-currency deals by a Japanese company this year, as the tech firm moves to expand investment in artificial intelligence.

Most Read from Bloomberg

Biden's Defiance Has Democrats Fearing They'll Lose White House

CLOs Have Too Much Money and Are Running Out of Things to Buy

Singapore Loses Last 18-Hole Public Golf Course to Redevelopment

In its first non-yen debt offering since 2021, billionaire Masayoshi Son’s company priced two dollar tranches totaling $900 million and two euro tranches raising €900 million ($964 million), according to the firm. SoftBank said the funds will be used to retire debt and fund operations. Its shares also climbed on optimism toward its AI investments.

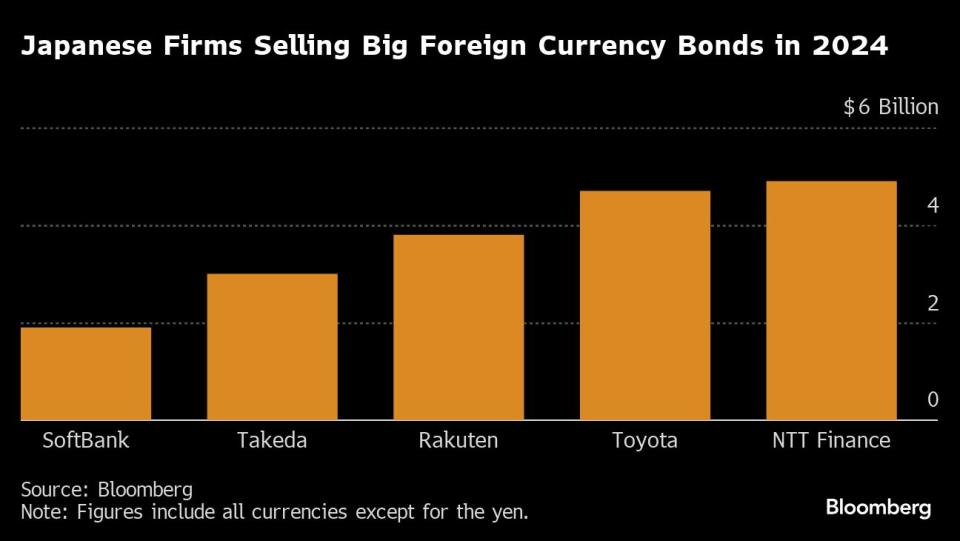

SoftBank joins a bond bonanza by issuers from Asia and elsewhere including even bigger deals from fellow Japanese borrowers such as Takeda Pharmaceutical Co. and Rakuten Group Inc. Investors are trying to lock in elevated yields before central banks outside of Japan start cutting interest rates, while the Bank of Japan is likely to raise rates further this year from rock-bottom levels. Japanese companies are increasing overseas debt deals because the large size of markets like the US enables more borrowings including via junk notes.

“Bond investors are injecting money in SoftBank Group in anticipation of future growth potential in AI-related fields,” said Takashi Nakagawa, senior credit analyst at Tokai Tokyo Intelligence Laboratory Co. “Its financial flexibility has been greatly enhanced by large issuance of bonds since the beginning of this year.”

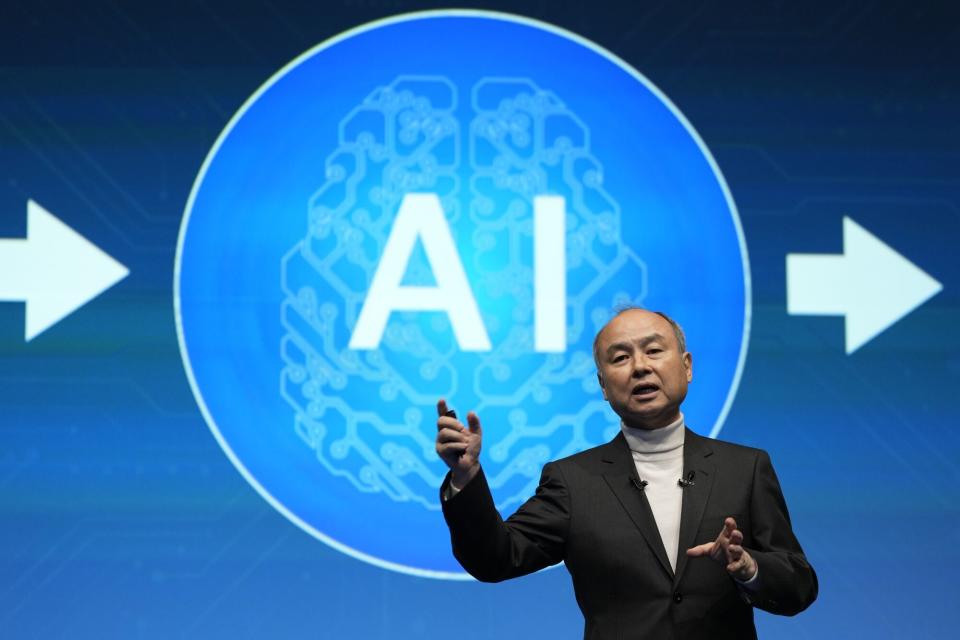

SoftBank and its founder Son have made major AI investments recently that underscore expectations they will quicken their pace of activity in that area. The Japanese firm this year directly invested $200 million into Tempus AI Inc., a startup that analyzes medical data for doctors and patients to come up with better treatments. More recently, it backed Perplexity AI at a $3 billion valuation, betting on a firm that aims to use AI to compete with Alphabet Inc.’s Google search.

Longer term, SoftBank’s working on a plan to deploy some $100 billion into AI-related chips in a project dubbed Izanagi, Bloomberg News reported in February.

SoftBank, with a BB+ rating from S&P Global Ratings, priced $400 million of five-year dollar bonds at a 6.75% coupon in one of its tranches. That compares with 2029 notes sold in April by domestic rival Rakuten Group Inc., which S&P rates one step lower at BB: the debt was yielding around 8.9% in Tokyo on Friday, Bloomberg-compiled data show.

SoftBank’s shares, meanwhile, gained as much as 3.5% on Friday. Tokai Tokyo raised its price target for the company to ¥12,000 from ¥9,750 on expectations that its AI investments will increase its net asset value in the coming year, Nakagawa said.

--With assistance from Min Jeong Lee.

(Adds other big Japanese foreign-currency bond issuers in third paragraph and bond details throughout.)

Most Read from Bloomberg Businessweek

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.