SoftBank-Backed Brainbees Surges 52% in Mumbai Trading Debut

(Bloomberg) -- Baby-products retailer Brainbees Solutions Ltd.’s shares jumped 46% in its trading debut, marking the best listing-day gains for any large Indian initial share sale this year.

Most Read from Bloomberg

How Chicago’s Gigantic Merchandise Mart Is Still Thriving as Office Space

Gottheimer Calls for Rail Riders to Be Reimbursed for Delays

Los Angeles Sees Remote Work Helping ‘No Car’ 2028 Olympic Games

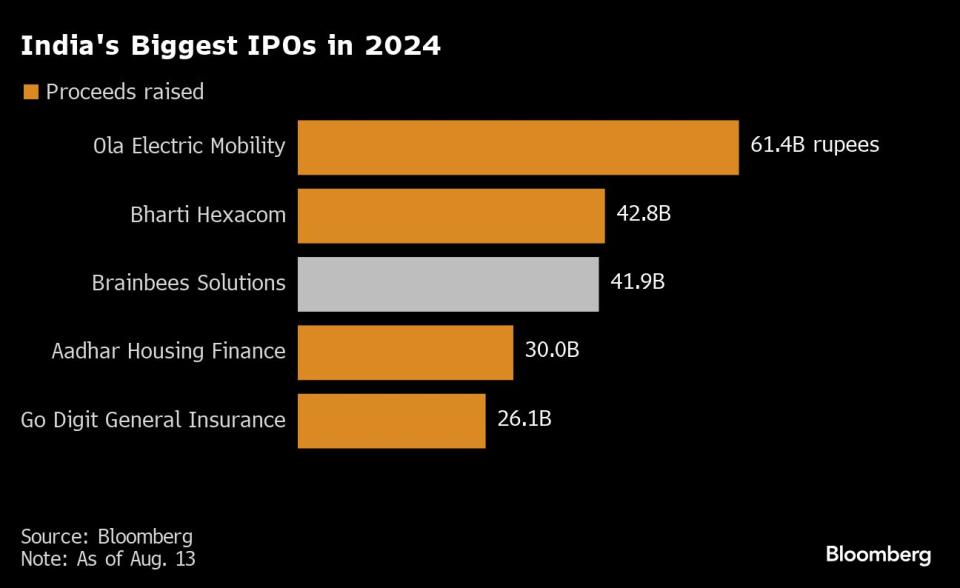

Shares soared as much as 52% over the offer price of 465 rupees before closing at 679.10 rupees in Mumbai on Tuesday. The company raised just short of 42 billion rupees ($500 million) in India’s third-largest IPO of 2024 that was oversubscribed more than 12 times.

The IPO came amid a rush of Indian companies going public, fueled by strong investor demand and a rally in the nation’s $4.9 trillion stock market. E-scooter maker Ola Electric Mobility Ltd.’s shares jumped by the 20% daily limit for two straight days after listing on Friday.

Brainbees’ blockbuster listing also caps a streak of windfall gains for SoftBank Group Corp., which backs the company. On Tuesday, shares of Unicommerce eSolutions Ltd., another SoftBank portfolio company, more than doubled on their debut. The Japanese investment firm had also invested in Ola.

Brainbees’ valuation appears to be cheap compared with recently listed companies in India, leading to the surge, said Sumeet Singh, head of equity research at Aequitas Research Pvt. The company’s growth lags its peers in the Indian internet sector, justifying its valuation discount, he said.

At its IPO price, the company’s valuation was nearly half of its online peers, Singh wrote in a note this month. The company had an enterprise value of 9.9 times gross profit for the fiscal year that ended March 2024, compared with online cosmetics retailer Nykaa’s 17.2 times, according to Aequitas calculations.

Founded in 2010, Brainbees operates under the brand FirstCry. It sells products for mothers, babies and kids via online platforms and stores. It posted a loss of 3.2 billion rupees for the year ended March 31.

The company’s online business will face competition in the longer term against bigger e-commerce rivals such as Amazon.com Inc., said Devi Subhakesan, an analyst at equity-research firm Investory Pte. “It seemed they were trying to compete on price in some categories, which is not sustainable.”

The company plans to use proceeds from the offering to build new stores, pay its leases and expand overseas, according to its prospectus. It has operations in the United Arab Emirates and Saudi Arabia.

Indian companies have raised $7 billion in initial share sales so far in 2024, up from $2.6 billion in the same period last year, according to data compiled by Bloomberg. Ola’s $733 million IPO was the biggest local offering this year, followed by Bharti Hexacom Ltd.’s $512 million in April.

“Overall sentiment is positive after the Ola run-up,” said Pranav Bhavsar, a consumer analyst at Trudence Capital Advisors. The company’s ability to house various childcare products under one roof in a fragmented market partly appealed to investors, he said.

--With assistance from Ashutosh Joshi.

(Updates with details throughout.)

Most Read from Bloomberg Businessweek

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

New Breed of EV Promises 700 Miles per Charge (Just Add Gas)

There’s a Gender Split in How US College Grads Are Tackling a More Difficult Job Market

The Fake Indian Cricket League Created for Real Online Betting

©2024 Bloomberg L.P.