Semiconductor Sales Soar on Surging Demand: 3 Stocks With Upside

The semiconductor industry is making a solid rebound on soaring demand for microchips. The past few months have seen worldwide semiconductor sales get a solid boost, with price pressures easing.

The ongoing enthusiasm surrounding artificial intelligence (AI) is also driving demand for semiconductors. The semiconductor industry is part of the broader technology sector, which is expected to grow further as the Federal Reserve goes ahead with more rate cuts.

Given this situation, investing in semiconductor stocks like Taiwan Semiconductor Manufacturing Company Limited TSM, Semtech Corporation SMTC and NVIDIA Corporation NVDA should be a wise decision.

Semiconductor Sales Continue to Grow

The Semiconductor Industry Association (SIA) said last week that global semiconductor sales totaled $53.1 billion in August, up 20.6% from year-ago levels of $44 billion. Month over month, semiconductor sales grew 3.5% from July’s total of $51.3 billion.

The year-over-year jump in semiconductor sales is the largest percentage gain since April 2022, driven by a 43.9% year-to-year sales surge in the Americas.

John Neuffer, SIA president and CEO, said, “The global semiconductor market continued to grow substantially in August, hitting its highest-ever sales total for August, and month-to-month sales increased for the fifth consecutive month.”

AI Enthusiasm, Rate Cut to Help Semiconductor Stocks

Cooling inflation is helping semiconductor sales, as easing price pressures have led to a rebound in demand. Also, the tech rally this year has primarily been driven by NVIDIA, which has taken a leading role in the generative AI sector, spurring a surge in interest and development in this field.

Experts believe that AI holds a lot of untapped potential, and there is still much for the world to explore. This soaring enthusiasm is likely to further boost demand as more semiconductor manufacturers venture into the AI domain. The AI market is projected to experience explosive growth in the near future, with the demand for AI chipsets already on the rise.

Also, the Federal Reserve started its easing cycle last month with a jumbo 50 basis point rate cut, the first since March 2020. The current benchmark policy rate is between 4.75% and 5%, marking the lowest level since April 2023.

Also, the Fed's latest dot plot indicates that the Fed funds rate is expected to decrease to a range of 4.25% to 4.5% by the year-end, with a projected reduction of one percentage point in 2025 and another half-point cut in 2026. This would lead to a final rate range of 2.75% to 3%. Lower interest rates typically benefit growth assets by decreasing the opportunity cost of holding non-yielding assets, like technology and semiconductor stocks.

4 Semiconductor Stocks With Growth Potential

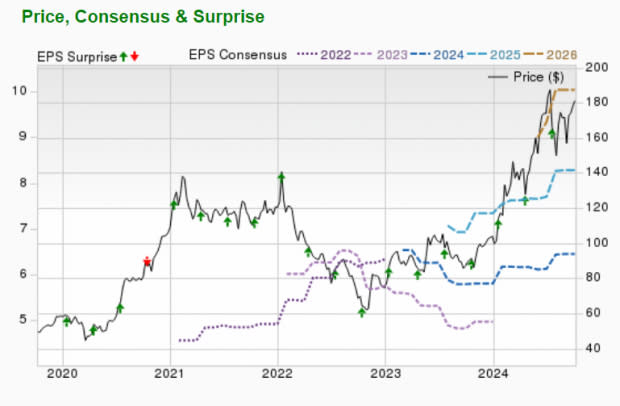

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited is the world's largest dedicated integrated circuit foundry. As a foundry, TSM manufactures ICs for its customers based on their proprietary IC designs using its advanced production processes. Taiwan Semiconductor Manufacturing Company Limited’s goal is to establish itself as one of the world's leading semiconductor companies by building upon the strengths that have made it the world's leading IC foundry.

Taiwan Semiconductor Manufacturing Company Limited’s expected earnings growth rate for the current year is 24.5%. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the past 60 days. TSM presently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

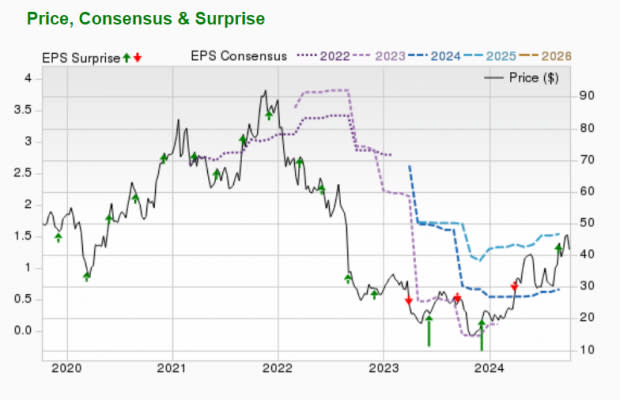

Semtech Corporation

Semtech Corporation designs, manufactures and markets a wide range of analog and mixed-signal semiconductors for commercial applications. SMTC’s product line comprises Signal Integrity Products, Protection Products, Power and High-Reliability Products, Wireless and Sensing Products, and Systems Innovation Group.

Semtech’s expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings improved 6.3% over the past 60 days. SMTC presently carries a Zacks Rank #3.

Image Source: Zacks Investment Researc

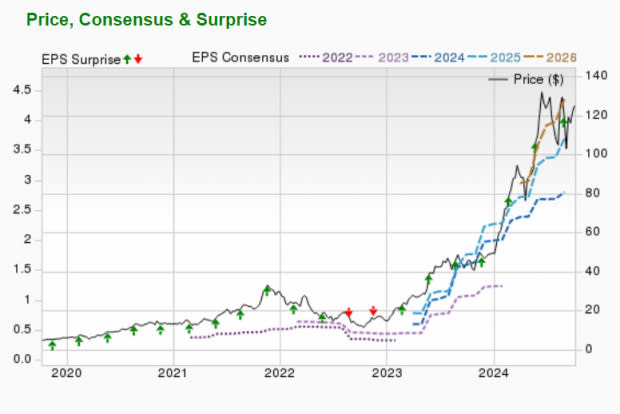

NVIDIA Corporation

NVIDIA Corporation is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

NVIDIA Corporation’s expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings improved 4.5% over the past 60 days. NVDA presently has a Zacks Rank #3.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report