Royce Investment Partners Commentary: Can Small-Caps Benefit From Higher Volatility?

With a little more than a month to go, the third quarter of 2024 has already proven to be eventful. First, we saw a welcome reversal in market leadership in July, with the small-cap Russell 2000 Index advancing 10.2% and the Russell Microcap increasing 11.9% versus a gain of 1.5% for the Russell 1000 and respective losses of -0.4% and -0.7% for the Russell Top 50 and Nasdaq. The Russell 2000 Value Index also finished July ahead of the Russell 2000 Growth Index, up 12.2% versus 8.2%. The Russell 2000's edge versus the Nasdaq was the fourth widest spread since the inception of the small-cap index after November 2000, December 2000, and February 2001. Relative to both the Russell 1000 and S&P 500, it was small-cap's third largest spread after January 1992 and February 2000. Thus far in August, large-caps have rebounded, with the Russell 2000 down -1.5% while the Russell 1000 rose 2.1% through 8/23/24.

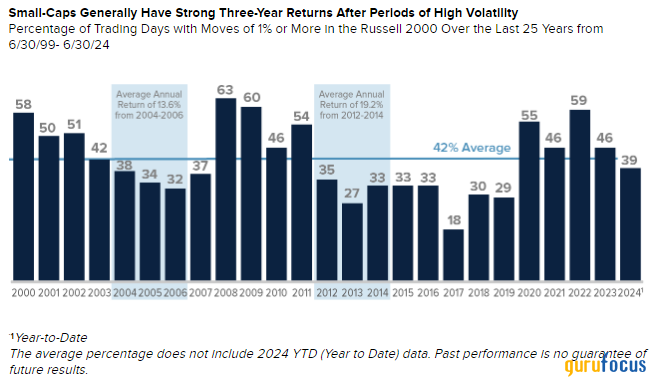

While hopeful that small-caps can sustain leadership, we also wanted to examine what small-caps have done following previous periods of heightened volatility. Rather than look at the short run, we chose to look at 3-year returns, going back 25 years and used trading days when the Russell 2000 rose or fell 1% or more on a single trading day. We found that from 2004-2006, the Russell 2000 had a 13.6% average annual total return while from 2012-2014, the small-cap index had an average annual total return of 19.2%.

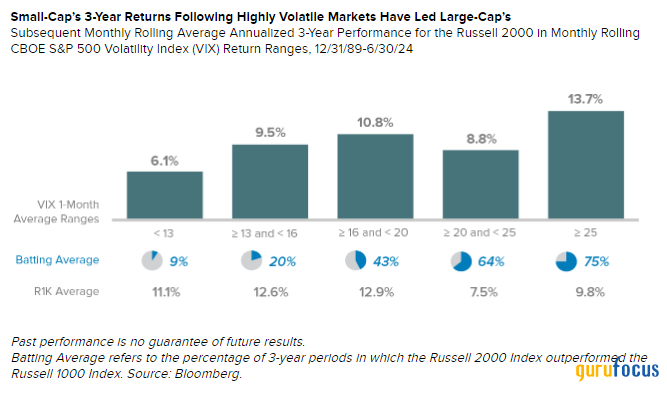

After a lengthy period of large-cap dominance, it is fair to ask how small-caps have fared versus their bigger siblings. For this analysis, we used the CBOE S&P 500 Volatility Index (the VIX). Also known as the fear gauge,' the VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices. We looked at subsequent average annualized returns for the Russell 2000 and Russell 1000 following periods when the VIX was elevated, using monthly rolling return ranges for the volatility index. We found that small-cap's batting averagethat is, the percentage of periods in which the Russell 2000 had higher average annualized 3-year returns than the Russell 1000was at its highest following periods of heightened volatility, as you can see in the chart below.

In light of the larger-than-usual amount of uncertainty in the markets and economy today, we would not be surprised to see more volatility through the remainder of 2024. Investors are trying to make sense of an apparently imminent interest rate reduction, a contentious election season, moderating inflation, and a somewhat muddy earnings and profit picture for stocks taken as a whole.

Our portfolio management teams are of course using recent volatility to take advantage of what they see as strong long-term opportunities in small-cap stocks whose prices have fallen to ranges they find attractively cheap. We have learned over more than five decades of small-cap specialization that short-term swings can create or enhance long-term performance. The upshot is that we remain highly confident in the benefits of active small-cap management for the long run.

Mr. Clark's thoughts concerning recent market movements and future prospects for small-company stocks are solely those of Royce Investment Partners, and, of course, there can be no assurances with respect to future small-cap market performance. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.

This article first appeared on GuruFocus.