Royalty Pharma (NASDAQ:RPRX) Is Paying Out A Larger Dividend Than Last Year

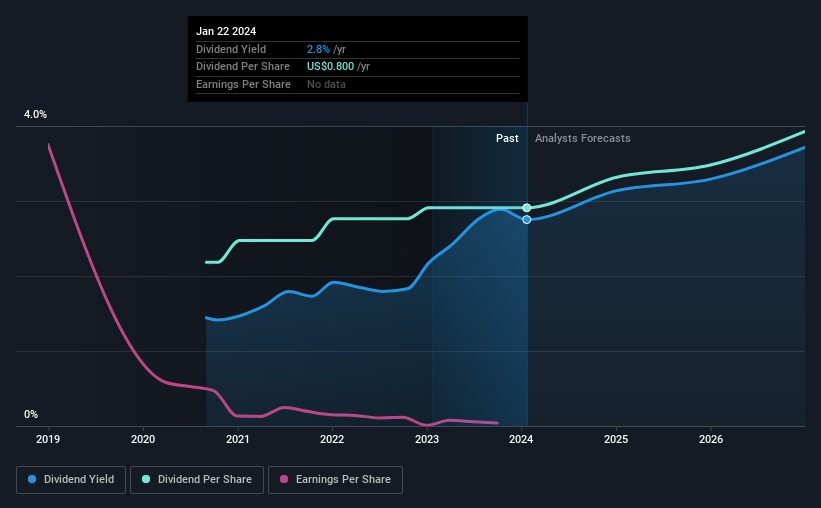

The board of Royalty Pharma plc (NASDAQ:RPRX) has announced that the dividend on 15th of March will be increased to $0.21, which will be 5.0% higher than last year's payment of $0.20 which covered the same period. This takes the annual payment to 2.8% of the current stock price, which is about average for the industry.

See our latest analysis for Royalty Pharma

Royalty Pharma's Dividend Is Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Based on the last payment, Royalty Pharma's profits didn't cover the dividend, but the company was generating enough cash instead. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

According to analysts, EPS should be several times higher next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 25% which is fairly sustainable.

Royalty Pharma Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The annual payment during the last 3 years was $0.60 in 2021, and the most recent fiscal year payment was $0.80. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Royalty Pharma's EPS has declined at around 59% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Royalty Pharma will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 5 warning signs for Royalty Pharma that investors should know about before committing capital to this stock. Is Royalty Pharma not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.