(Bloomberg) -- Wary lenders, a watchful government, activist investors scrutinizing every move. Add to the mix infighting among prospective buyers, including a consortium involving more than 20 different Japanese companies and financial institutions.

Most Read from Bloomberg

It’s no wonder that Toshiba Corp.’s buyout decision was delayed for months.

The rocky road to the storied conglomerate’s $15 billion sale to a group led by private equity firm Japan Industrial Partners Inc. is raising fresh doubts about Toshiba’s ability to navigate a fast-changing tech landscape, given all the competing interests tugging at it.

The fear is “if the new CEO still has to cater to many, many different stakeholders,” said Jesper Koll, expert director at Monex Group Inc. in Tokyo. Toshiba has some lucrative operations such as in quantum computing, cybersecurity and in infrastructure business that could benefit from strong leadership, he said.

“The most worrying factor is if the new CEO does not get to actually make decisions.”

Under Thursday’s agreement — originally expected last fall — the JIP-led consortium aims to buy Toshiba at ¥4,620 a share and take one of Japan’s most well-known brands private through a tender offer to begin around late July. If successful, the deal could close a troubled chapter in the firm’s 147-year history, after a series of scandals and missteps set it on the path to a sale. The questions now are whether activist investors will accept the terms — and whether the firm can restore its former glories.

The decision came after months of squabbling, miscommunication and confusion, according to people close to the talks, who asked not to be identified discussing private information. During that time, competitors made rapid strides in artificial intelligence, material sciences and quantum technologies, even as sluggish demand undercut Toshiba’s own cash-churning ability in semiconductors and hard drives.

As weeks turned into months, banks became even more wary of signing off on financing without some implied guarantee from the government, and asked for board seats and priority in recouping their loans, the people said. JIP’s initially proposed price of as much as ¥5,500 per share was whittled down as banks reduced financing, Toshiba said in a statement.

All the while, talks proceeded under the watchful gaze of Japan’s government, which sought to make sure sensitive technology and businesses didn’t fall into foreign hands, deterring many foreign investors from taking part in what could be one of Asia’s biggest deals this year.

“Toshiba owns many important technologies related to national security,” Yasutoshi Nishimura, Japan’s minister of economy, trade and industry, told reporters in Tokyo Friday. “I want to pay close attention and follow the company’s progress.”

Drafting a business plan involving more than 20 counterparties — each wanting something different from the deal — has been a nightmare, the people involved in the talks said. Without a viable business plan, banks were unable to provide commitment letters, even if they wanted to, by an originally scheduled November deadline.

The consortium includes 17 Japanese companies, six domestic financial firms as well as JIP and other funds, Toshiba said without naming the companies and finance firms. Financial services giant Orix Corp. and chipmaker Rohm Co. are among the companies, Bloomberg News previously reported.

Given the diverse array of companies involved in the consortium, the number of voices vying to steer Toshiba will only increase. That’s an additional hurdle for a conglomerate that must now decide which of its wide-ranging operations to sell and which to keep.

“It’s a big and complex company with a lot of competition in its various segments,” said Travis Lundy, an analyst at Quiddity Advisors who publishes on Smartkarma. “That doesn’t change.”

The agreement will help enhance the company’s corporate value, a Toshiba spokesperson said in an emailed response. “The transaction will create a stable foundation for management to grow and transform the company, through implementing a consistent business strategy over the medium- to long- term and uniting shareholder support.”

Years of scandals and mismanagement, as well as bad luck in its bets on nuclear power and memory, have sapped faith in Toshiba’s ability to turn itself around. Last month, the company slashed its annual profit forecast, while its chief operating officer resigned over inappropriate entertainment expenses.

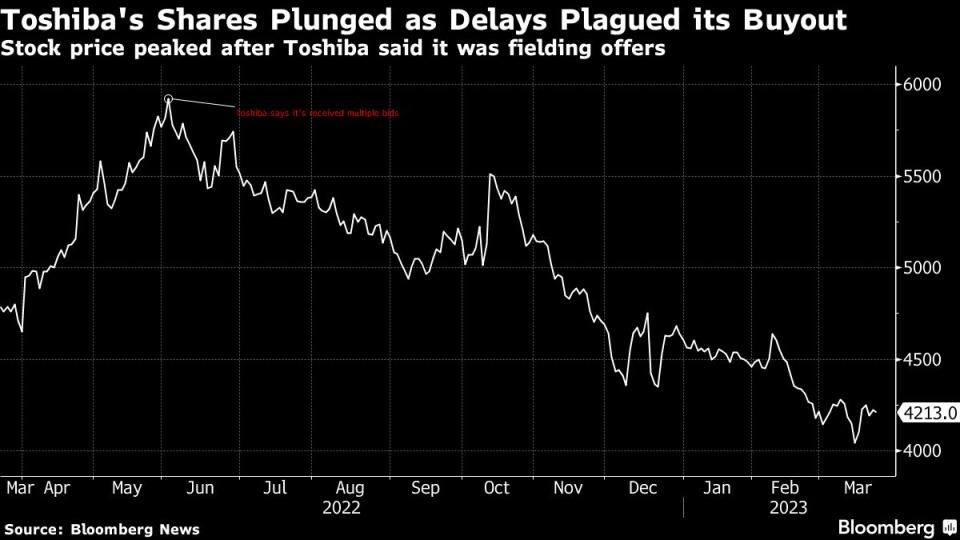

The sale of Toshiba was supposed to showcase how shareholder activism had at last taken root in Japan, as some prominent investor activists, including billionaire Paul Singer’s Elliott Management Corp., took positions in the stock. But after an initial surge on hopes of a privatization deal, Toshiba shares have fallen about 25% from a June peak.

With roots dating back to 1875, Toshiba was once a household name in consumer electronics. It created the world’s first laptop PC, launched a global media format war in the 2000s and developed NAND flash memory, essential to store data on mobile devices without powering down.

But after more than a decade of reeling from one scandal to another, and with key decisions interrupted by frequent leadership changes, Toshiba has lost much of its technological edge.

Losses from its nuclear business forced it to sell off a majority-stake in its memory-chip business — still the world’s No. 3 maker of NAND — but even that operation, rebranded Kioxia Holdings Corp., is now a year behind market leader Samsung Electronics Co. in terms of production technology.

Toshiba is now the smallest of the world’s three remaining hard-disk drive suppliers in an industry that’s getting squeezed by tepid electronics demand. Cloud service providers are trimming data center spending following years of expansion in magnetic storage. That has been especially tough for Toshiba, which lacks the scale of Seagate Technology Holdings and Western Digital Corp.

In early June, Toshiba said that it had received eight buyout offers and expected to begin due diligence procedures starting July, with two new activist directors on the board, one from Elliott and one from Farallon Capital Management, spurring hopes of privatization.

One of the plans floated was a potential joint bid by state-funded Japan Investment Corp. and the JIP-led consortium. JIC — which is more than 95%-owned by the Japanese government — would have lent the deal implicit public backing, easing banks’ concerns.

But the two clashed and then filed separate second-round bids in September. JIC and JIP declined to comment for this story.

The takeover process was “rather messy,” according to Mio Kato, an analyst from LightStream Research. But it’s not clear that it could have been done much better, he said.

“Too many people wanted too many different things from Toshiba and it wasn’t realistic to expect Toshiba to make all stakeholders happy,” Kato said. “In the end, this feels like a rather mediocre solution but not an especially bad one.”

--With assistance from Yuki Furukawa, Takako Taniguchi and Manuel Baigorri.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.