Reflecting On Specialized Consumer Services Stocks’ Q2 Earnings: ADT (NYSE:ADT)

Looking back on specialized consumer services stocks' Q2 earnings, we examine this quarter's best and worst performers, including ADT (NYSE:ADT) and its peers.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 9 specialized consumer services stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.8%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and specialized consumer services stocks have had a rough stretch, with share prices down 6.5% on average since the previous earnings results.

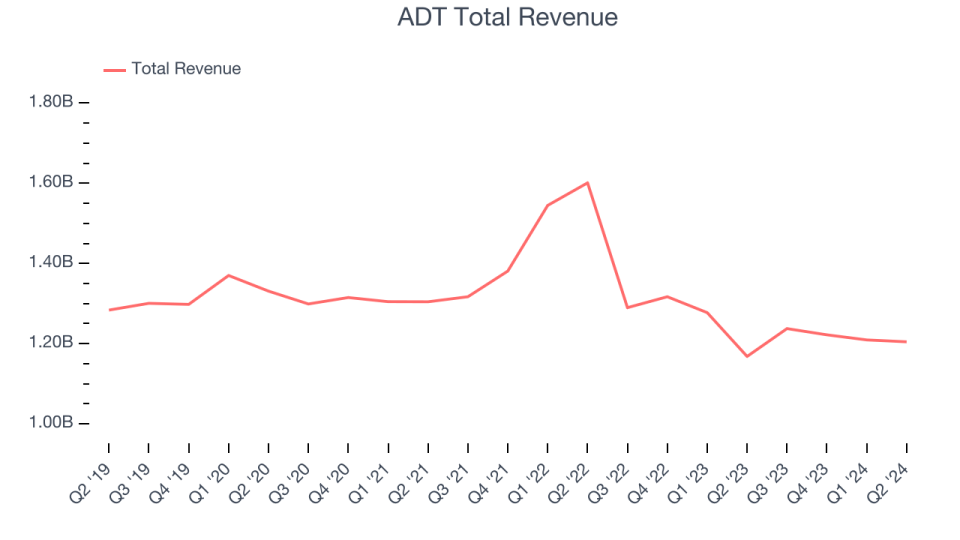

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

ADT reported revenues of $1.20 billion, up 3.1% year on year, in line with analysts' expectations. Overall, it was a solid quarter for the company with an impressive beat of analysts' earnings estimates and in-line earnings guidance for the full year.

“ADT delivered a solid first half with continued revenue growth momentum, as well as strong operating profitability and cash flow generation. With our streamlined focus on the consumer and small business markets, we continue to expand and improve our innovative offerings, unrivaled safety, and premium experience for security and smart home customers,” said ADT Chairman, President, and CEO, Jim DeVries.

The stock is down 6.5% since reporting and currently trades at $7.27.

Is now the time to buy ADT? Access our full analysis of the earnings results here, it's free.

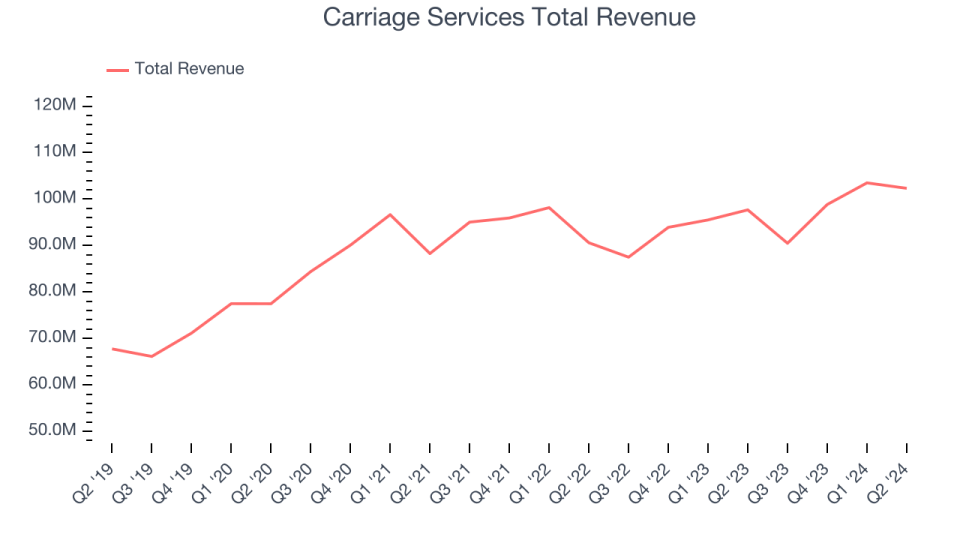

Best Q2: Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $102.3 million, up 4.8% year on year, outperforming analysts' expectations by 7.7%. It was a strong quarter for the company with full-year revenue guidance exceeding analysts' expectations.

Carriage Services scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 6.6% since reporting. It currently trades at $30.

Is now the time to buy Carriage Services? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $427.8 million, down 10.9% year on year, falling short of analysts' expectations by 10%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Matthews posted the weakest performance against analyst estimates in the group. As expected, the stock is down 7.7% since the results and currently trades at $25.89.

Read our full analysis of Matthews's results here.

WeightWatchers (NASDAQ:WW)

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $202.1 million, down 10.9% year on year, falling short of analysts' expectations by 3.3%. Zooming out, it was a weak quarter for the company with full-year revenue guidance missing analysts' expectations and a miss of analysts' earnings estimates.

WeightWatchers had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 29.7% since reporting and currently trades at $0.75.

Read our full, actionable report on WeightWatchers here, it's free.

Frontdoor (NASDAQ:FTDR)

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $542 million, up 3.6% year on year, in line with analysts' expectations. Taking a step back, it was an ok quarter for the company with a solid beat of analysts' earnings estimates but a miss of analysts' home service plans estimates.

The stock is up 15.4% since reporting and currently trades at $45.56.

Read our full, actionable report on Frontdoor here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.