Reasons for Bitcoin traders to stay optimistic this 'Uptober'

This October, bitcoin's price movement is being eagerly watched by market analysts, who are anticipating a repeat of an upcoming "Uptober," a historical time when bitcoin experiences significant price increases.

At the moment, the price of bitcoin is currently trading around $63,000, after previously dipping to $59,828 earlier this month. The overall market sentiment this month, however, remains optimistic, especially if 'Uptober' comes to pass despite the early volatility.

Whales on the Move

There's been a dramatic drop in the number of bitcoins held on crypto exchange reserves, which have hit a six-year low. This decline signals that large holders, known as "whales," may be accumulating bitcoin at an unprecedented rate. While reserves have been steadily decreasing, 2024 has seen a remarkable acceleration in this trend. In some cases, data points to the amount of accumulation mirroring early 2017 or 2019 levels.

Institutional Interest Soars

The surge in institutional interest is a key factor driving demand. Companies like MicroStrategy are continuing their aggressive buying strategies, while big Wall Street players like BlackRock continue to scoop up interested investors through their massively popular bitcoin ETFs.

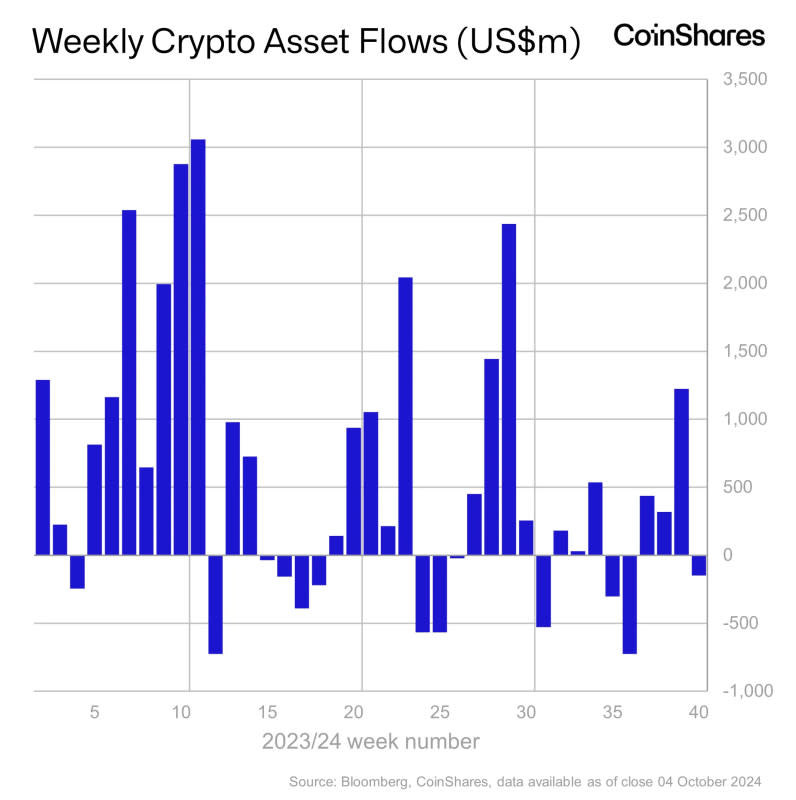

Last week, however, saw a brief period of net outflows among investors in bitcoin ETFs, according to CoinShares. After three weeks of net inflows, bitcoin asset product outflows stacked up to total $159 million.

Market Dynamics

This month, analysts are closely monitoring these institutional movements. The rapid accumulation by major financial players is creating a supply squeeze, which could put upward pressure on Bitcoin's price. Analysts speculate that if this trend continues, bitcoin might hit its historical price rally of 30% this month, reigniting the possibility of the world's largest crypto scaling new all-time highs.

Navigating Volatility

Despite the bullish outlook, some traders remain cautious. Political and geopolitical events may inject volatility into the market, spurring occasional dips. Nevertheless, the overall trend appears positive, bolstered by the influx of institutional capital and dwindling exchange reserves.

Even if a possible October break out takes time, it is entirely possible to experience three consecutive weeks of bearish performance in crypto markets – making the prospect of another strong Uptober possible.