RBC Shares Hit All-Time High on ‘Standout’ Earnings Report

(Bloomberg) -- Royal Bank of Canada’s shares hit a new all-time high on news of a “standout quarter” in which it put away less money than expected for potentially bad loans and earnings jumped at its domestic banking division.

Most Read from Bloomberg

Intergenerational Housing Could Help Older Adults Combat Loneliness

As Rural Hospitals Shutter Maternity Wards, Urban Ones Follow

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

Canada’s largest bank earned C$3.26 a share on an adjusted basis in the fiscal third quarter, it said in a statement Wednesday, topping the C$2.97 average estimate of analysts in a Bloomberg survey.

The results are the first for a full quarter to include HSBC Holdings Plc’s Canadian assets, which Royal Bank acquired in late March, a deal that has given the Toronto-based lender a welcome source of momentum as the domestic banking sector faces tepid loan growth and rising deposit costs.

Strong earnings helped boost the bank’s capital levels, and Chief Executive Officer Dave McKay said on a conference call Wednesday that he expects “an increasing level of buybacks in coming quarters to provide longterm value to shareholders.”

The company’s shares gained 2.6% to trade at C$160.62 at 10:20 a.m. in Toronto and earlier hit an all-time high of C$160.93.

RBC’s Canadian personal and commercial banking unit posted net income of C$2.5 billion ($1.9 billion) for the three months through July, up 17% from the same period last year. Excluding HSBC Canada’s results, net income in the division was up 7%.

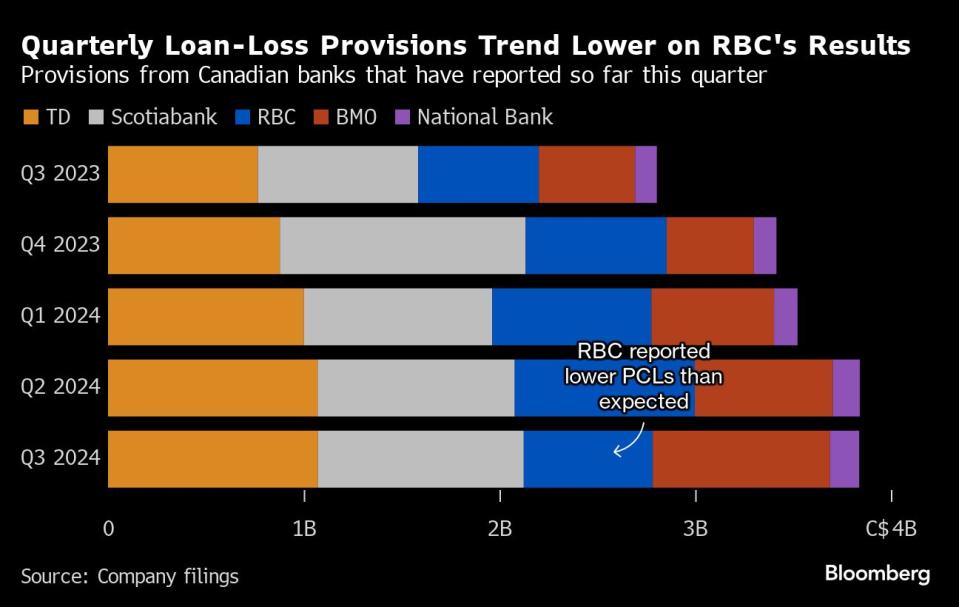

Provisions for potential credit losses totaled C$659 million in the period, less than the C$921 million analysts had forecast. That compared with C$920 million in the most recent quarter and C$616 million a year earlier.

Also reporting this week, National Bank of Canada and Bank of Nova Scotia posted loan-loss provisions in line with analysts’ expectations. In contrast, Bank of Montreal said Tuesday that it put aside far more than forecast for potentially bad loans, fueling concern that the lender’s credit performance is an outlier among both US and Canadian peers. BMO’s shares tumbled and several analysts downgraded their calls on its stock.

Royal Bank’s capital-markets business saw profit increase 23% from the prior year to C$1.17 billion, driven by higher revenue in corporate and investment banking. Still, that was down from the previous quarter, when the bank reported record earnings of C$1.26 billion in the unit. It blamed lower merger-and-acquisition activity in the US.

“We would expect to see Royal’s valuation well rewarded for the strength of the beat and the quality of its earnings today,” Jefferies Financial Group Inc. analyst John Aiken said, calling it a “standout quarter” for RBC.

Scotiabank analyst Meny Grauman said the strong results extended beyond Royal Bank’s loan-loss provisions, but added that “the conversation on reporting day will largely revolve around credit.”

Leadership Changes

The report comes just ahead of Royal Bank’s plan to split its Canadian business into two reporting lines on Sept. 1. Erica Nielsen is set to the lead the new personal banking unit, the lender announced in July, while Sean Amato-Gauci will head up the commercial side.

Neil McLaughlin, longtime head of the combined banking division, will move to chief of wealth management, a business that includes Royal Bank’s US retail banking subsidiary, City National Bank.

Over the past year, Royal Bank has replaced top executives at City National after injecting billions of dollars in capital to prop up the unit’s balance sheet. The subsidiary, which is investing in improving risk controls after agreeing to a regulatory fine over compliance lapses, had net income of $52 million in the third quarter.

Royal Bank is fighting a wrongful dismissal lawsuit filed by former Chief Financial Officer Nadine Ahn, who was fired in April over allegations she had an undisclosed personal relationship with another executive and arranged promotions and pay raises for him. She denied having a romantic affair with her colleague and Royal Bank has hit back with its own counterclaim seeking damages from Ahn and alleging it has proof of the relationship.

The bank’s shares closed at an all-time high on Tuesday of C$156.57.

National Bank results

Montreal-based National Bank continued an earnings winning streak with all of its business segments topping analysts’ expectations on Wednesday.

Adjusted earnings were C$2.68 a share for the third quarter, according to a statement, surpassing estimates of C$2.47. The results marked National Bank’s fourth-straight quarterly earnings beat.

Its shares also hit an all-time high Wednesday and were up 4.8% to C$125.68 at 10:25 a.m.

(Adds share price in fifth paragraph, chart)

Most Read from Bloomberg Businessweek

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

©2024 Bloomberg L.P.