The Q2 Earnings Season Gets Underway

The recent Adobe ADBE and Oracle ORCL quarterly releases kicked off the 2024 Q2 earnings season. These results from the two Tech players followed quarterly reports from Costco and AutoZone for their respective fiscal quarters ending in May.

We and other research organizations engaged in tracking earnings results in real time count such May-quarter results as part of the overall June-quarter or Q2 tally.

In fact, by the time the big banks release their quarterly results on July 12th, we will have such Q2 results from almost two dozen S&P 500 members.

Regular readers of our earnings commentary are familiar with our sanguine view of corporate profitability. The growth picture has been steadily improving over the last few quarters, and the revisions trend has notably stabilized lately.

The ‘doom & gloom view’ of corporate profitability that a noisy market segment appeared to subscribe to last year has largely moved to the fringes. Driving this evolution has been the U.S. economy’s resilient performance in the face of the Fed’s extraordinary tightening. With the Fed now gearing up to start easing policy in the coming months, many of the dire risks to the economy and corporate earnings have eased significantly.

This is the macro backdrop in which we digested the Q1 earnings season and will receive the Q2 earnings results in the coming days.

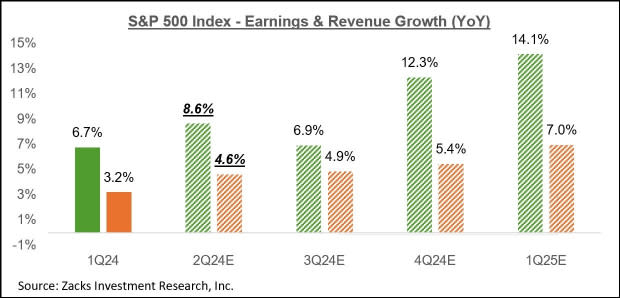

The current expectation is that Q2 earnings for the S&P index will be up +8.6% from the same period last year on +4.6% higher revenues. This would follow the +6.7% earnings growth on +3.2% revenue gains in 2024 Q1.

The chart below shows current earnings and revenue growth expectations for 2024 Q2 in the context of where growth has been over the preceding five quarters and what is currently expected for the following three quarters.

Image Source: Zacks Investment Research

As we have consistently flagged in our commentaries, the revisions trend for 2024 Q2 and full-year 2024 has been very favorable lately.

The chart below shows how Q2 earnings growth expectations have evolved since the quarter got underway.

Image Source: Zacks Investment Research

As you can see above, Q2 estimates went up after the period got underway, started coming down only in recent weeks, and still remain only a hair below where they stood at the start of the quarter.

The improving earnings outlook for the Energy sector has been a major contributor to this favorable revisions trend at the index level. But the Energy sector isn’t the only sector that has enjoyed positive estimate revisions since the start of April. Other sectors enjoying positive estimate revisions include Transportation, Utilities, Tech, and Autos. On the negative side, estimates have been cut for 11 of the 16 Zacks sectors, with notable declines in Industrial Products, Aerospace, Consumer Staples, Conglomerates, Construction, and others.

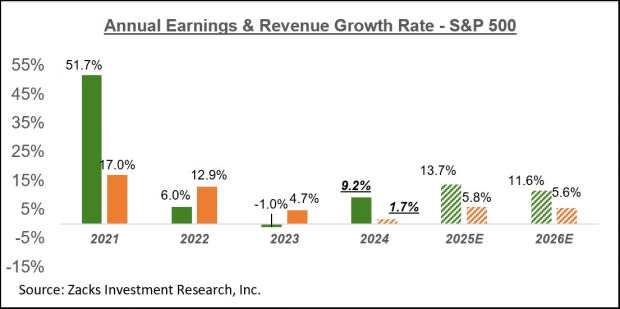

Embedded in current Q2 earnings and revenue estimates is a steady improvement in margins, continuing the positive trend that has been in place since 2023 Q3. The chart below shows the year-over-year change in net margins.

Image Source: Zacks Investment Research

This chart shows that the extreme margin pressure that we witnessed in 2022 and the first half of 2023 is now behind us.

For 2024 Q2, net margins are expected to be above the year-earlier level for 9 of the 16 Zacks sectors, with the biggest gains at Tech, Medical, Finance, Consumer Discretionary, and others. On the negative side, margins are expected to be below the year-earlier level for 7 of the 16 Zacks sectors, with major pressure at Basic Materials, Autos, Transportation, and other sectors.

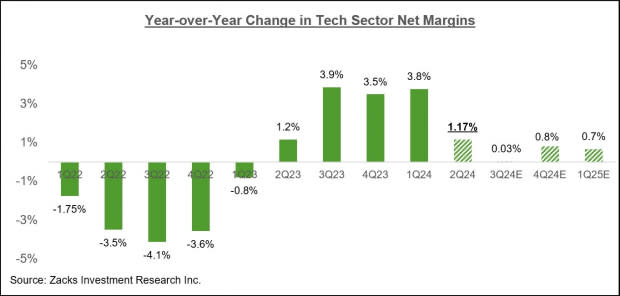

The Tech sector has been a major contributor to the index growth in recent quarters. That trend is also expected to remain in place in 2024 Q2, with total earnings for the sector expected to be up +15.3% on +9.4% higher revenues paired with a 117-basis point expansion in net margins.

The chart below shows the year-over-year change in the Tech sector’s net margins

Image Source: Zacks Investment Research

As you can see above, the period of easy comparisons is coming to an end, but the overall margins outlook is still favorable for the space.

Looking at the overall earnings picture on an annual basis, total 2024 S&P 500 earnings are expected to be up +9.2% on +1.7% revenue growth.

Image Source: Zacks Investment Research

Q2 Earnings Season Scorecard

As noted earlier, the recent earnings reports from Adobe ADBE, Oracle ORCL, Costco COST, and AutoZone AZO for their respective fiscal quarters ending in May get counted as part of our official 2024 Q2 earnings tally. This week brings an additional 7 S&P 500 members reporting similar Q2 results, including Darden Restaurants, Accenture, Lennar, and others.

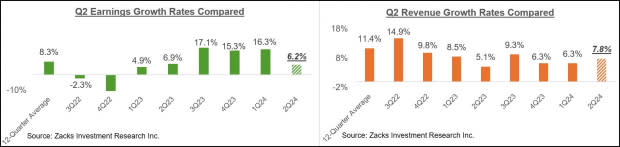

For the four S&P 500 members that have reported their fiscal May quarter results already, total earnings are up +6.2% from the same period last year on +7.8% higher revenues, with all four beating EPS estimates and only one of the four able to beat revenue estimates.

This is too small a sample of results to draw any conclusions from, but the comparisons charts below put the earnings and revenue growth rates for these companies in a historical context.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> What Will the Q2 Earnings Season Show?

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report